Jefferies Financial Group Investor Day Presentation Deck

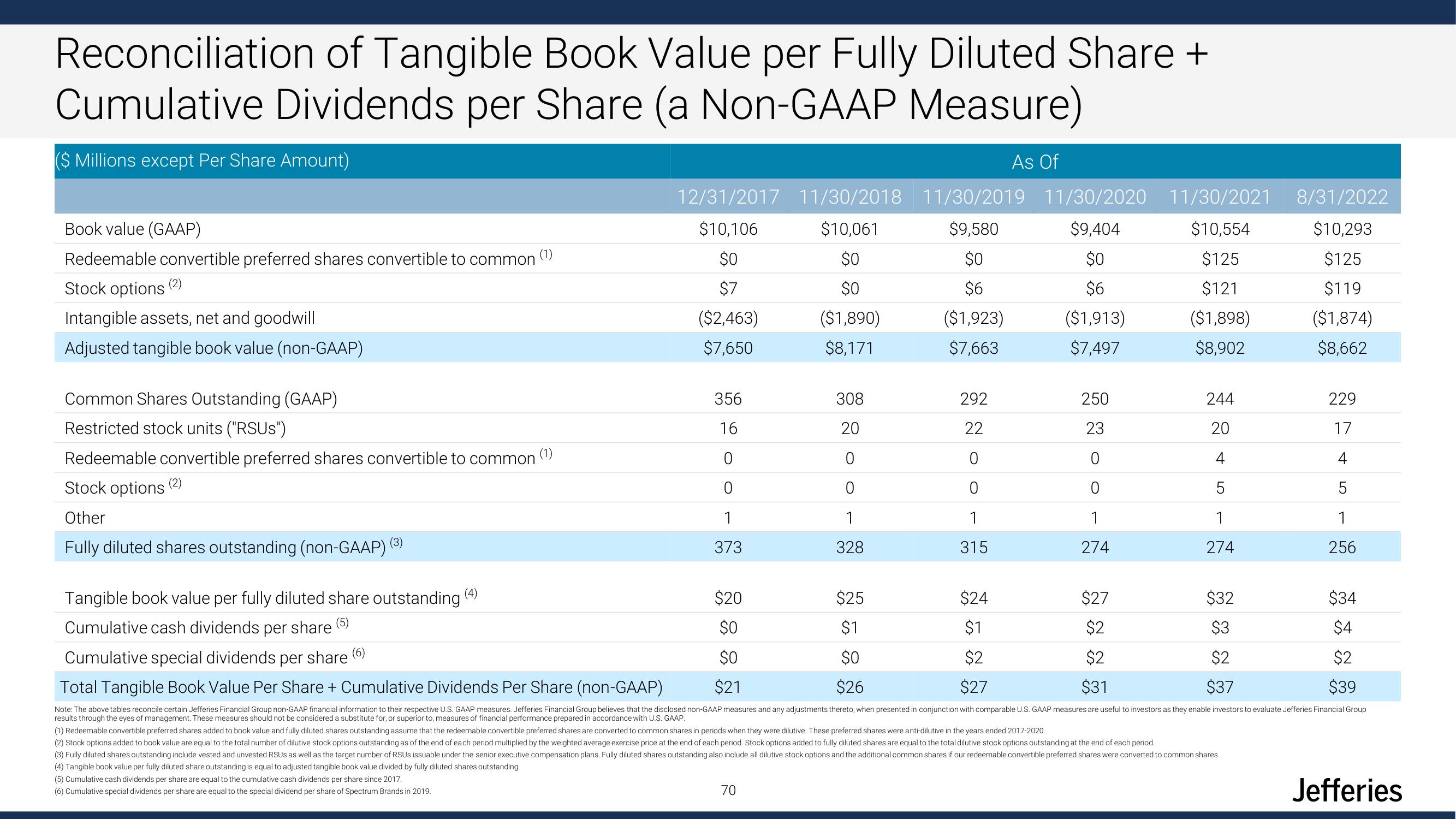

Reconciliation of Tangible Book Value per Fully Diluted Share +

Cumulative Dividends per Share (a Non-GAAP Measure)

($ Millions except Per Share Amount)

Book value (GAAP)

Redeemable convertible preferred shares convertible to common

Stock options (2)

Intangible assets, net and goodwill

Adjusted tangible book value (non-GAAP)

(1)

Common Shares Outstanding (GAAP)

Restricted stock units ("RSUS")

Redeemable convertible preferred shares convertible to common (1)

Stock options

Other

Fully diluted shares outstanding (non-GAAP) (³)

12/31/2017 11/30/2018 11/30/2019 11/30/2020 11/30/2021

$10,554

$10,061

$9,580

$9,404

$10,106

$0

$7

$0

$0

$0

$0

$125

$121

$6

$6

($1,923)

($1,890)

($1,913)

($1,898)

($2,463)

$7,650

$8,171

$7,663

$7,497

$8,902

356

16

0

0

1

373

308

20

0

70

1

328

292

22

As Of

0

1

315

250

23

0

0

1

274

244

20

LO

5

1

274

8/31/2022

$10,293

$125

$119

($1,874)

$8,662

229

17

5

1

256

Tangible book value per fully diluted share outstanding (4)

$20

$25

$24

$27

$32

(5)

Cumulative cash dividends per share

$0

$1

$1

$2

$3

(6)

Cumulative special dividends per share

$0

$0

$2

$2

$2

$2

Total Tangible Book Value Per Share + Cumulative Dividends Per Share (non-GAAP)

$21

$26

$27

$31

$37

$39

Note: The above tables reconcile certain Jefferies Financial Group non-GAAP financial information to their respective U.S. GAAP measures. Jefferies Financial Group believes that the disclosed non-GAAP measures and any adjustments thereto, when presented in conjunction with comparable U.S. GAAP measures are useful to investors as they enable investors to evaluate Jefferies Financial Group

results through the eyes of management. These measures should not be considered a substitute for, or superior to, measures of financial performance prepared in accordance with U.S. GAAP.

(1) Redeemable convertible preferred shares added to book value and fully diluted shares outstanding assume that the redeemable convertible preferred shares are converted to common shares in periods when they were dilutive. These preferred shares were anti-dilutive in the years ended 2017-2020.

(2) Stock options added to book value are equal to the total number of dilutive stock options outstanding as of the end of each period multiplied by the weighted average exercise price at the end of each period. Stock options added to fully diluted shares are equal to the total dilutive stock options outstanding at the end of each period.

(3) Fully diluted shares outstanding include vested and unvested RSUS as well as the target number of RSUS issuable under the senior executive compensation plans. Fully diluted shares outstanding also include all dilutive stock options and the additional common shares if our redeemable convertible preferred shares were converted to common shares.

(4) Tangible book value per fully diluted share outstanding is equal to adjusted tangible book value divided by fully diluted shares outstanding.

(5) Cumulative cash dividends per share are equal to the cumulative cash dividends per share since 2017.

(6) Cumulative special dividends per share are equal to the special dividend per share of Spectrum Brands in 2019.

$34

$4

JefferiesView entire presentation