Trian Partners Activist Presentation Deck

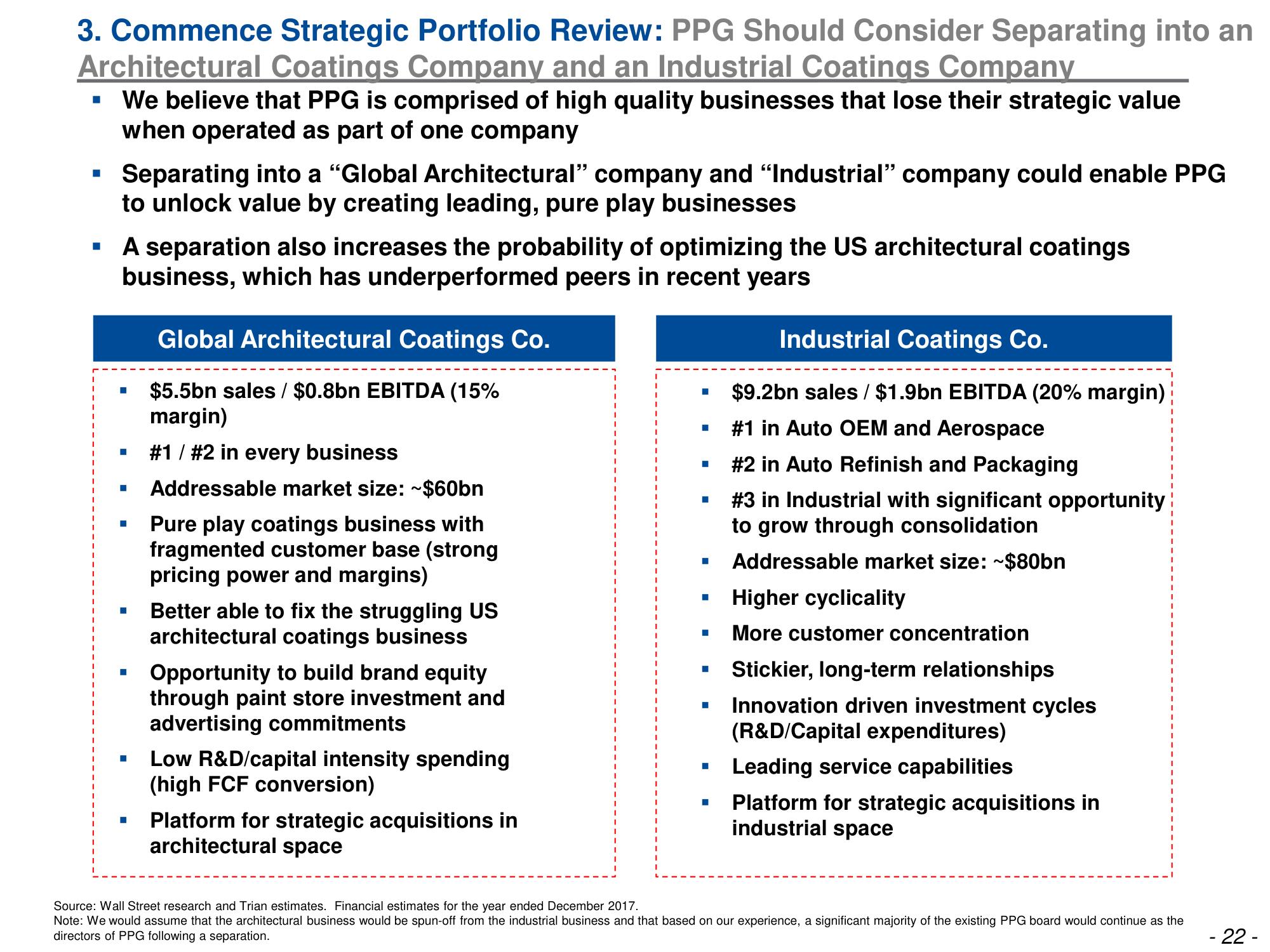

3. Commence Strategic Portfolio Review: PPG Should Consider Separating into an

Architectural Coatings Company and an Industrial Coatings Company

I

I

We believe that PPG is comprised of high quality businesses that lose their strategic value

when operated as part of one company

Separating into a "Global Architectural" company and "Industrial" company could enable PPG

to unlock value by creating leading, pure play businesses

A separation also increases the probability of optimizing the US architectural coatings

business, which has underperformed peers in recent years

M

■

■

■

H

■

■

■

Global Architectural Coatings Co.

$5.5bn sales / $0.8bn EBITDA (15%

margin)

#1 / #2 in every business

Addressable market size: ~$60bn

Pure play coatings business with

fragmented customer base (strong

pricing power and margins)

Better able to fix the struggling US

architectural coatings business

Opportunity to build brand equity

through paint store investment and

advertising commitments

Low R&D/capital intensity spending

(high FCF conversion)

Platform for strategic acquisitions in

architectural space

H

■

■

■

■

H

■

■

Industrial Coatings Co.

$9.2bn sales / $1.9bn EBITDA (20% margin)

#1 in Auto OEM and Aerospace

#2 in Auto Refinish and Packaging

#3 in Industrial with significant opportunity

to grow through consolidation

Addressable market size: ~$80bn

Higher cyclicality

More customer concentration

Stickier, long-term relationships

Innovation driven investment cycles

(R&D/Capital expenditures)

Leading service capabilities

Platform for strategic acquisitions in

industrial space

Source: Wall Street research and Trian estimates. Financial estimates for the year ended December 2017.

Note: We would assume that the architectural business would be spun-off from the industrial business and that based on our experience, a significant majority of the existing PPG board would continue as the

directors of PPG following a separation.

- 22-View entire presentation