Zegna Investor Presentation Deck

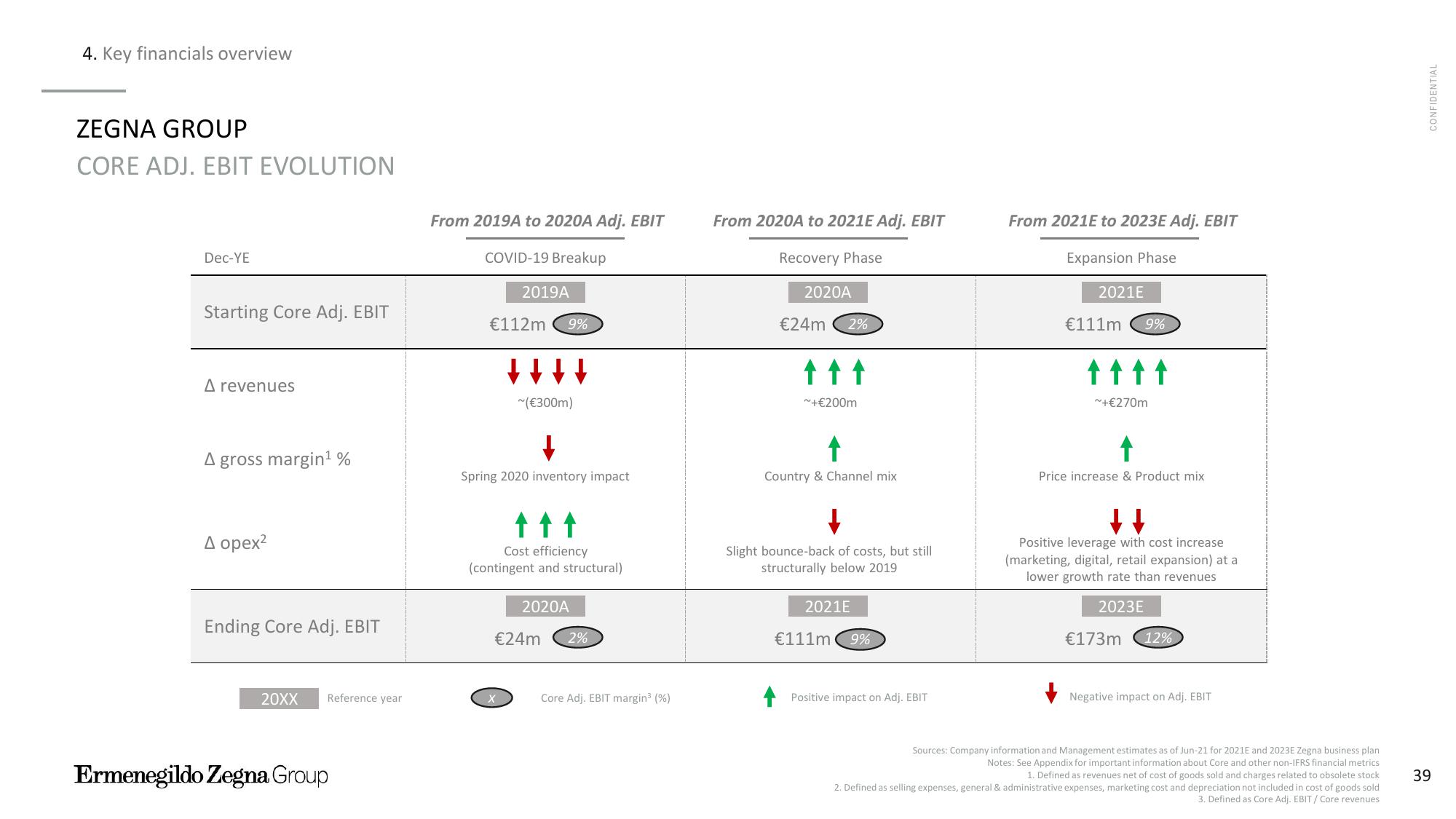

4. Key financials overview

ZEGNA GROUP

CORE ADJ. EBIT EVOLUTION

Dec-YE

Starting Core Adj. EBIT

A revenues

A gross margin¹ %

A opex²

Ending Core Adj. EBIT

20XX Reference year

Ermenegildo Zegna Group

From 2019A to 2020A Adj. EBIT

COVID-19 Breakup

2019A

€112m

9%

↓↓↓↓

~(€300m)

Spring 2020 inventory impact

↑↑↑

Cost efficiency

(contingent and structural)

2020A

€24m 2%

Core Adj. EBIT margin³ (%)

From 2020A to 2021E Adj. EBIT

Recovery Phase

2020A

€24m

2%

↑↑↑

~+€200m

↑

Country & Channel mix

Slight bounce-back of costs, but still

structurally below 2019

2021E

€111m 9%

Positive impact on Adj. EBIT

From 2021E to 2023E Adj. EBIT

Expansion Phase

2021E

€111m

9%

↑↑↑↑

~+€270m

Price increase & Product mix

↓↓↓

Positive leverage with cost increase

(marketing, digital, retail expansion) at a

lower growth rate than revenues

2023E

€173m

12%

Negative impact on Adj. EBIT

Sources: Company information and Management estimates as of Jun-21 for 2021E and 2023E Zegna business plan

Notes: See Appendix for important information about Core and other non-IFRS financial metrics

1. Defined as revenues net of cost of goods sold and charges related to obsolete stock

2. Defined as selling expenses, general & administrative expenses, marketing cost and depreciation not included in cost of goods sold

3. Defined as Core Adj. EBIT/ Core revenues

CONFIDENTIAL

39View entire presentation