Comcast Results Presentation Deck

Cable Communications 3rd Quarter 2020 Overview

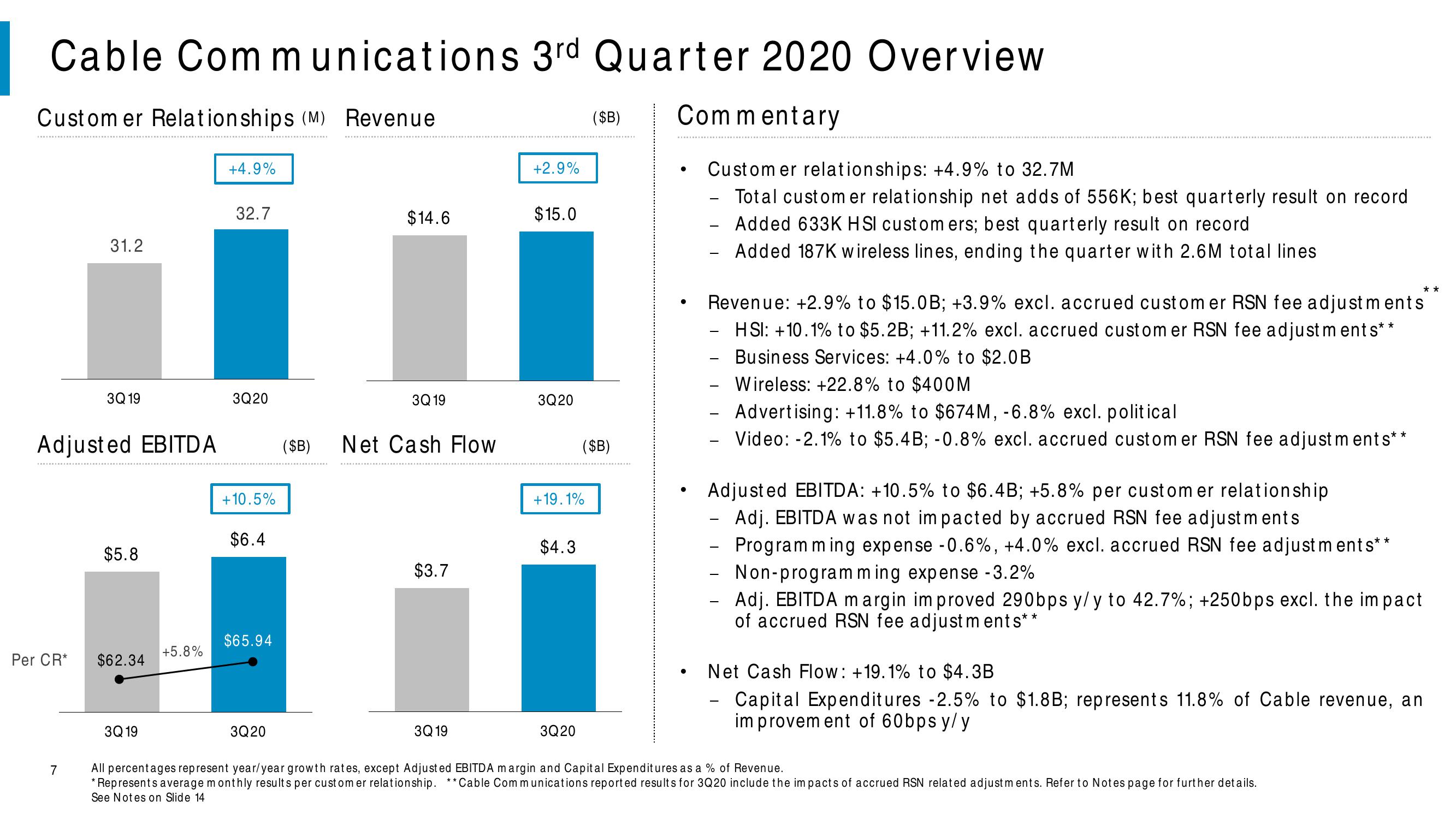

Customer Relationships (M) Revenue

Per CR*

31.2

Adjusted EBITDA

7

3Q 19

$5.8

$62.34

3Q 19

+5.8%

+4.9%

32.7

3Q20

+10.5%

$6.4

$65.94

3Q20

$14.6

3Q 19

($B) Net Cash Flow

$3.7

3Q 19

+2.9%

$15.0

3Q20

+19.1%

$4.3

3Q 20

($B)

($B)

Commentary

Customer relationships: +4.9% to 32.7M

Total customer relationship net adds of 556K; best quarterly result on record

Added 633K HSI customers; best quarterly result on record

Added 187K wireless lines, ending the quarter with 2.6M total lines

●

●

●

-

Revenue: +2.9% to $15.0B; +3.9% excl. accrued customer RSN fee adjustments

HSI: +10.1% to $5.2B; +11.2% excl. accrued custom er RSN fee adjustments**

Business Services: +4.0% to $2.0B

Wireless: +22.8% to $400M

-

Advertising: +11.8% to $674M, -6.8% excl. political

Video: -2.1% to $5.4B; -0.8% excl. accrued customer RSN fee adjustments**

**

Adjusted EBITDA: +10.5% to $6.4B; +5.8% per customer relationship

Adj. EBITDA was not impacted by accrued RSN fee adjustments

Programming expense -0.6%, +4.0% excl. accrued RSN fee adjustments**

Non-programming expense -3.2%

Adj. EBITDA margin improved 290bps y/y to 42.7%; +250bps excl. the impact

of accrued RSN fee adjustments*

*

Net Cash Flow: +19.1% to $4.3B

Capital Expenditures -2.5% to $1.8B; represents 11.8% of Cable revenue, an

improvement of 60bps y/y

All percentages represent year/year growth rates, except Adjusted EBITDA margin and Capital Expenditures as a % of Revenue.

*Represents average monthly results per customer relationship. ** Cable Communications reported results for 3Q20 include the impacts of accrued RSN related adjustments. Refer to Notes page for further details.

See Notes on Slide 14.View entire presentation