LSE Investor Presentation Deck

ForexClear - The FX Opportunity

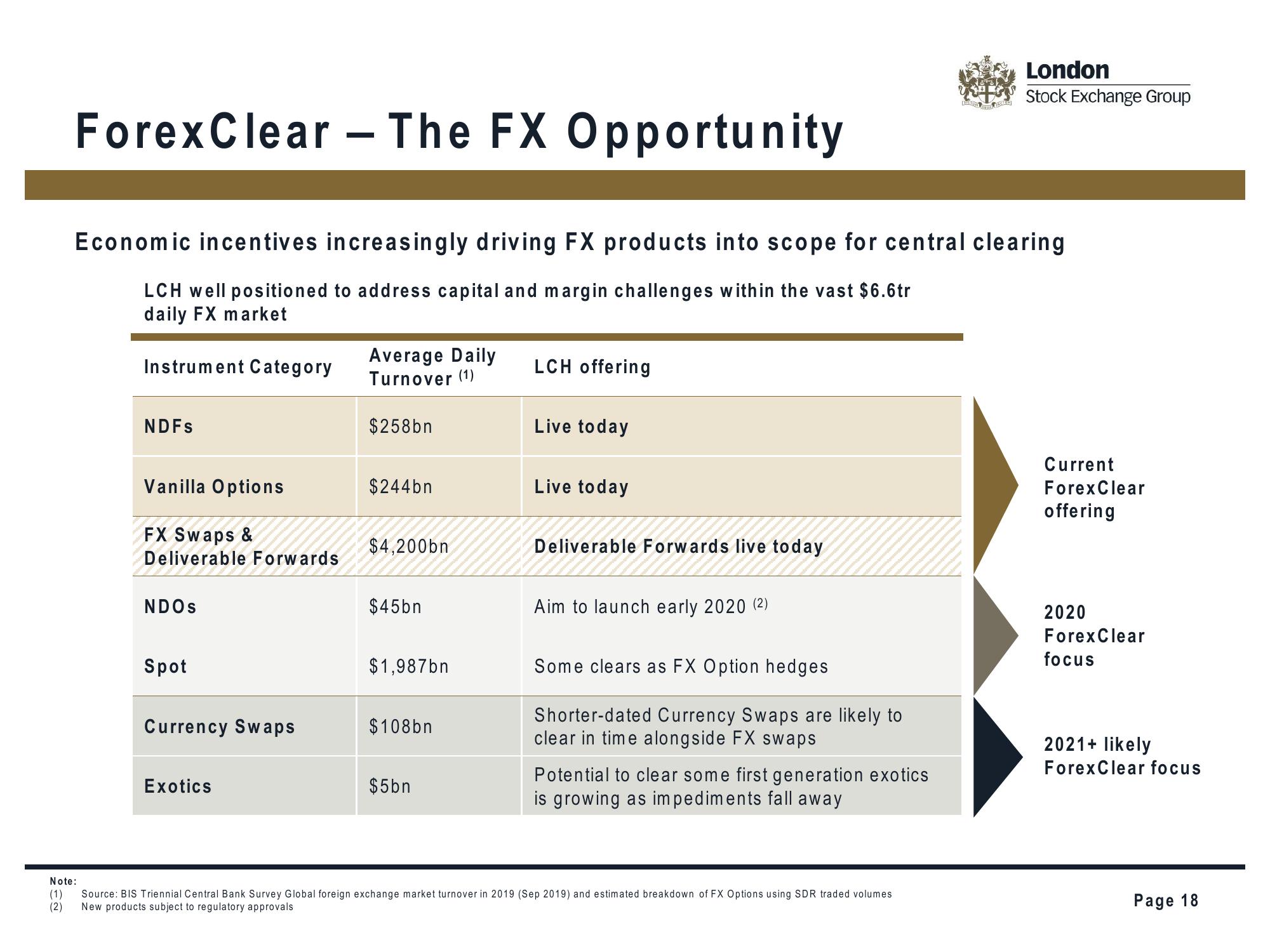

Economic incentives increasingly driving FX products into scope for central clearing

LCH well positioned to address capital and margin challenges within the vast $6.6tr

daily FX market

Instrument Category

NDFs

Vanilla Options

FX Swaps &

Deliverable Forwards

NDOS

Spot

Currency Swaps

Exotics

Average Daily

Turnover (1)

$258bn

$244bn

$4,200bn

$45bn

$1,987bn

$108bn

$5bn

LCH offering

Live today

Live today

Deliverable Forwards live today

Aim to launch early 2020 (2)

Some clears as FX Option hedges

Shorter-dated Currency Swaps are likely to

clear in time alongside FX swaps

Potential to clear some first generation exotics

is growing as impediments fall away

London

Stock Exchange Group

Note:

(1) Source: BIS Triennial Central Bank Survey Global foreign exchange market turnover in 2019 (Sep 2019) and estimated breakdown of FX Options using SDR traded volumes

(2) New products subject to regulatory approvals

Current

Forex Clear

offering

2020

ForexClear

focus

2021+ likely

ForexClear focus

Page 18View entire presentation