Coppersmith Presentation to Alere Inc Stockholders

PAGE 48 |

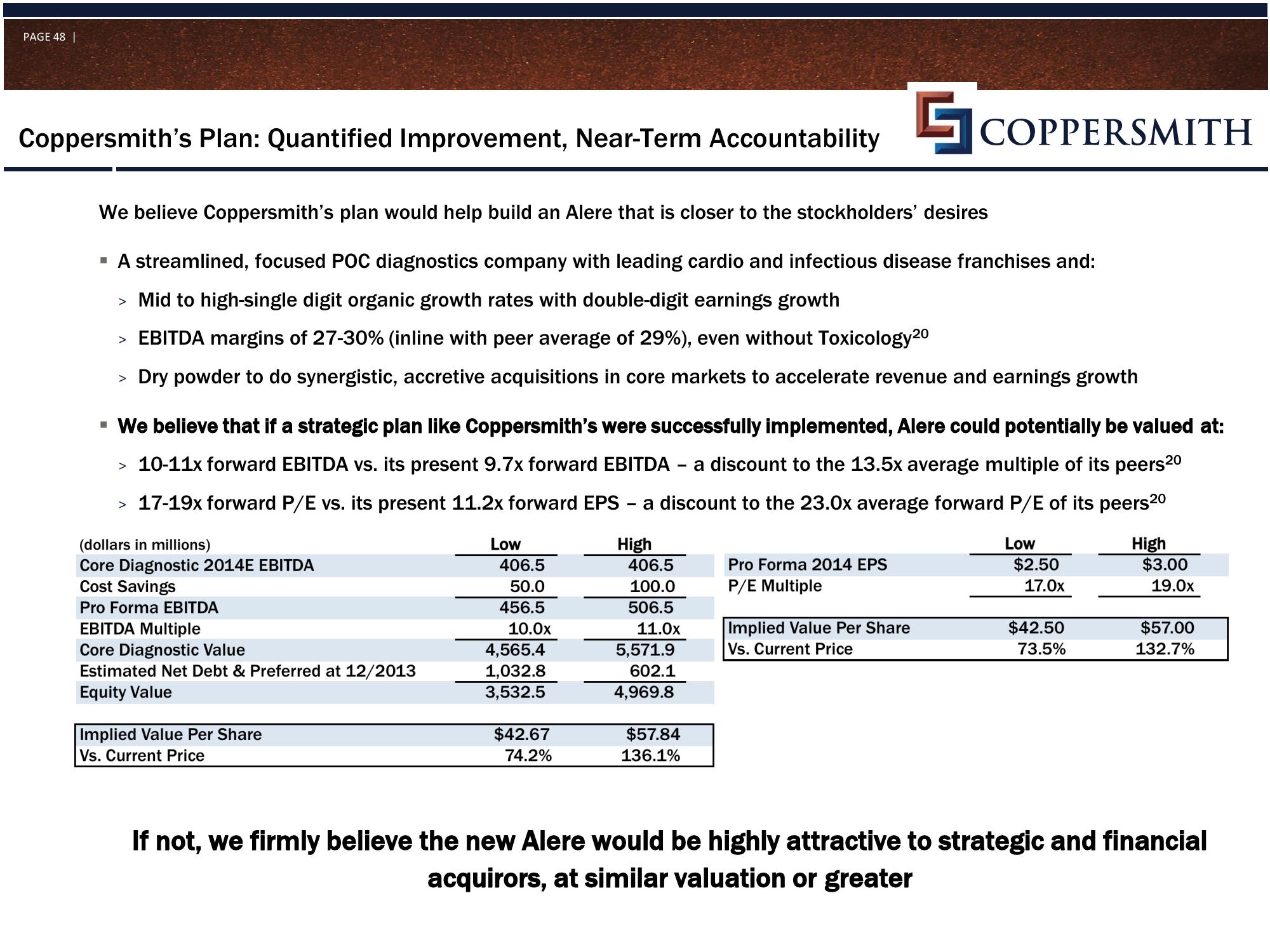

Coppersmith's Plan: Quantified Improvement, Near-Term Accountability

We believe Coppersmith's plan would help build an Alere that is closer to the stockholders' desires

▪ A streamlined, focused POC diagnostics company with leading cardio and infectious disease franchises and:

> Mid to high-single digit organic growth rates with double-digit earnings growth

> EBITDA margins of 27-30% (inline with peer average of 29%), even without Toxicology 20

> Dry powder to do synergistic, accretive acquisitions in core markets to accelerate revenue and earnings growth

▪ We believe that if a strategic plan like Coppersmith's were successfully implemented, Alere could potentially be valued at:

> 10-11x forward EBITDA vs. its present 9.7x forward EBITDA a discount to the 13.5x average multiple of its peers 2⁰

> 17-19x forward P/E vs. its present 11.2x forward EPS - a discount to the 23.0x average forward P/E of its peers20

(dollars in millions)

Core Diagnostic 2014E EBITDA

Cost Savings

Pro Forma EBITDA

EBITDA Multiple

Core Diagnostic Value

Estimated Net Debt & Preferred at 12/2013

Equity Value

Implied Value Per Share

Vs. Current Price

Low

406.5

50.0

456.5

10.0x

4,565.4

1,032.8

3,532.5

$42.67

74.2%

High

406.5

100.0

506.5

11.0x

5,571.9

602.1

4,969.8

$57.84

136.1%

COPPERSMITH

Pro Forma 2014 EPS

P/E Multiple

Implied Value Per Share

Vs. Current Price

Low

$2.50

17.0x

$42.50

73.5%

High

$3.00

19.0x

$57.00

132.7%

If not, we firmly believe the new Alere would be highly attractive to strategic and financial

acquirors, at similar valuation or greaterView entire presentation