Landmark Equity Partners XVII, L.P. Recommendation Repor

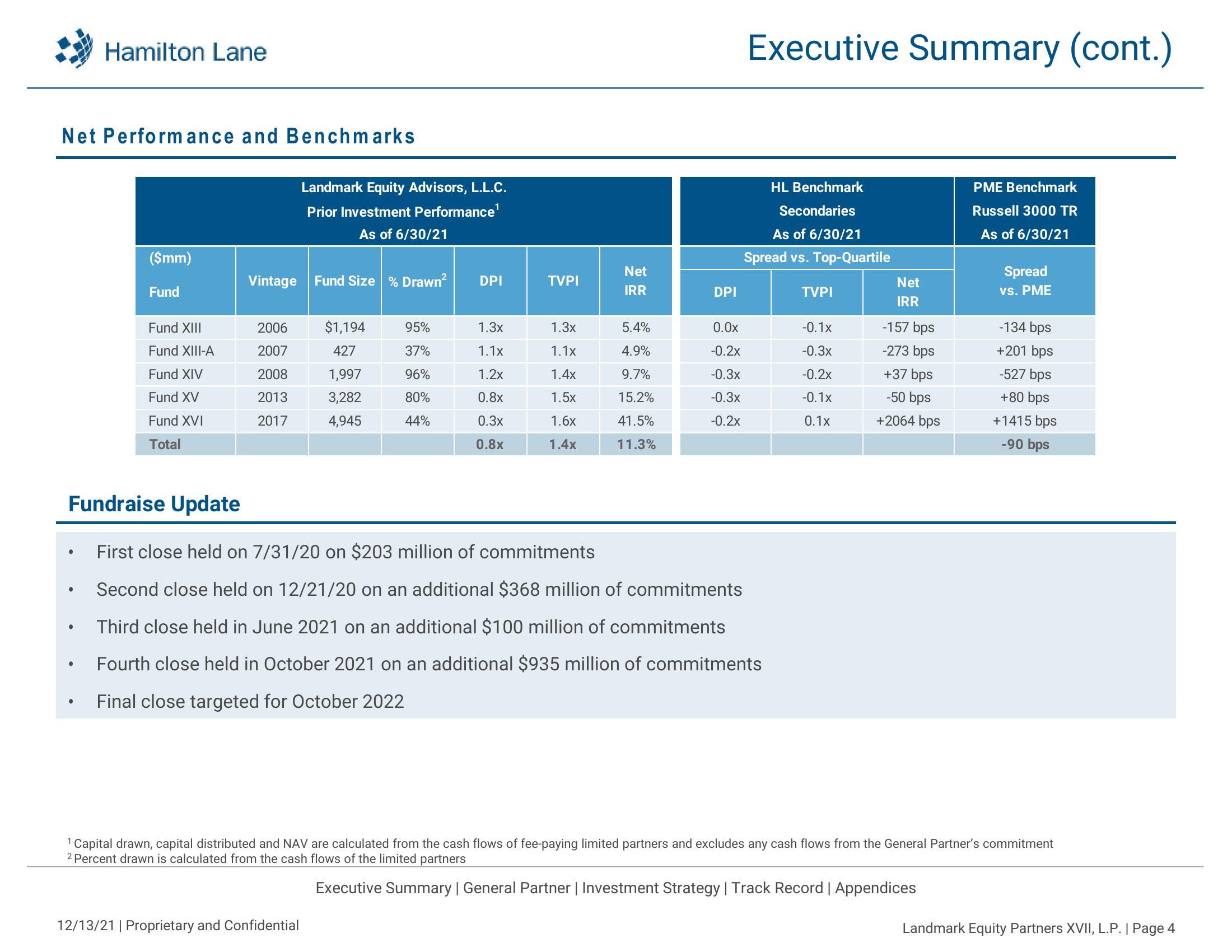

Net Performance and Benchmarks

●

●

Hamilton Lane

●

●

($mm)

Fund

Fund XIII

Fund XIII-A

Fund XIV

Fund XV

Fund XVI

Total

Vintage Fund Size % Drawn²

2006

2007

2008

2013

2017

Landmark Equity Advisors, L.L.C.

Prior Investment Performance¹

As of 6/30/21

$1,194

427

1,997

3,282

4,945

12/13/21 | Proprietary and Confidential

95%

37%

96%

80%

44%

DPI

1.3x

1.1x

1.2x

0.8x

0.3x

0.8x

TVPI

1.3x

1.1x

1.4x

1.5x

1.6x

1.4x

Net

IRR

5.4%

4.9%

9.7%

15.2%

41.5%

11.3%

Fundraise Update

First close held on 7/31/20 on $203 million of commitments

Second close held on 12/21/20 on an additional $368 million of commitments

Third close held in June 2021 on an additional $100 million of commitments

Fourth close held in October 2021 on an additional $935 million of commitments

Final close targeted for October 2022

DPI

0.0x

-0.2x

-0.3x

-0.3x

-0.2x

Executive Summary (cont.)

HL Benchmark

Secondaries

As of 6/30/21

Spread vs. Top-Quartile

TVPI

-0.1x

-0.3x

-0.2x

-0.1x

0.1x

Net

IRR

-157 bps

-273 bps

+37 bps

-50 bps

+2064 bps

PME Benchmark

Russell 3000 TR

As of 6/30/21

Spread

vs. PME

-134 bps

+201 bps

-527 bps

+80 bps

+1415 bps

-90 bps

¹ Capital drawn, capital distributed and NAV are calculated from the cash flows of fee-paying limited partners and excludes any cash flows from the General Partner's commitment

2 Percent drawn is calculated from the cash flows of the limited partners

Executive Summary | General Partner | Investment Strategy | Track Record | Appendices

Landmark Equity Partners XVII, L.P. | Page 4View entire presentation