ironSource SPAC Presentation Deck

Overview of Thoma Bravo

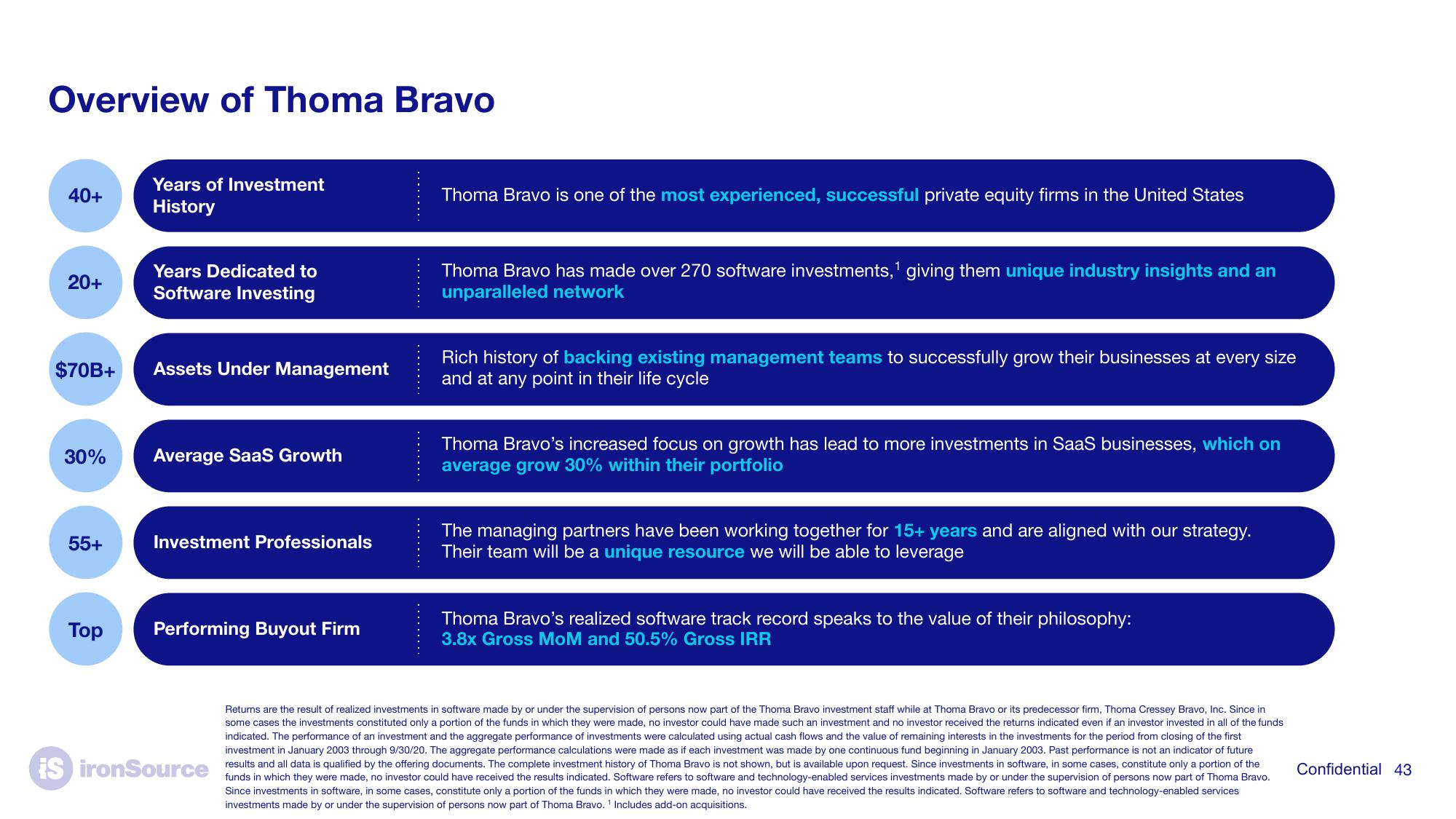

40+

20+

$70B+

30%

55+

Top

Years of Investment

History

Years Dedicated to

Software Investing

Assets Under Management

Average SaaS Growth

Investment Professionals

Performing Buyout Firm

IS ironSource

Thoma Bravo is one of the most experienced, successful private equity firms in the United States

Thoma Bravo has made over 270 software investments, ¹ giving them unique industry insights and an

unparalleled network

Rich history of backing existing management teams to successfully grow their businesses at every size

and at any point in their life cycle

Thoma Bravo's increased focus on growth has lead to more investments in SaaS businesses, which on

average grow 30% within their portfolio

The managing partners have been working together for 15+ years and are aligned with our strategy.

Their team will be a unique resource we will be able to leverage

Thoma Bravo's realized software track record speaks to the value of their philosophy:

3.8x Gross MoM and 50.5% Gross IRR

Returns are the result of realized investments in software made by or under the supervision of persons now part of the Thoma Bravo investment staff while at Thoma Bravo or its predecessor firm, Thoma Cressey Bravo, Inc. Since in

some cases the investments constituted only a portion of the funds in which they were made, no investor could have made such an investment and no investor received the returns indicated even if an investor invested in all of the funds

indicated. The performance of an investment and the aggregate performance of investments were calculated using actual cash flows and the value of remaining interests in the investments for the period from closing of the first

investment in January 2003 through 9/30/20. The aggregate performance calculations were made as if each investment was made by one continuous fund beginning in January 2003. Past performance is not an indicator of future

results and all data is qualified by the offering documents. The complete investment history of Thoma Bravo is not shown, but is available upon request. Since investments in software, in some cases, constitute only a portion of the

funds in which they were made, no investor could have received the results indicated. Software refers to software and technology-enabled services investments made by or under the supervision of persons now part of Thoma Bravo.

Since investments in software, in some cases, constitute only a portion of the funds in which they were made, no investor could have received the results indicated. Software refers to software and technology-enabled services

investments made by or under the supervision of persons now part of Thoma Bravo.¹ Includes add-on acquisitions.

Confidential 43View entire presentation