Affirm Results Presentation Deck

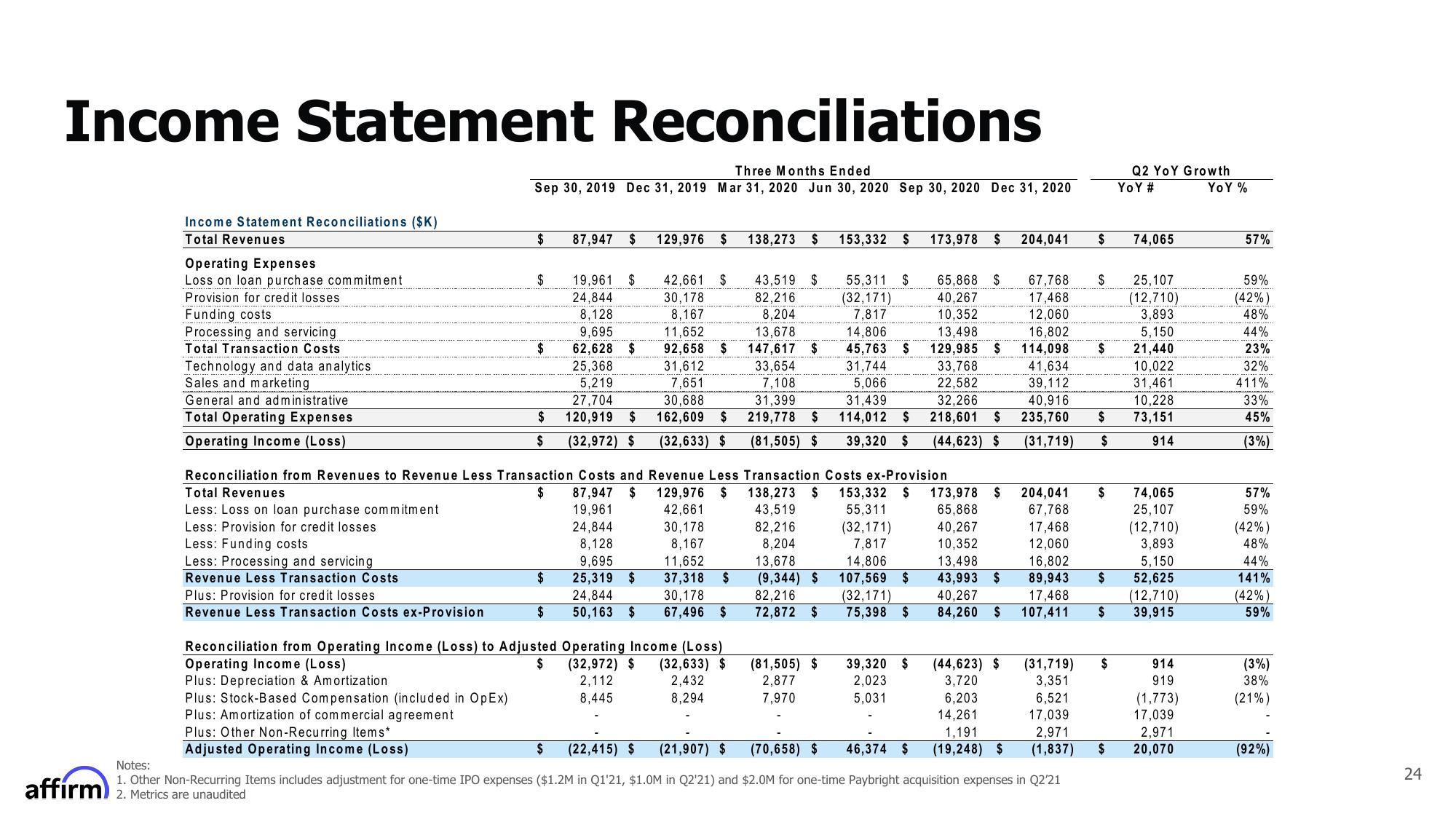

Income Statement Reconciliations

Income Statement Reconciliations ($K)

Total Revenues

Operating Expenses

Loss on loan purchase commitment

Provision for credit losses

Funding costs

Processing and servicing

Total Transaction Costs

Technology and data analytics

Sales and marketing

General and administrative

Total Operating Expenses

Operating Income (Loss)

Less: Funding costs

Less: Processing and servicing

Revenue Less Transaction Costs

Plus: Provision for credit losses

Revenue Less Transaction Costs ex-Provision

Three Months Ended

Sep 30, 2019 Dec 31, 2019 Mar 31, 2020 Jun 30, 2020 Sep 30, 2020 Dec 31, 2020

$

Plus: Depreciation & Amortization

Plus: Stock-Based Compensation (included in OpEx)

Plus: Amortization of commercial agreement

Plus: Other Non-Recurring Items*

Adjusted Operating Income (Loss)

$

$

$

87,947 $ 129,976

Reconciliation from Revenues to Revenue Less Transaction Costs and

Total Revenues

87,947 $

19,961

$

Less: Loss on loan purchase commitment

Less: Provision for credit losses

24,844

$

19,961 $ 42,661

24,844

30,178

8,128

8,167

9,695

11,652

13,678

62,628

92,658 $ 147,617 $

25,368

31,612

5,219

7,651

30,688

162,609 $

(32,633) $

27,704

120,919 $

(32,972) $

8,128

9,695

25,319 $

24,844

$ 50,163 $

$ 138,273 $

11,652

37,318 $

30,178

67,496 $

Reconciliation from Operating Income (Loss) to Adjusted Operating Income (Loss)

Operating Income (Loss)

$

(32,972) $ (32,633) $

2,112

2,432

8,445

8,294

43,519 $

82,216

8,204

33,654

7,108

31,399

219,778 $

(81,505) $

153,332 $

(81,505) $

2,877

7,970

Revenue Less Transaction Costs ex-Provision

129,976 $ 138,273 $

42,661

43,519

30,178

82,216

8,167

8,204

13,678

(9,344) $

82,216

72,872 $

55,311 $

(32,171)

7,817

65,868 $

40,267

10,352

13,498

14,806

45,763

31,744

129,985 $

33,768

5,066

22,582

31,439

32.266

114,012 $ 218,601 $

39,320 $

(44,623) $

$

173,978 $

(32,171)

7,817

14,806

107,569 $

(32,171)

75,398 $

39,320 $

2,023

5,031

(44,623) $

3,720

204,041

6,203

14,261

1,191

(19,248) $

67,768

17,468

12,060

153,332 $ 173,978 $

55,311

65,868

40,267

10,352

13,498

43,993 $

40,267

16,802

89,943 $

17,468

84,260 $ 107,411

$

$

25,107

(12,710)

3,893

5,150

16,802

114,098

21,440

41,634

10,022

39,112

40,916

235,760 $ 73,151

31,461

10,228

(31,719)

$

914

204,041 $

67,768

17,468

12,060

6,521

17,039

2,971

(1,837)

$ (22,415) $ (21,907) $ (70,658) $ 46,374 $

Notes:

1. Other Non-Recurring Items includes adjustment for one-time IPO expenses ($1.2M in Q1'21, $1.0M in Q2'21) and $2.0M for one-time Paybright acquisition expenses in Q2'21

affirm) 2. Metrics are unaudited

(31,719) $

3,351

$

Q2 YOY Growth

YOY #

YOY %

74,065

74,065

25,107

(12,710)

3,893

5,150

52,625

(12,710)

39,915

914

919

(1,773)

17,039

2,971

$ 20,070

57%

59%

(42%)

48%

44%

23%

32%

411%

33%

45%

(3%)

57%

59%

(42%)

48%

44%

141%

(42%)

59%

(3%)

38%

(21%)

(92%)

24View entire presentation