Engine No. 1 Activist Presentation Deck

ExxonMobil may currently be a good trade, but long-term

goal should be becoming a good investment

●

$ millions

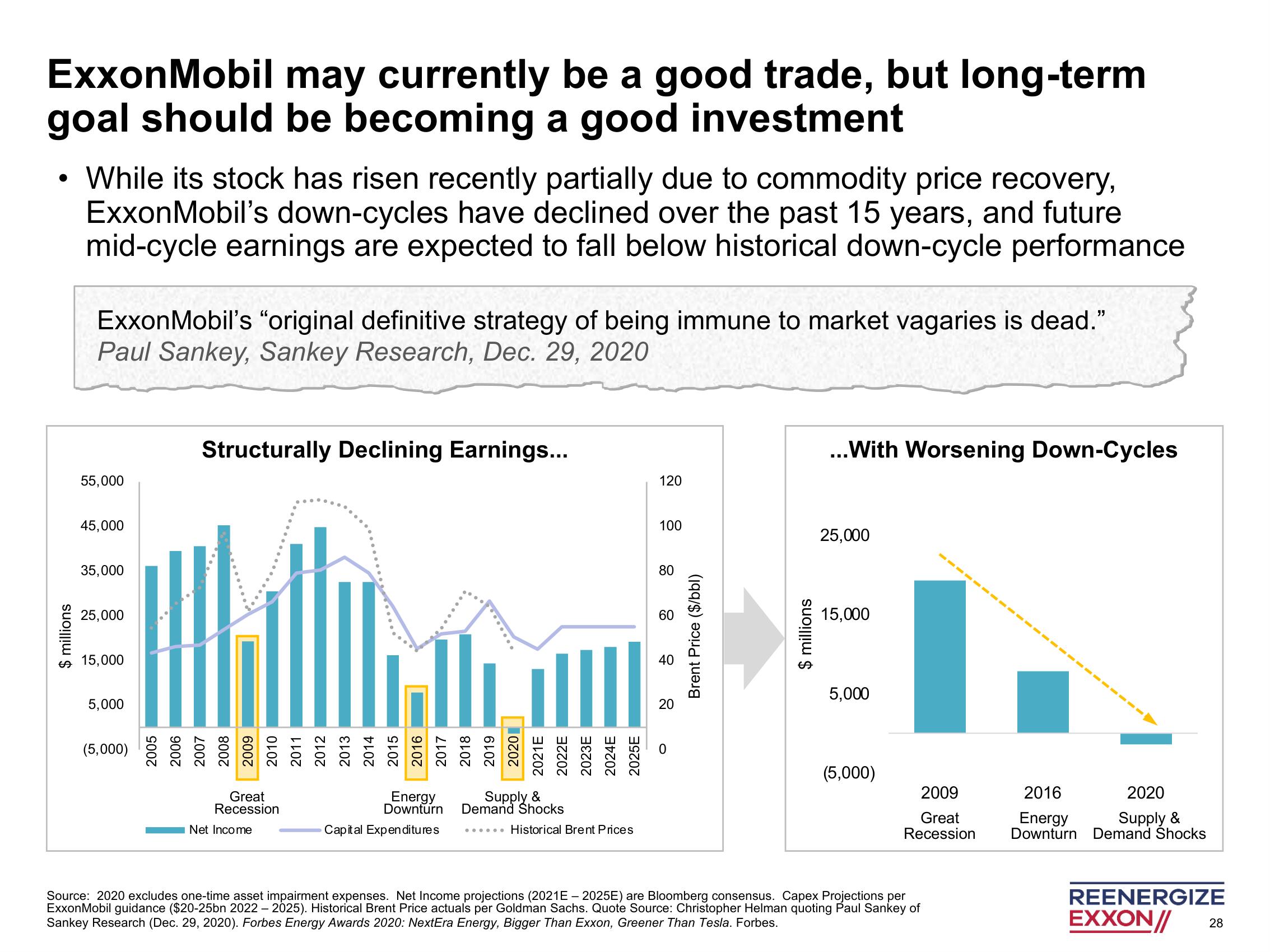

While its stock has risen recently partially due to commodity price recovery,

ExxonMobil's down-cycles have declined over the past 15 years, and future

mid-cycle earnings are expected to fall below historical down-cycle performance

ExxonMobil's "original definitive strategy of being immune to market vagaries is dead."

Paul Sankey, Sankey Research, Dec. 29, 2020

55,000

45,000

35,000

25,000

15,000

5,000

(5,000)

2005

2006

Structurally Declining Earnings...

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021E

2022E

2023E

2024E

2025E

Great

Recession

110

Net Income

Energy

Supply &

Downturn Demand Shocks

Capital Expenditures

...... Historical Brent Prices

120

100

80

60

40

20

0

Brent Price ($/bbl)

$ millions

...With Worsening Down-Cycles

25,000

15,000

5,000

(5,000)

2009

Great

Recession

Source: 2020 excludes one-time asset impairment expenses. Net Income projections (2021E - 2025E) are Bloomberg consensus. Capex Projections per

ExxonMobil guidance ($20-25bn 2022 2025). Historical Brent Price actuals per Goldman Sachs. Quote Source: Christopher Helman quoting Paul Sankey of

Sankey Research (Dec. 29, 2020). Forbes Energy Awards 2020: NextEra Energy, Bigger Than Exxon, Greener Than Tesla. Forbes.

2016

Energy

Downturn

2020

Supply &

Demand Shocks

REENERGIZE

EXXON//

28View entire presentation