Nexters Results Presentation Deck

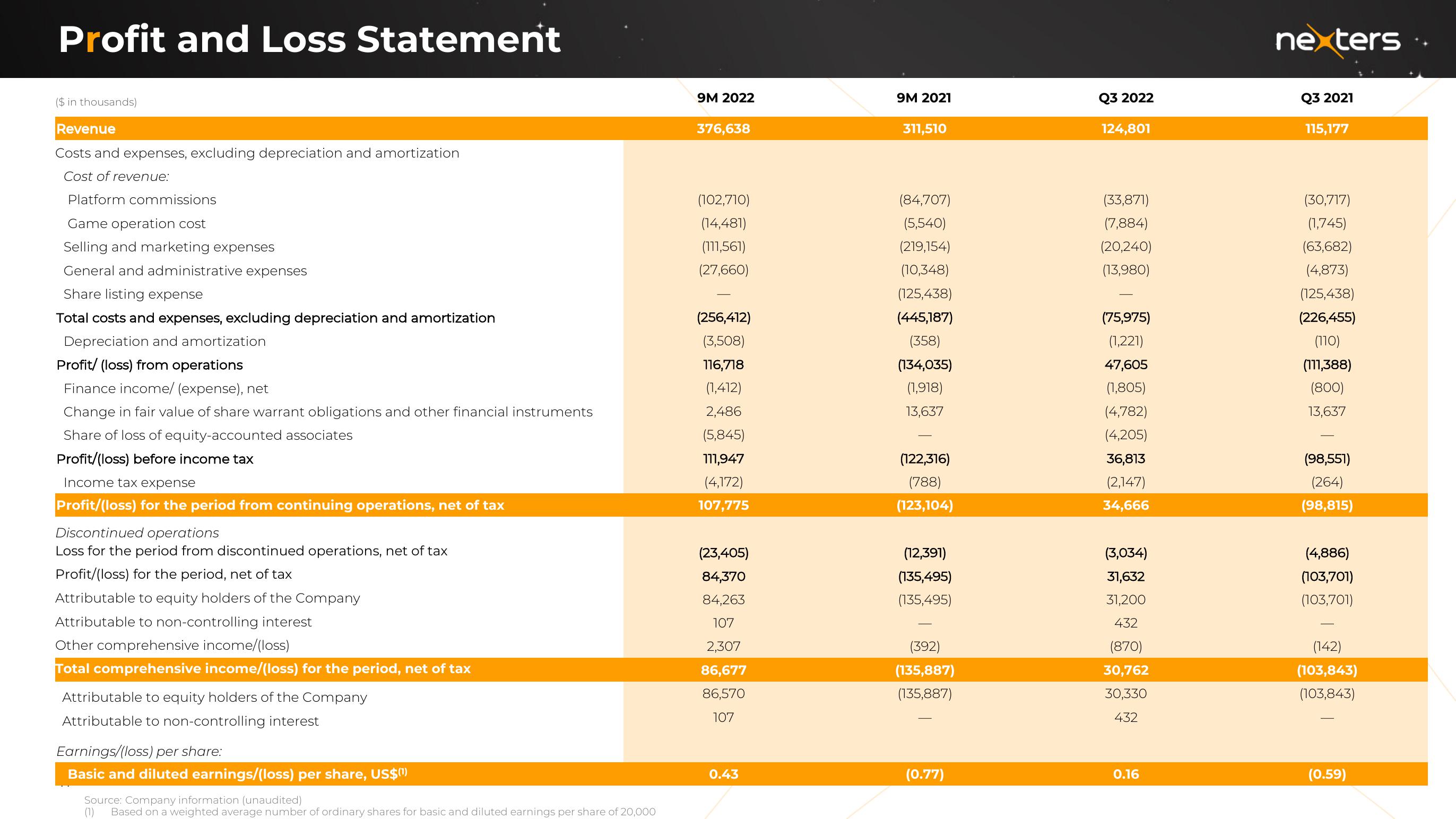

Profit and Loss Statement

($ in thousands)

Revenue

Costs and expenses, excluding depreciation and amortization

Cost of revenue:

Platform commissions

Game operation cost

Selling and marketing expenses

General and administrative expenses

Share listing expense

Total costs and expenses, excluding depreciation and amortization

Depreciation and amortization

Profit/ (loss) from operations

Finance income/ (expense), net

Change in fair value of share warrant obligations and other financial instruments

Share of loss of equity-accounted associates

Profit/(loss) before income tax

Income tax expense

Profit/(loss) for the period from continuing operations, net of tax

Discontinued operations

Loss for the period from discontinued operations, net of tax

Profit/(loss) for the period, net of tax

Attributable to equity holders of the Company

Attributable to non-controlling interest

Other comprehensive income/(loss)

Total comprehensive income/(loss) for the period, net of tax

Attributable to equity holders of the Company

Attributable to non-controlling interest

Earnings/(loss) per share:

Basic and diluted earnings/(loss) per share, US$(¹)

Source: Company information (unaudited)

(1) Based on a weighted average number of ordinary shares for basic and diluted earnings per share of 20,000

9M 2022

376,638

(102,710)

(14,481)

(111,561)

(27,660)

(256,412)

(3,508)

116,718

(1,412)

2,486

(5,845)

111,947

(4,172)

107,775

(23,405)

84,370

84,263

107

2,307

86,677

86,570

107

0.43

9M 2021

311,510

(84,707)

(5,540)

(219,154)

(10,348)

(125,438)

(445,187)

(358)

(134,035)

(1,918)

13,637

(122,316)

(788)

(123,104)

(12,391)

(135,495)

(135,495)

(392)

(135,887)

(135,887)

(0.77)

Q3 2022

124,801

(33,871)

(7,884)

(20,240)

(13,980)

(75,975)

(1,221)

47,605

(1,805)

(4,782)

(4,205)

36,813

(2,147)

34,666

(3,034)

31,632

31,200

432

(870)

30,762

30,330

432

0.16

nexters

Q3 2021

115,177

(30,717)

(1,745)

(63,682)

(4,873)

(125,438)

(226,455)

(110)

(111,388)

(800)

13,637

(98,551)

(264)

(98,815)

(4,886)

(103,701)

(103,701)

(142)

(103,843)

(103,843)

(0.59)View entire presentation