Bank of America Results Presentation Deck

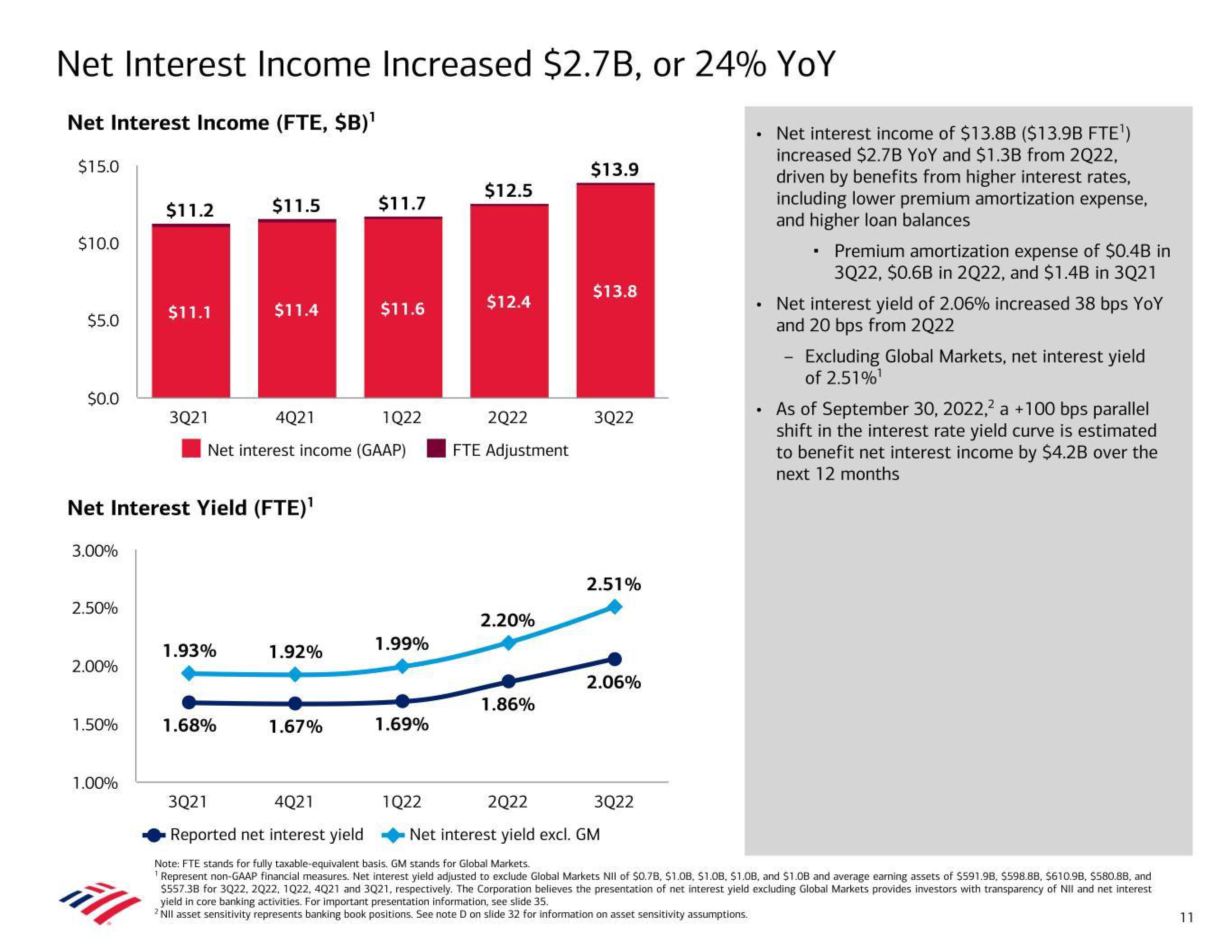

Net Interest Income Increased $2.7B, or 24% YoY

Net Interest Income (FTE, $B)¹

$15.0

$10.0

$5.0

$0.0

3.00%

2.50%

2.00%

1.50%

1.00%

$11.2

ill

$11.1

Net Interest Yield (FTE)¹

3Q21

$11.5

1.93%

$11.4

1Q22

Net interest income (GAAP)

1.68%

4Q21

1.92%

$11.7

1.67%

$11.6

1.99%

1.69%

$12.5

$12.4

1Q22

2Q22

FTE Adjustment

2.20%

1.86%

$13.9

$13.8

3Q22

2.51%

2.06%

2Q22

Net interest yield excl. GM

Net interest income of $13.8B ($13.9B FTE¹)

increased $2.7B YoY and $1.3B from 2022,

driven by benefits from higher interest rates,

including lower premium amortization expense,

and higher loan balances

3Q22

Premium amortization expense of $0.4B in

3Q22, $0.6B in 2Q22, and $1.4B in 3Q21

Net interest yield of 2.06% increased 38 bps YoY

and 20 bps from 2Q22

3Q21

4Q21

Reported net interest yield

Note: FTE stands for fully taxable-equivalent basis. GM stands for Global Markets.

¹ Represent non-GAAP financial measures. Net interest yield adjusted to exclude Global Markets NII of $0.7B, $1.0B, $1.0B, $1.0B, and $1.0B and average earning assets of $591.9B, $598.8B, $610.9B, $580.8B, and

$557.3B for 3Q22, 2022, 1022, 4021 and 3Q21, respectively. The Corporation believes the presentation of net interest yield excluding Global Markets provides investors with transparency of NII and net interest

yield in core banking activities. For important presentation information, see slide 35.

2 NII asset sensitivity represents banking book positions. See note D on slide 32 for information on asset sensitivity assumptions.

- Excluding Global Markets, net interest yield

of 2.51%¹

• As of September 30, 2022,² a +100 bps parallel

shift in the interest rate yield curve is estimated

to benefit net interest income by $4.2B over the

next 12 months

11View entire presentation