Hydrofarm IPO Presentation Deck

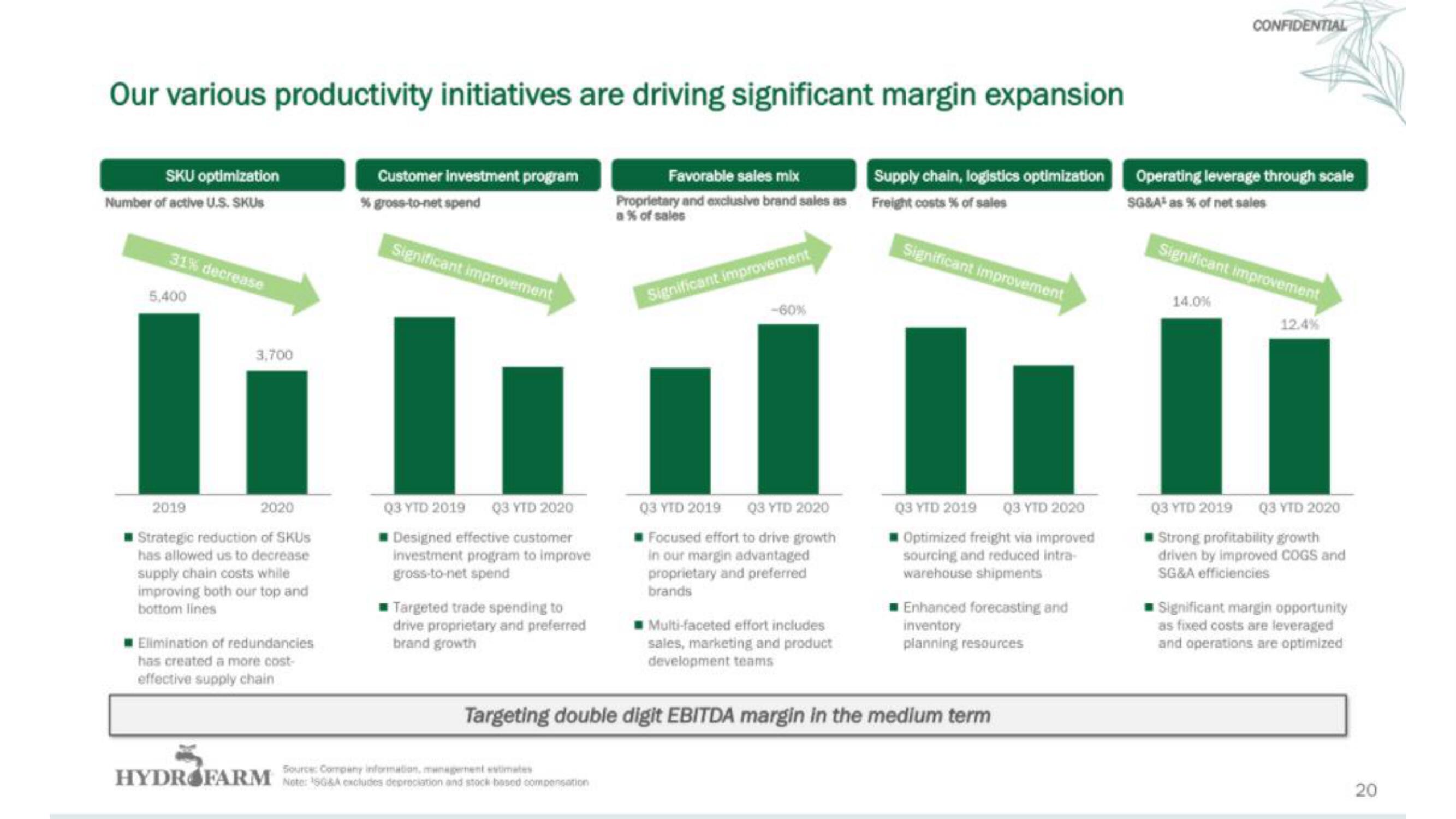

Our various productivity initiatives are driving significant margin expansion

SKU optimization

Number of active U.S. SKUs

31% decrease

5,400

3,700

2019

2020

Strategic reduction of SKUS

has allowed us to decrease

supply chain costs while

improving both our top and

bottom lines

Elimination of redundancies

has created a more cost-

effective supply chain

Customer Investment program

% gross-to-net spend

Significant improvement

Q3 YTD 2019 Q3 YTD 2020

Designed effective customer

investment program to improve

gross-to-net spend

Targeted trade spending to

drive proprietary and preferred

brand growth

Favorable sales mix

Proprietary and exclusive brand sales as Freight costs % of sales

a % of sales

Source: Company information, management estimates

HYDROFARM Note: 198A excludes depreciation and stock based compensation

Significant improvement

-60%

Q3 YTD 2019 Q3 YTD 2020

Focused effort to drive growth

in our margin advantaged

proprietary and preferred

brands

☐Multi-faceted effort includes

sales, marketing and product

development teams

Supply chain, logistics optimization

Significant improvement

Q3 YTD 2019 Q3 YTD 2020

Optimized freight via improved

sourcing and reduced intra-

warehouse shipments

Enhanced forecasting and

inventory

planning resources

Targeting double digit EBITDA margin in the medium term

CONFIDENTIAL

Operating leverage through scale

SG&A¹ as % of net sales

Significant improvement

14.0%

12.4%

Q3 YTD 2019 Q3 YTD 2020

Strong profitability growth

driven by improved COGS and

SG&A efficiencies

Significant margin opportunity

as fixed costs are leveraged

and operations are optimized

20View entire presentation