Ares US Real Estate Opportunity Fund III, L.P Market and Portfolio Update

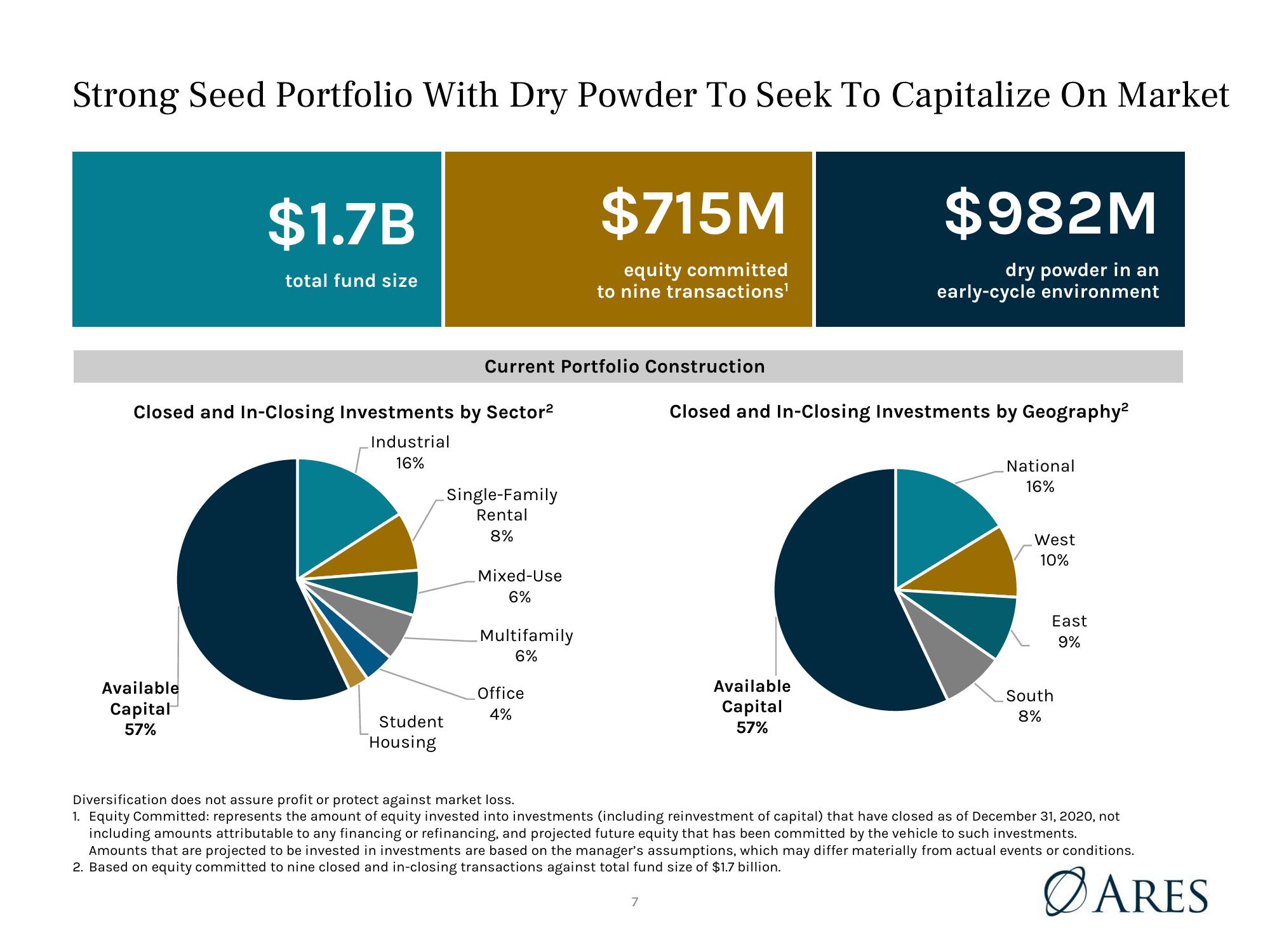

Strong Seed Portfolio With Dry Powder To Seek To Capitalize On Market

$1.7B

total fund size

Available

Capital

57%

Closed and In-Closing Investments by Sector²

Industrial

16%

Student

Housing

Current Portfolio Construction

Single-Family

Rental

8%

Mixed-Use

6%

Multifamily

6%

$715M

equity committed

to nine transactions¹

Office

4%

7

$982M

dry powder in an

early-cycle environment

Closed and In-Closing Investments by Geography²

Available

Capital

57%

National

16%

West

10%

East

9%

South

8%

Diversification does not assure profit or protect against market loss.

1. Equity Committed: represents the am of equity invested into investments (including reinvestment of capital) that have closed as of December 31, 2020, not

including amounts attributable to any financing or refinancing, and projected future equity that has been committed by the vehicle to such investments.

Amounts that are projected to be invested in investments are based on the manager's assumptions, which may differ materially from actual events or conditions.

2. Based on equity committed to nine closed and in-closing transactions against total fund size of $1.7 billion.

ØARESView entire presentation