UBS Fixed Income Presentation Deck

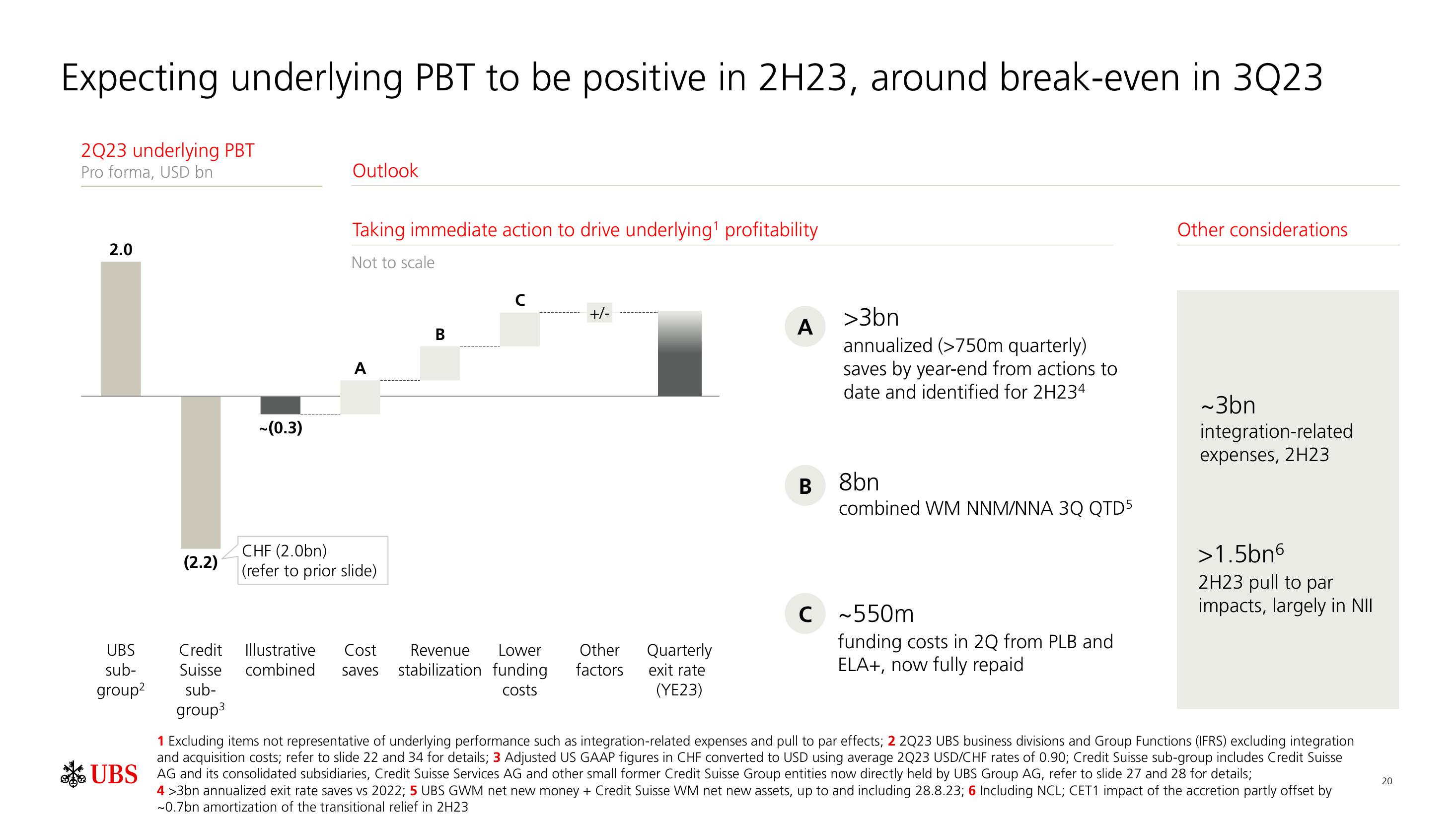

Expecting underlying PBT to be positive in 2H23, around break-even in 3Q23

2Q23 underlying PBT

Pro forma, USD bn

2.0

UBS

sub-

group²

(2.2)

~(0.3)

Outlook

Taking immediate action to drive underlying¹ profitability

Not to scale

A

CHF (2.0bn)

(refer to prior slide)

Credit Illustrative Cost

Suisse combined saves

sub-

group³

B

с

Revenue Lower

stabilization funding

costs

+/-

Other

factors

Quarterly

exit rate

(YE23)

A

B

>3bn

annualized (>750m quarterly)

saves by year-end from actions to

date and identified for 2H234

8bn

combined WM NNM/NNA 3Q QTD5

C~550m

funding costs in 2Q from PLB and

ELA+, now fully repaid.

Other considerations

~3bn

integration-related

expenses, 2H23

>1.5bn6

2H23 pull to par

impacts, largely in NII

1 Excluding items not representative of underlying performance such as integration-related expenses and pull to par effects; 2 2Q23 UBS business divisions and Group Functions (IFRS) excluding integration

and acquisition costs; refer to slide 22 and 34 for details; 3 Adjusted US GAAP figures in CHF converted to USD using average 2Q23 USD/CHF rates of 0.90; Credit Suisse sub-group includes Credit Suisse

UBS AG and its consolidated subsidiaries, Credit Suisse Services AG and other small former Credit Suisse Group entities now directly held by UBS Group AG, refer to slide 27 and 28 for details;

4>3bn annualized exit rate saves vs 2022; 5 UBS GWM net new money + Credit Suisse WM net new assets, up to and including 28.8.23; 6 Including NCL; CET1 impact of the accretion partly offset by

~0.7bn amortization of the transitional relief in 2H23

20View entire presentation