Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

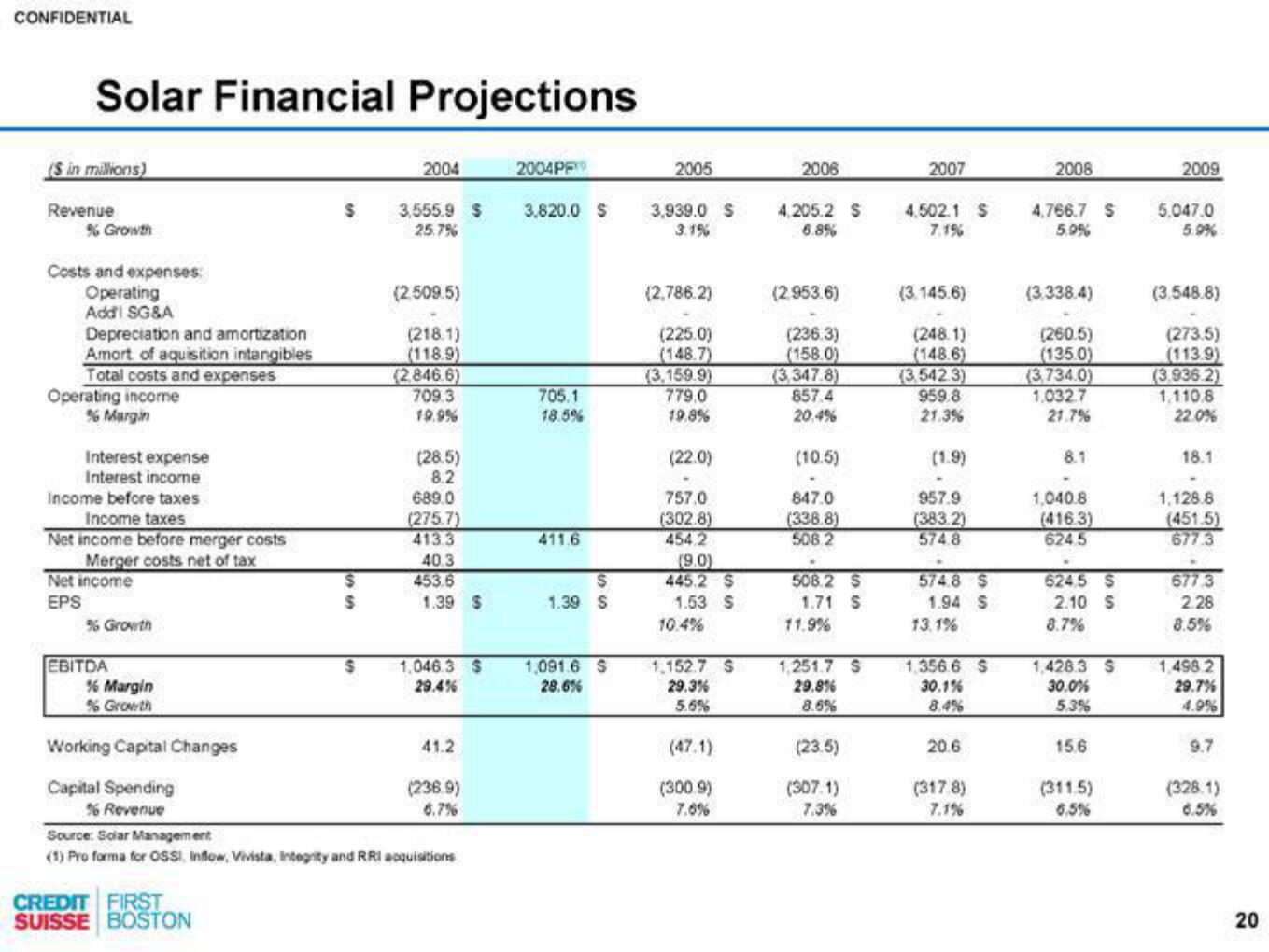

Solar Financial Projections

($ in millions)

Revenue

% Growth

Costs and expenses:

Operating

Addi SG&A

Depreciation and amortization

Amort of aquisition intangibles

Total costs and expenses

Operating income

% Margin

Interest expense

Interest income

Income before taxes

Income taxes

Net income before merger costs

Merger costs net of tax

Net income

EPS

% Growth

EBITDA

% Margin

% Growth

Working Capital Changes

Capital Spending

% Revenue

$

CREDIT FIRST

SUISSE BOSTON

$

$

$

2004

3,555.9 $

25.7%

(2.509.5)

(218.1)

(118.9)

(2,846.6)

709.3

19.9%

(28.5)

8.2

689.0

(275.7)

413.3

40.3

453.6

1.39 $

1,046.3 S

29.4%

41.2

(236.9)

6.7%

Source: Solar Management

(1) Pro forma for OSSI, Inflow, Vivista, Integrity and RRI acquisitions

2004PF

3,820.0 S

705.1

18.5%

411.6

S

1.39 S

1,091.6 S

28.6%

2005

3,939.0 S

3.1%

(2,786.2)

(225.0)

(148.7)

(3,159.9)

779.0

19.8%

(22.0)

757.0

(302.8)

454.2

(9.0)

445.2 S

1.53 S

10.4%

1,152.7 S

29.3%

5.6%

(47.1)

(300.9)

7.6%

2006

4,205.2 S

6.8%

(2.953.6)

(236.3)

(158.0)

(3,347.8)

857.4

20.4%

(10.5)

847.0

(338.8)

508.2

508.2 S

1.71 S

11.9%

1,251.7 S

29.8%

8.6%

(23.5)

(307.1)

7.3%

2007

4.502.1 S

7.1%

(3.145.6)

(248.1)

(148.6)

(3.542.3)

959.8

21.3%

(1.9)

957.9

(383.2)

574.8

574.8 S

1.94 S

13.1%

1.356.6 S

30.1%

8.4%

20.6

(317.8)

7.1%

2008

4,766.7 S

5.9%

(3.338.4)

(260.5)

(135.0)

(3.734.0)

1,032.7

21.7%

8.1

1,040.8

(416.3)

624.5

624.5 S

2.10 S

8.7%

1,428.3 S

30.0%

5.3%

15.6

(311.5)

6.5%

2009

5,047.0

5.9%

(3.548.8)

(273.5)

(113.9)

(3.936.2)

1.110.8

22.0%

18.1

1,128.8

(451.5)

677.3

677 3

2.28

8.5%

1,498.2

29.7%

4.9%

9.7

(328.1)

6.5%

20View entire presentation