SoftBank Investor Presentation Deck

SVF1

SVF2

LATAM

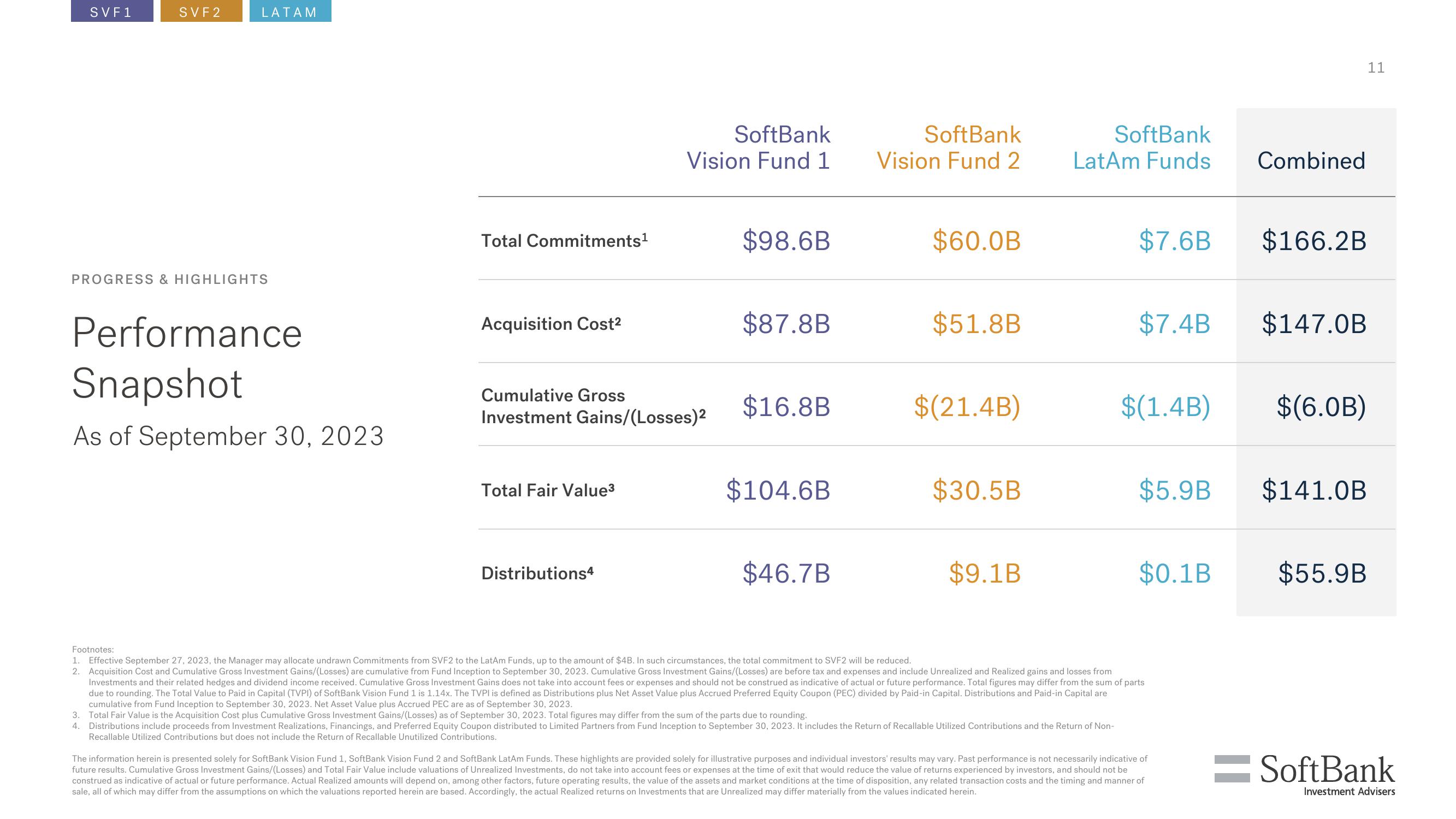

PROGRESS & HIGHLIGHTS

Performance

Snapshot

As of September 30, 2023

Total Commitments¹

Acquisition Cost²

Cumulative Gross

Investment Gains/(Losses)2

Total Fair Value³

SoftBank

Vision Fund 1

Distributions4

$98.6B

$87.8B

$16.8B

$104.6B

$46.7B

SoftBank

Vision Fund 2

$60.0B

$51.8B

$(21.4B)

$30.5B

$9.1B

SoftBank

LatAm Funds

$7.6B

$7.4B

$(1.4B)

$5.9B

$0.1B

Footnotes:

1. Effective September 27, 2023, the Manager may allocate undrawn Commitments from SVF2 to the LatAm Funds, up to the amount of $4B. In such circumstances, the total commitment to SVF2 will be reduced.

2. Acquisition Cost and Cumulative Gross Investment Gains/(Losses) are cumulative from Fund Inception to September 30, 2023. Cumulative Gross Investment Gains/(Losses) are before tax and expenses and include Unrealized and Realized gains and losses from

Investments and their related hedges and dividend income received. Cumulative Gross Investment Gains does not take into account fees or expenses and should not be construed as indicative of actual or future performance. Total figures may differ from the sum of parts

due to rounding. The Total Value to Paid in Capital (TVPI) of SoftBank Vision Fund 1 is 1.14x. The TVPI is defined as Distributions plus Net Asset Value plus Accrued Preferred Equity Coupon (PEC) divided by Paid-in Capital. Distributions and Paid-in Capital are

cumulative from Fund Inception to September 30, 2023. Net Asset Value plus Accrued PEC are as of September 30, 2023.

3. Total Fair Value is the Acquisition Cost plus Cumulative Gross Investment Gains/(Losses) as of September 30, 2023. Total figures may differ from the sum of the parts due to rounding.

4. Distributions include proceeds from Investment Realizations, Financings, and Preferred Equity Coupon distributed to Limited Partners from Fund Inception to September 30, 2023. It includes the Return of Recallable Utilized Contributions and the Return of Non-

Recallable Utilized Contributions but does not include the Return of Recallable Unutilized Contributions.

The information herein is presented solely for SoftBank Vision Fund 1, SoftBank Vision Fund 2 and SoftBank LatAm Funds. These highlights are provided solely for illustrative purposes and individual investors' results may vary. Past performance is not necessarily indicative of

future results. Cumulative Gross Investment Gains/(Losses) and Total Fair Value include valuations of Unrealized Investments, do not take into account fees or expenses at the time of exit that would reduce the value of returns experienced by investors, and should not be

construed as indicative of actual or future performance. Actual Realized amounts will depend on, among other factors, future operating results, the value of the assets and market conditions at the time of disposition, any related transaction costs and the timing and manner of

sale, all of which may differ from the assumptions on which the valuations reported herein are based. Accordingly, the actual Realized returns on Investments that are Unrealized may differ materially from the values indicated herein.

Combined

$166.2B

$147.0B

$(6.OB)

$141.0B

$55.9B

11

=SoftBank

Investment AdvisersView entire presentation