Kin SPAC Presentation Deck

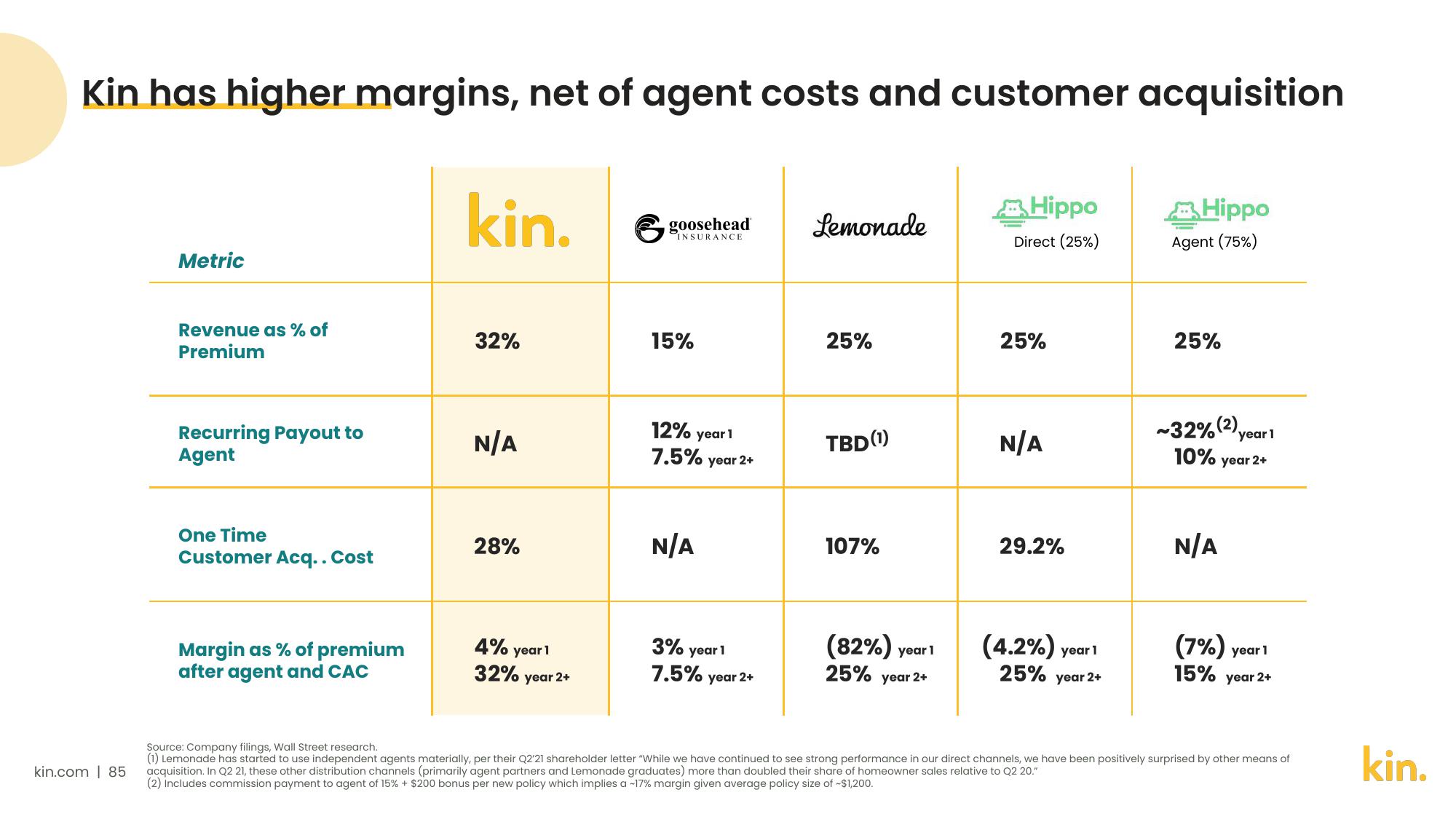

Kin has higher margins, net of agent costs and customer acquisition

kin.com | 85

Metric

Revenue as % of

Premium

Recurring Payout to

Agent

One Time

Customer Acq.. Cost

Margin as % of premium

after agent and CAC

kin.

32%

N/A

28%

4%

32%

year 1

year 2+

INSURANCE

15%

12% year 1

7.5%

N/A

year 2+

3% year 1

7.5%

year 2+

Lemonade

25%

TBD (1)

107%

(82%) year 1

25% year 2+

Hippo

Direct (25%)

25%

N/A

29.2%

(4.2%) year 1

25% year 2+

Hippo

Agent (75%)

25%

~32% (2)

10% year 2+

year 1

N/A

(7%) year 1

15% year 2+

Source: Company filings, Wall Street research.

(1) Lemonade has started to use independent agents materially, per their Q2'21 shareholder letter "While we have continued to see strong performance in our direct channels, we have been positively surprised by other means of

acquisition. In Q2 21, these other distribution channels (primarily agent partners and Lemonade graduates) more than doubled their share of homeowner sales relative to Q2 20."

(2) Includes commission payment to agent of 15% + $200 bonus per new policy which implies a -17% margin given average policy size of -$1,200.

kin.View entire presentation