Q2 Quarter 2023

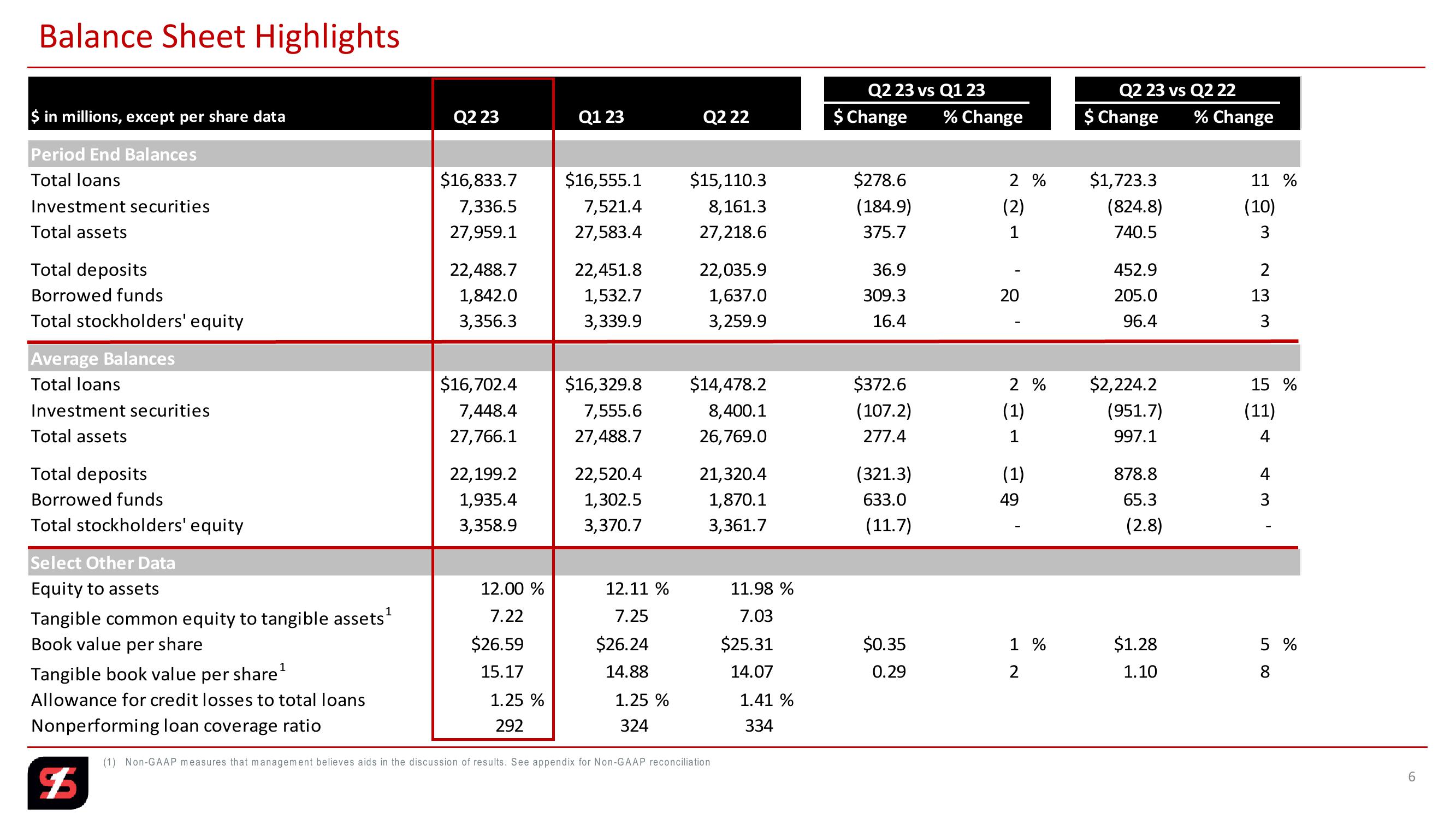

Balance Sheet Highlights

$ in millions, except per share data

Period End Balances

Total loans

Q2 23 vs Q1 23

Q2 23

Q1 23

Q2 22

$ Change

Q2 23 vs Q2 22

% Change

$ Change

% Change

$16,833.7

$16,555.1

$15,110.3

$278.6

2 %

Investment securities

7,336.5

7,521.4

8,161.3

(184.9)

(2)

Total assets

27,959.1

27,583.4

27,218.6

375.7

$1,723.3

(824.8)

740.5

11 %

(10)

3

Total deposits

22,488.7

22,451.8

22,035.9

36.9

452.9

2

Borrowed funds

1,842.0

1,532.7

1,637.0

309.3

20

20

205.0

13

Total stockholders' equity

3,356.3

3,339.9

3,259.9

16.4

96.4 3

3

Average Balances

Total loans

Investment securities

Total assets

Total deposits

Borrowed funds

Total stockholders' equity

Select Other Data

$16,702.4

$16,329.8

$14,478.2

$372.6

2 %

7,448.4

7,555.6

8,400.1

(107.2)

(1)

27,766.1

27,488.7

26,769.0

277.4

1

$2,224.2

(951.7)

997.1

15 %

(11)

4

22,199.2

22,520.4

21,320.4

(321.3)

(1)

878.8

1,935.4

1,302.5

1,870.1

3,358.9

3,370.7

3,361.7

633.0

(11.7)

49

65.3

(2.8)

+31

4

Equity to assets

12.00 %

12.11%

11.98 %

Tangible common equity to tangible assets¹

Book value per share

Tangible book value per share¹

1

7.22

7.25

7.03

$26.59

15.17

$26.24

14.88

$25.31

14.07

$0.35

0.29

1 %

$1.28

2

1.10

58

5 %

Allowance for credit losses to total loans

1.25 %

1.25 %

1.41 %

Nonperforming loan coverage ratio

292

324

334

(1) Non-GAAP measures that management believes aids in the discussion of results. See appendix for Non-GAAP reconciliation

$

6View entire presentation