FAT Brands Results Presentation Deck

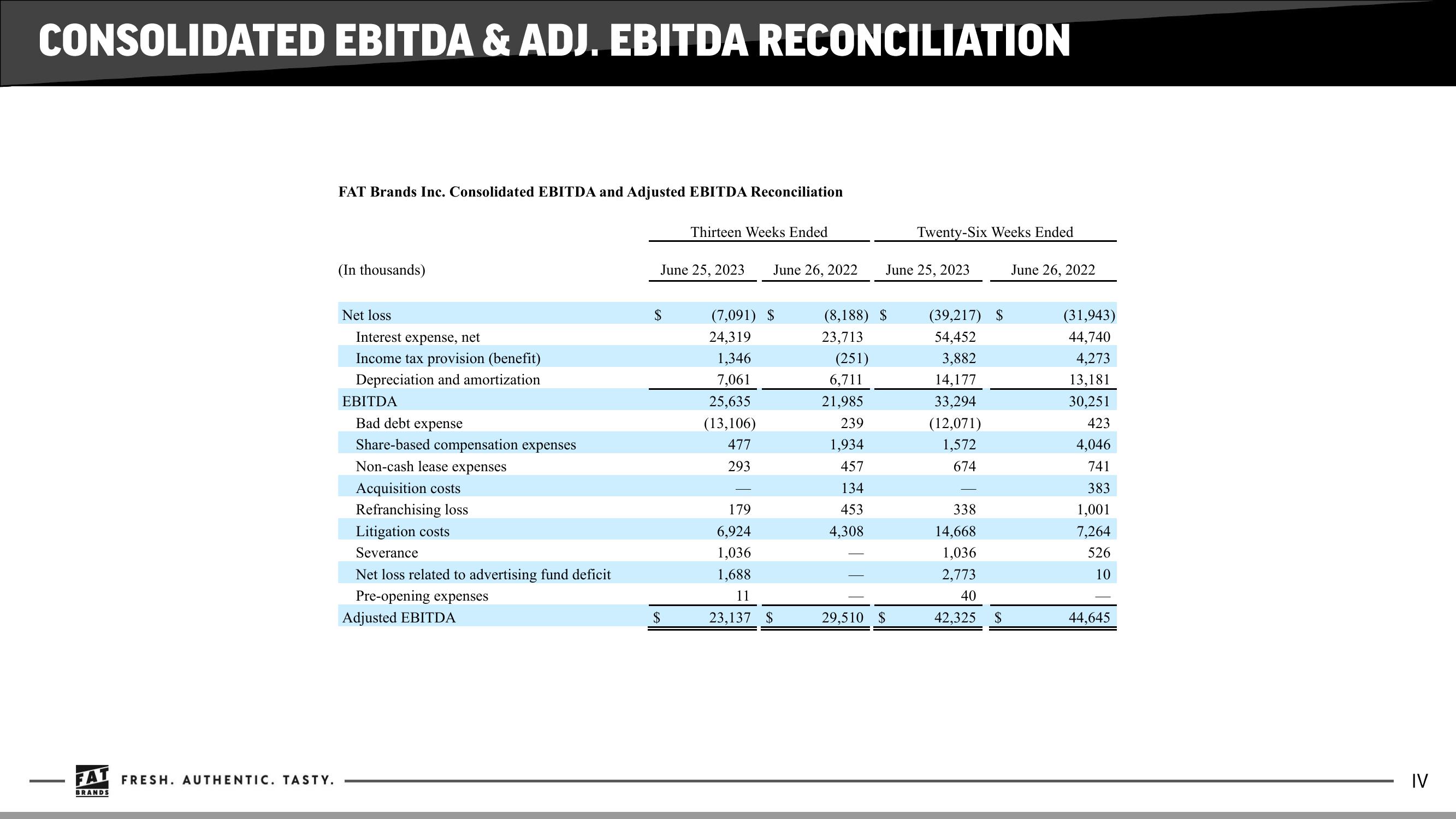

CONSOLIDATED EBITDA & ADJ. EBITDA RECONCILIATION

I

FAT FRESH. AUTHENTIC. TASTY.

BRANDS

FAT Brands Inc. Consolidated EBITDA and Adjusted EBITDA Reconciliation

(In thousands)

Net loss

Interest expense, net

Income tax provision (benefit)

Depreciation and amortization

EBITDA

Bad debt expense

Share-based compensation expenses

Non-cash lease expenses

Acquisition costs

Refranchising loss

Litigation costs

Severance

Net loss related to advertising fund deficit

Pre-opening expenses

Adjusted EBITDA

Thirteen Weeks Ended

June 25, 2023 June 26, 2022

$

(7,091) $

24,319

1,346

7,061

25,635

(13,106)

477

293

179

6,924

1,036

1,688

11

23,137 $

(8,188) $

23,713

(251)

6,711

21,985

239

1,934

457

134

453

4,308

June 25, 2023

Twenty-Six Weeks Ended

29,510 $

(39,217) $

54,452

3,882

14,177

33,294

(12,071)

1,572

674

338

14,668

1,036

2,773

40

42,325 $

June 26, 2022

(31,943)

44,740

4,273

13,181

30,251

423

4,046

741

383

1,001

7,264

526

10

44,645

IVView entire presentation