FiscalNote Investor Presentation Deck

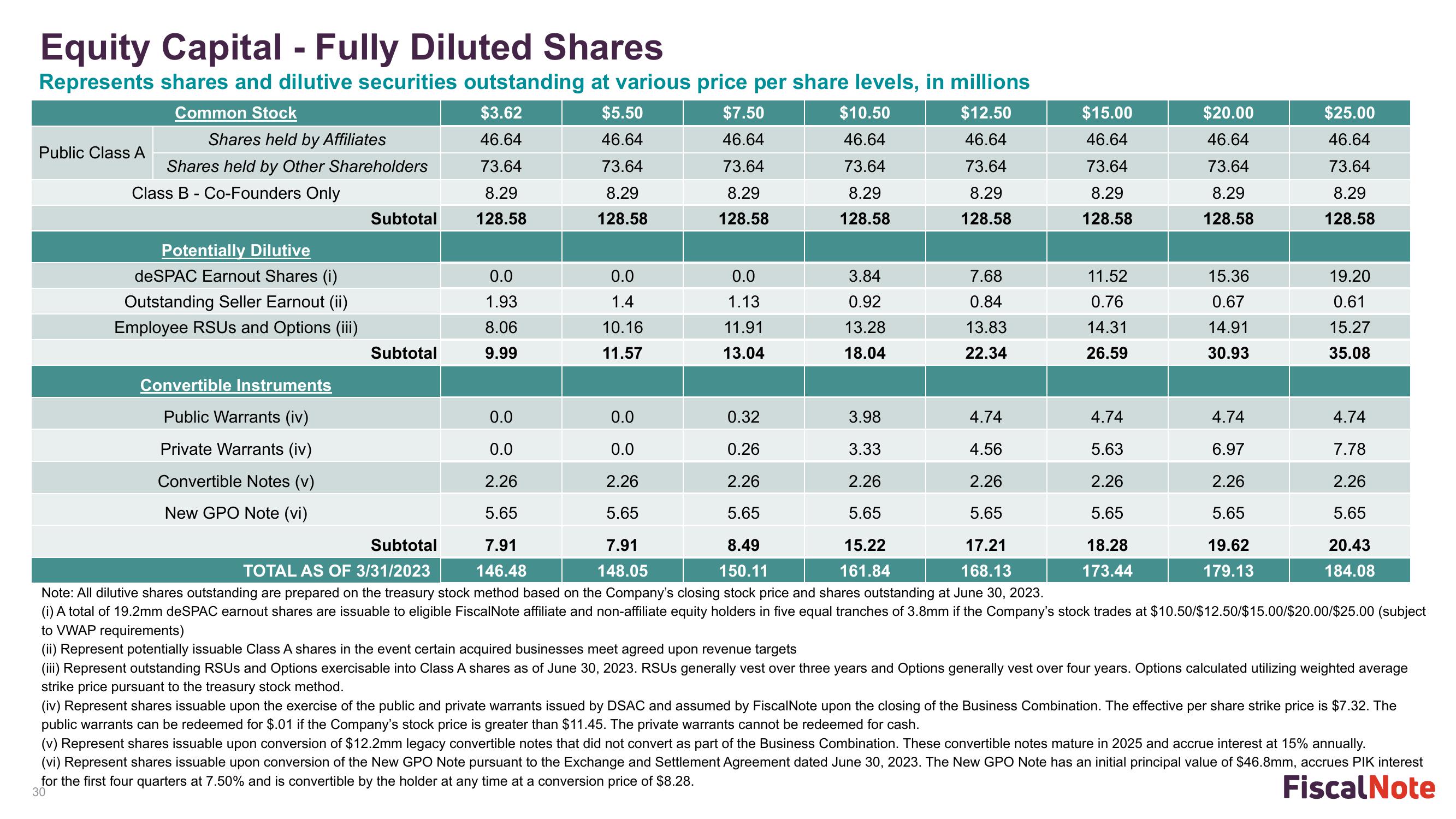

Equity Capital - Fully Diluted Shares

Represents shares and dilutive securities outstanding at various price per share levels, in millions

$12.50

46.64

73.64

8.29

128.58

Public Class A

Common Stock

Shares held by Affiliates

Shares held by Other Shareholders

Class B - Co-Founders Only

Potentially Dilutive

deSPAC Earnout Shares (i)

Outstanding Seller Earnout (ii)

Employee RSUs and Options (iii)

Convertible Instruments

Public Warrants (iv)

Private Warrants (iv)

Convertible Notes (v)

New GPO Note (vi)

Subtotal

Subtotal

$3.62

46.64

73.64

8.29

128.58

0.0

1.93

8.06

9.99

$5.50

46.64

73.64

8.29

128.58

0.0

1.4

10.16

11.57

$7.50

46.64

73.64

8.29

128.58

0.0

0.0

2.26

5.65

7.91

148.05

0.0

1.13

11.91

13.04

$10.50

46.64

73.64

8.29

128.58

3.84

0.92

13.28

18.04

7.68

0.84

13.83

22.34

3.98

3.33

2.26

5.65

15.22

161.84

$15.00

46.64

73.64

8.29

128.58

11.52

0.76

14.31

26.59

$20.00

46.64

73.64

8.29

128.58

4.74

5.63

2.26

5.65

18.28

173.44

15.36

0.67

14.91

30.93

0.0

0.32

4.74

0.0

0.26

4.56

2.26

2.26

2.26

5.65

5.65

5.65

Subtotal

8.49

17.21

7.91

146.48

150.11

168.13

TOTAL AS OF 3/31/2023

Note: All dilutive shares outstanding are prepared on the treasury stock method based on the Company's closing stock price and shares outstanding at June 30, 2023.

(i) A total of 19.2mm deSPAC earnout shares are issuable to eligible FiscalNote affiliate and non-affiliate equity holders in five equal tranches of 3.8mm if the Company's stock trades at $10.50/$12.50/$15.00/$20.00/$25.00 (subject

to VWAP requirements)

(ii) Represent potentially issuable Class A shares in the event certain acquired businesses meet agreed upon revenue targets

(iii) Represent outstanding RSUS and Options exercisable into Class A shares as of June 30, 2023. RSUS generally vest over three years and Options generally vest over four years. Options calculated utilizing weighted average

strike price pursuant to the treasury stock method.

(iv) Represent shares issuable upon the exercise of the public and private warrants issued by DSAC and assumed by FiscalNote upon the closing of the Business Combination. The effective per share strike price is $7.32. The

public warrants can be redeemed for $.01 if the Company's stock price is greater than $11.45. The private warrants cannot be redeemed for cash.

$25.00

46.64

73.64

8.29

128.58

4.74

6.97

2.26

5.65

19.62

179.13

19.20

0.61

15.27

35.08

4.74

7.78

2.26

5.65

20.43

184.08

(v) Represent shares issuable upon conversion of $12.2mm legacy convertible notes that did not convert as part of the Business Combination. These convertible notes mature in 2025 and accrue interest at 15% annually.

(vi) Represent shares issuable upon conversion of the New GPO Note pursuant to the Exchange and Settlement Agreement dated June 30, 2023. The New GPO Note has an initial principal value of $46.8mm, accrues PIK interest

for the first four quarters at 7.50% and is convertible by the holder at any time at a conversion price of $8.28.

Fiscal Note

30View entire presentation