eToro SPAC Presentation Deck

бетого

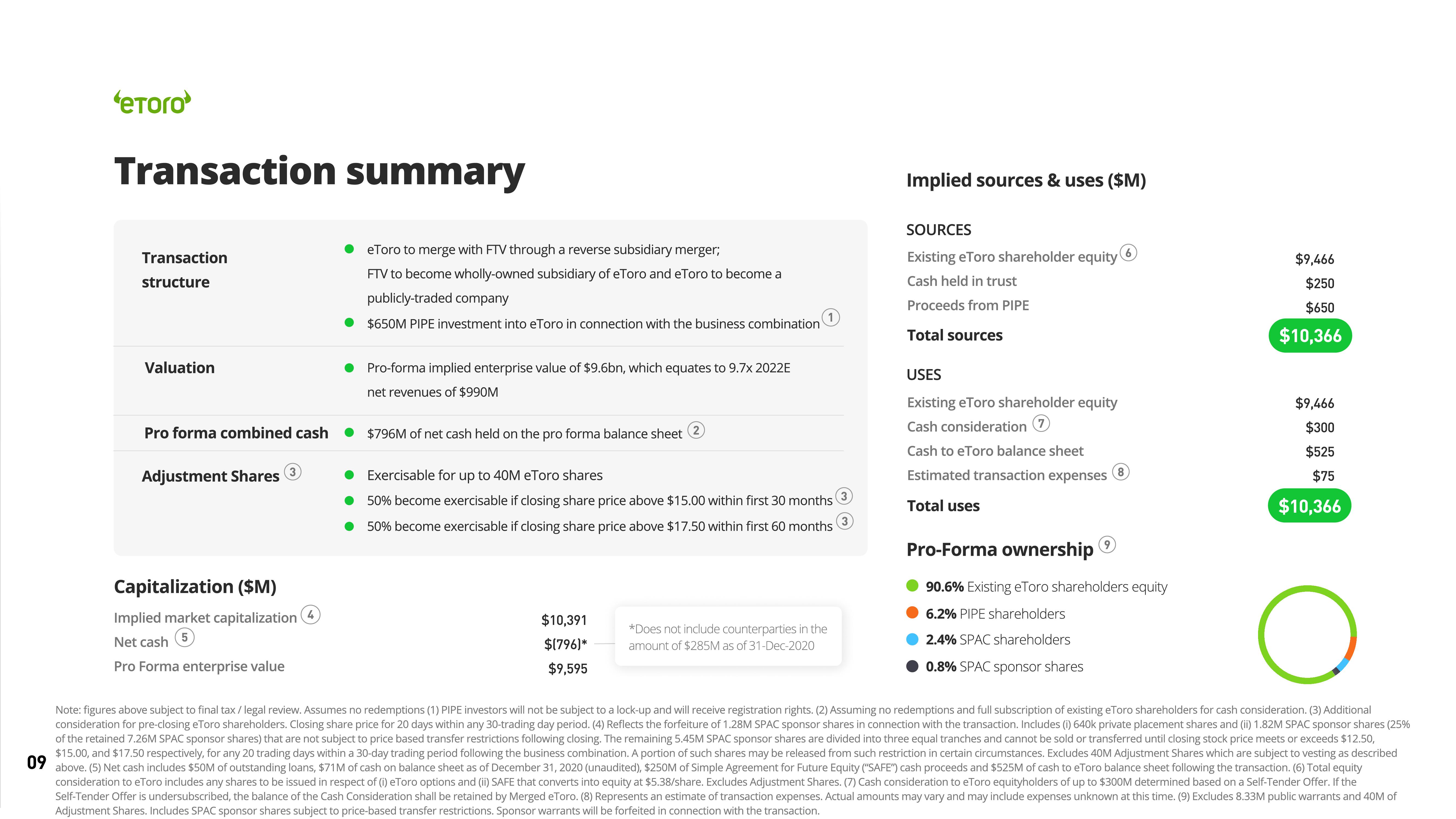

Transaction summary

Transaction

structure

Valuation

Pro forma combined cash

Adjustment Shares

Capitalization ($M)

Implied market capitalization

Net cash 5

Pro Forma enterprise value

eToro to merge with FTV through a reverse subsidiary merger;

FTV to become wholly-owned subsidiary of eToro and eToro to become a

publicly-traded company

● $650M PIPE investment into eToro in connection with the business combination

Pro-forma implied enterprise value of $9.6bn, which equates to 9.7x 2022E

net revenues of $990M

$796M of net cash held on the pro forma balance sheet

Exercisable for up to 40M eToro shares

●

50% become exercisable if closing share price above $15.00 within first 30 months 3

● 50% become exercisable if closing share price above $17.50 within first 60 months

$10,391

$(796)*

$9,595

*Does not include counterparties in the

amount of $285M as of 31-Dec-2020

Implied sources & uses ($M)

SOURCES

Existing eToro shareholder equity (6)

Cash held in trust

Proceeds from PIPE

Total sources

USES

Existing eToro shareholder equity

Cash consideration 7

Cash to eToro balance sheet

Estimated transaction expenses

Total uses

8

Pro-Forma ownership

90.6% Existing eToro shareholders equity

6.2% PIPE shareholders

2.4% SPAC shareholders

0.8% SPAC sponsor shares

$9,466

$250

$650

$10,366

$9,466

$300

$525

$75

$10,366

O

09

Note: figures above subject to final tax/legal review. Assumes no redemptions (1) PIPE investors will not be subject to a lock-up and will receive registration rights. (2) Assuming no redemptions and full subscription of existing eToro shareholders for cash consideration. (3) Additional

consideration for pre-closing eToro shareholders. Closing share price for 20 days within any 30-trading day period. (4) Reflects the forfeiture of 1.28M SPAC sponsor shares in connection with the transaction. Includes (i) 640k private placement shares and (ii) 1.82M SPAC sponsor shares (25%

of the retained 7.26M SPAC sponsor shares) that are not subject to price based transfer restrictions following closing. The remaining 5.45M SPAC sponsor shares are divided into three equal tranches and cannot be sold or transferred until closing stock price meets or exceeds $12.50,

$15.00, and $17.50 respectively, for any 20 trading days within a 30-day trading period following the business combination. A portion of such shares may be released from such restriction in certain circumstances. Excludes 40M Adjustment Shares which are subject to vesting as described

above. (5) Net cash includes $50M of outstanding loans, $71M of cash on balance sheet as of December 31, 2020 (unaudited), $250M of Simple Agreement for Future Equity ("SAFE") cash proceeds and $525M of cash to eToro balance sheet following the transaction. (6) Total equity

consideration to eToro includes any shares to be issued in respect of (i) eToro options and (ii) SAFE that converts into equity at $5.38/share. Excludes Adjustment Shares. (7) Cash consideration to eToro equityholders of up to $300M determined based on a Self-Tender Offer. If the

Self-Tender Offer is undersubscribed, the balance of the Cash Consideration shall be retained by Merged eToro. (8) Represents an estimate of transaction expenses. Actual amounts may vary and may include expenses unknown at this time. (9) Excludes 8.33M public warrants and 40M of

Adjustment Shares. Includes SPAC sponsor shares subject to price-based transfer restrictions. Sponsor warrants will be forfeited in connection with the transaction.View entire presentation