Eutelsat Investor Presentation Deck

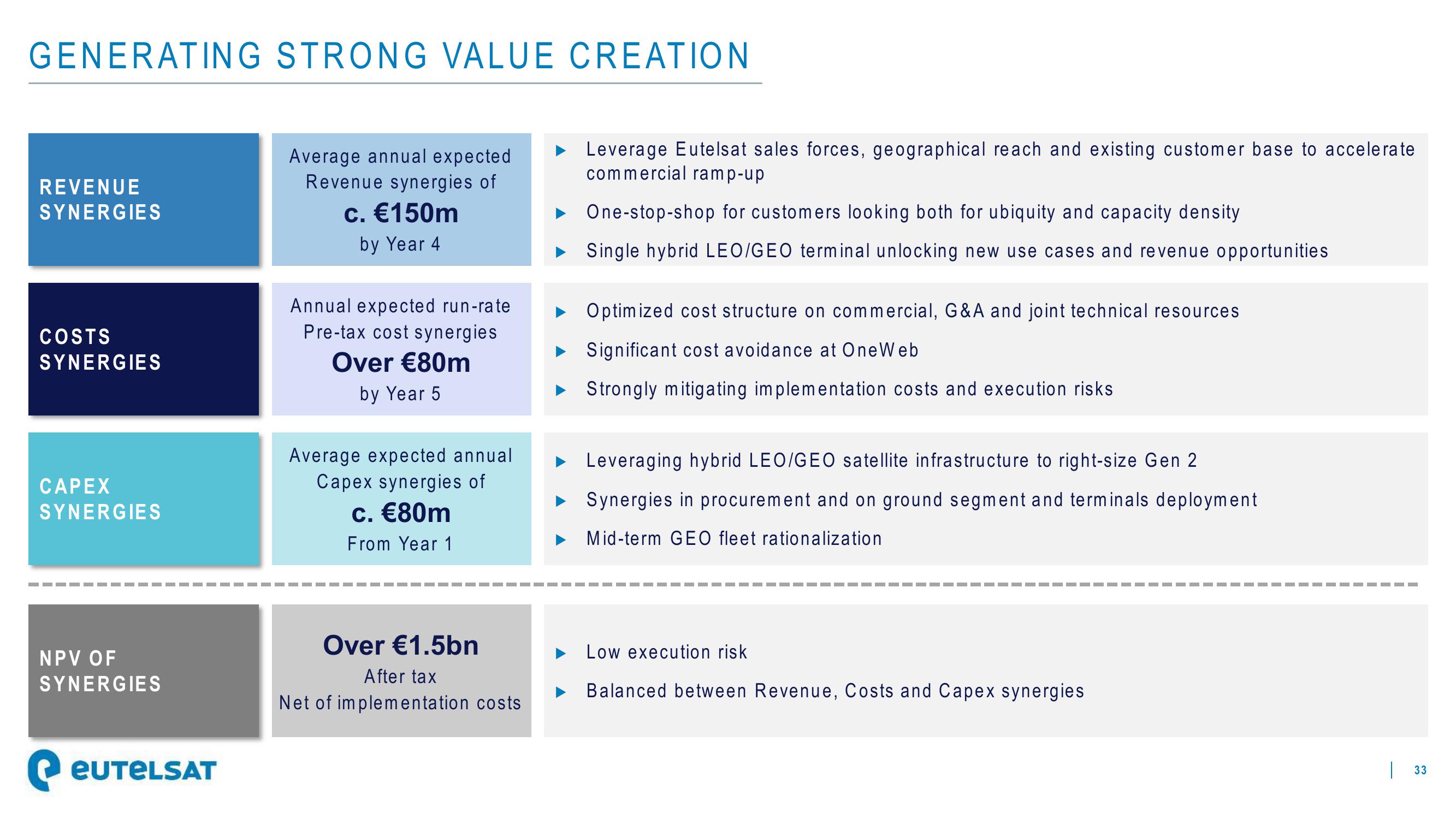

GENERATING STRONG VALUE CREATION

REVENUE

SYNERGIES

COSTS

SYNERGIES

CAPEX

SYNERGIES

NPV OF

SYNERGIES

EUTELSAT

Average annual expected

Revenue synergies of

c. €150m

by Year 4

Annual expected run-rate

Pre-tax cost synergies

Over €80m

by Year 5

Average expected annual

Capex synergies of

c. €80m

From Year 1

Over €1.5bn

After tax

Net of implementation costs

Leverage Eutelsat sales forces, geographical reach and existing customer base to accelerate

commercial ramp-up

One-stop-shop for customers looking both for ubiquity and capacity density

Single hybrid LEO/GEO terminal unlocking new use cases and revenue opportunities

Optimized cost structure on commercial, G&A and joint technical resources

Significant cost avoidance at OneWeb

Strongly mitigating implementation costs and execution risks

► Leveraging hybrid LEO/GEO satellite infrastructure to right-size Gen 2

Synergies in procurement and on ground segment and terminals deployment

Mid-term GEO fleet rationalization

Low execution risk

Balanced between Revenue, Costs and Capex synergies

|

33View entire presentation