Carlyle Investor Conference Presentation Deck

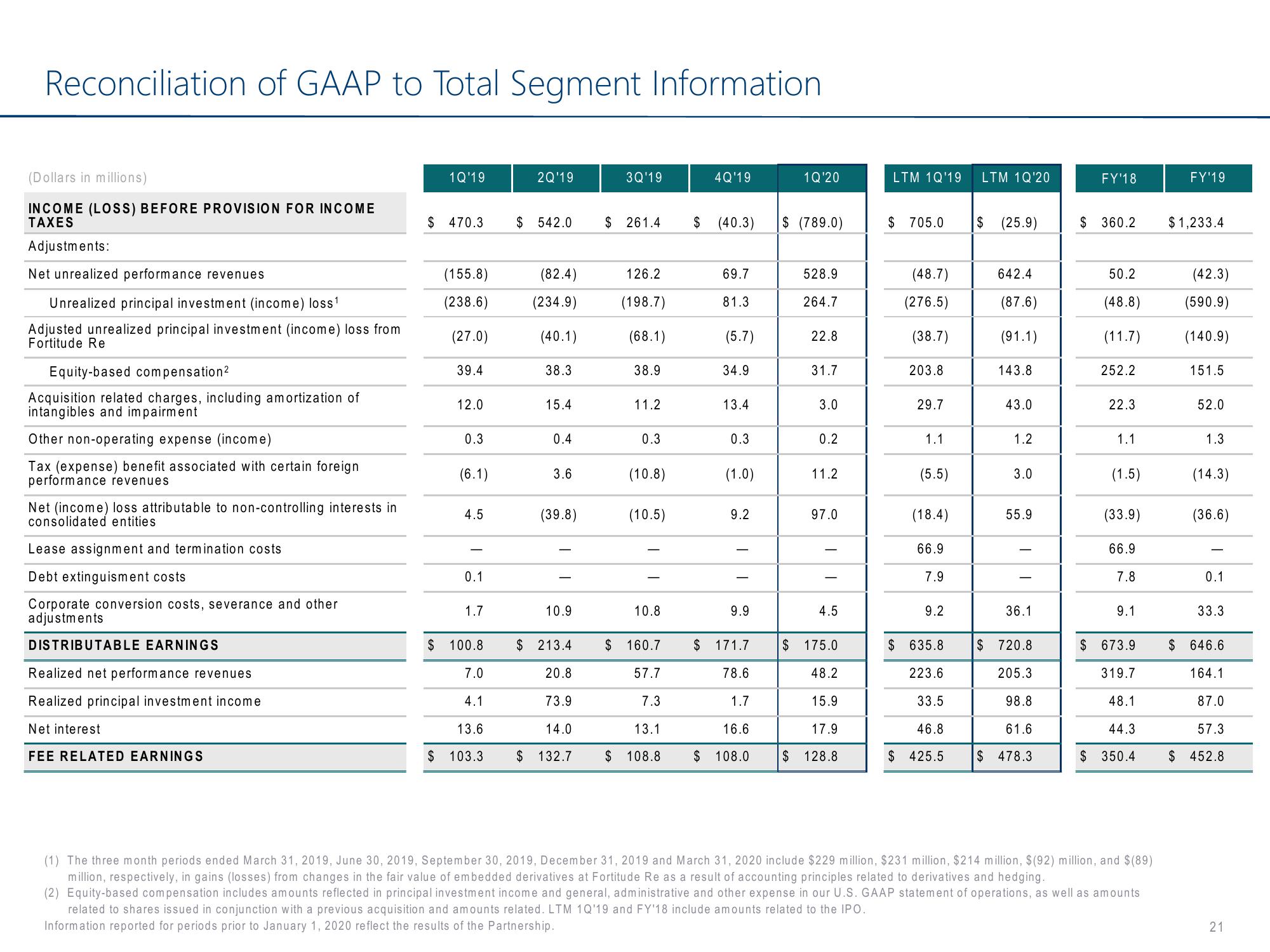

Reconciliation of GAAP to Total Segment Information

(Dollars in millions)

INCOME (LOSS) BEFORE PROVISION FOR INCOME

TAXES

Adjustments:

Net unrealized performance revenues

Unrealized principal investment (income) loss¹

Adjusted unrealized principal investment (income) loss from

Fortitude Re

Equity-based compensation²

Acquisition related charges, including amortization of

intangibles and impairment

Other non-operating expense (income)

Tax (expense) benefit associated with certain foreign

performance revenues

Net (income) loss attributable to non-controlling interests in

consolidated entities

Lease assignment and termination costs

Debt extinguisment costs

Corporate conversion costs, severance and other

adjustments

DISTRIBUTABLE EARNINGS

Realized net performance revenues

Realized principal investment income

Net interest

FEE RELATED EARNINGS

1Q'19

$470.3

(155.8)

(238.6)

(27.0)

39.4

12.0

0.3

(6.1)

4.5

0.1

1.7

$100.8

7.0

4.1

13.6

$ 103.3

2Q'19

$ 542.0

(82.4)

(234.9)

(40.1)

38.3

15.4

0.4

3.6

(39.8)

10.9

$213.4

20.8

73.9

14.0

$ 132.7

3Q'19

$ 261.4

126.2

(198.7)

(68.1)

38.9

11.2

0.3

(10.8)

(10.5)

10.8

$

4Q'19

(40.3)

69.7

81.3

(5.7)

34.9

13.4

0.3

(1.0)

9.2

9.9

$ 160.7 $ 171.7

57.7

78.6

7.3

1.7

13.1

16.6

$ 108.8

$ 108.0

1Q'20

$ (789.0)

$

528.9

264.7

22.8

31.7

3.0

0.2

11.2

97.0

4.5

$ 175.0

48.2

15.9

17.9

128.8

LTM 1Q'19 LTM 1Q'20

$ 705.0

(48.7)

(276.5)

(38.7)

203.8

29.7

1.1

(5.5)

(18.4)

66.9

7.9

9.2

$ 635.8

223.6

33.5

46.8

$425.5

$ (25.9)

642.4

(87.6)

(91.1)

143.8

43.0

1.2

3.0

55.9

36.1

$ 720.8

205.3

98.8

61.6

$ 478.3

FY'18

$360.2

50.2

(48.8)

(11.7)

252.2

22.3

1.1

(1.5)

(33.9)

66.9

7.8

9.1

$ 673.9

319.7

48.1

44.3

$ 350.4

(1) The three month periods ended March 31, 2019, June 30, 2019, September 30, 2019, December 31, 2019 and March 31, 2020 include $229 million, $231 million, $214 million, $(92) million, and $(89)

million, respectively, in gains (losses) from changes in the fair value of embedded derivatives at Fortitude Re as a result of accounting principles related to derivatives and hedging.

(2) Equity-based compensation includes amounts reflected in principal investment income and general, administrative and other expense in our U.S. GAAP statement of operations, as well as amounts

related to shares issued in conjunction with a previous acquisition and amounts related. LTM 1Q'19 and FY'18 include amounts related to the IPO.

Information reported for periods prior to January 1, 2020 reflect the results of the Partnership.

FY'19

$1,233.4

(42.3)

(590.9)

(140.9)

151.5

52.0

1.3

(14.3)

(36.6)

0.1

33.3

$646.6

164.1

87.0

57.3

$452.8

21View entire presentation