Bakkt Results Presentation Deck

FINANCIAL RESULTS/1Q22 SUMMARY

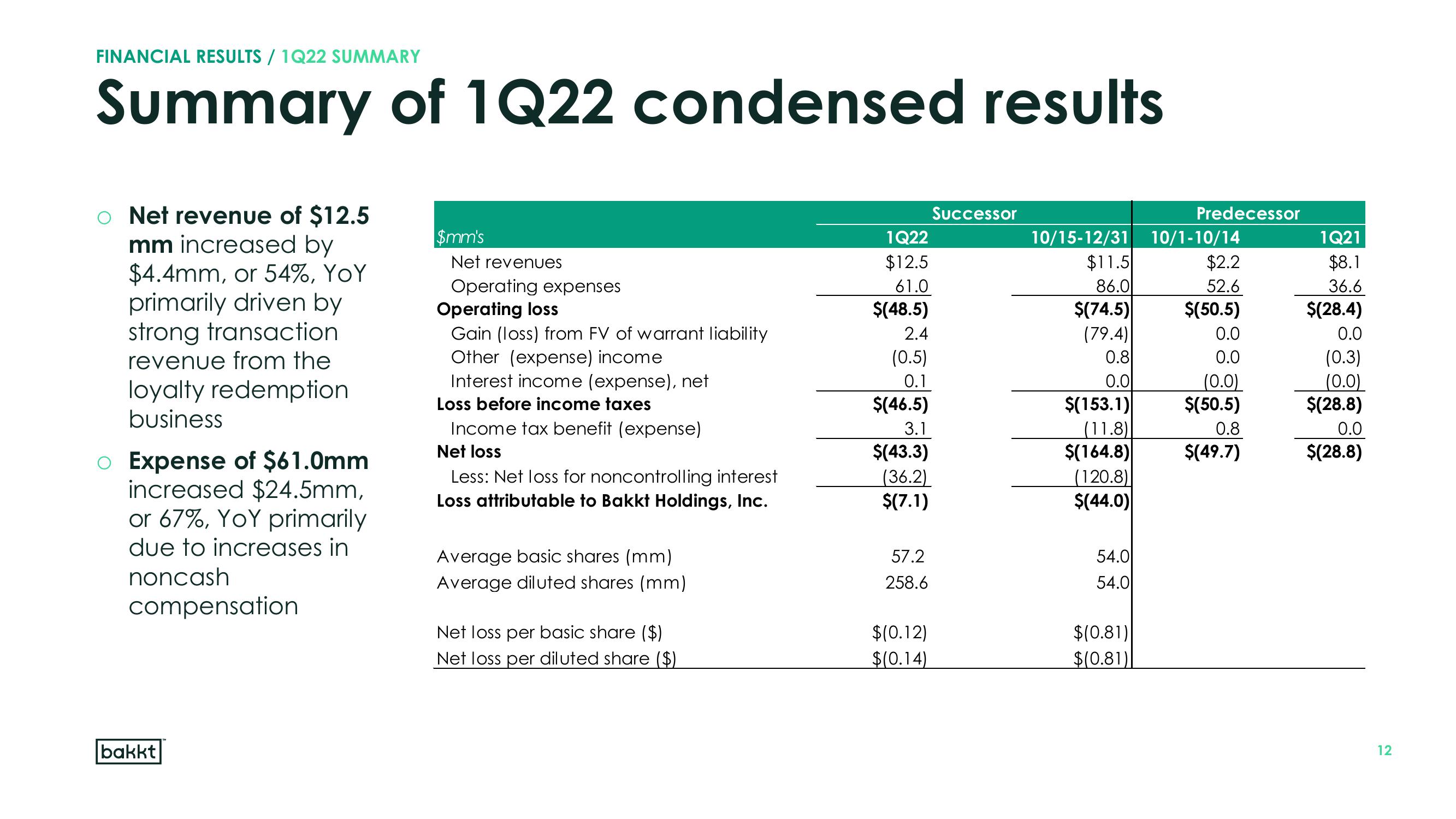

Summary of 1Q22 condensed results

o Net revenue of $12.5

mm increased by

$4.4mm, or 54%, YOY

primarily driven by

strong transaction

revenue from the

loyalty redemption

business

O Expense of $61.0mm

increased $24.5mm,

or 67%, YOY primarily

due to increases in

noncash

compensation

bakkt

$mm's

Net revenues

Operating expenses

Operating loss

Gain (loss) from FV of warrant liability

Other (expense) income

Interest income (expense), net

Loss before income taxes

Income tax benefit (expense)

Net loss

Less: Net loss for noncontrolling interest

Loss attributable to Bakkt Holdings, Inc.

Average basic shares (mm)

Average diluted shares (mm)

Net loss per basic share ($)

Net loss per diluted share ($)

1Q22

$12.5

61.0

$(48.5)

2.4

(0.5)

0.1

$(46.5)

3.1

$(43.3)

(36.2)

$(7.1)

57.2

258.6

$(0.12)

$(0.14)

Successor

10/15-12/31 10/1-10/14

$11.5

$2.2

52.6

86.0

$(50.5)

$(74.5)

(79.4)

0.8

0.01

$(153.1)

(11.8)

$(164.8)

(120.8)

$(44.0)

54.0

54.0

Predecessor

$(0.81)

$(0.81)

0.0

0.0

(0.0)

$(50.5)

0.8

$(49.7)

1Q21

$8.1

36.6

$(28.4)

0.0

(0.3)

(0.0)

$(28.8)

0.0

$(28.8)

12View entire presentation