Ashtead Group Results Presentation Deck

28

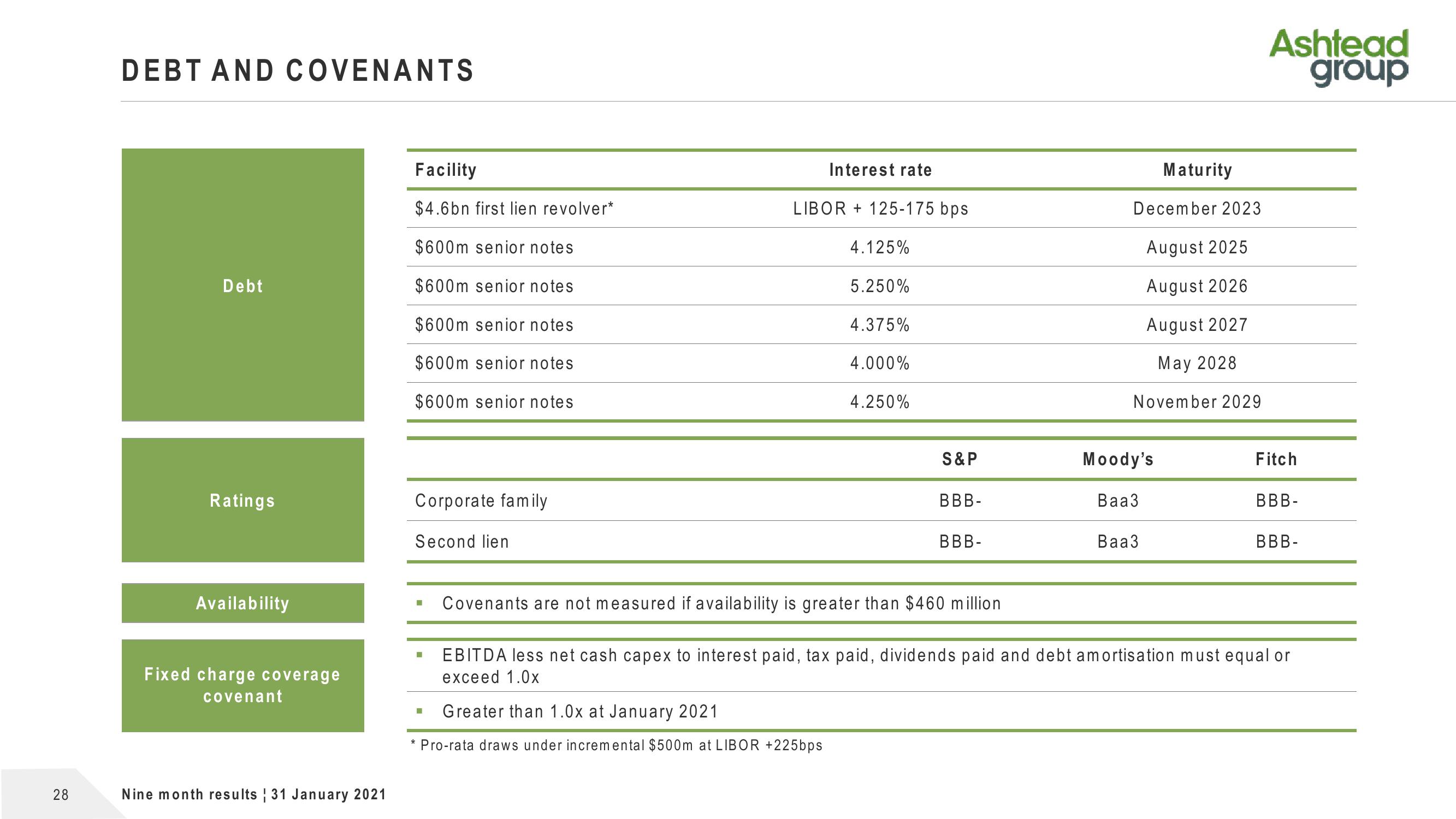

DEBT AND COVENANTS

Debt

Ratings

Availability

Fixed charge coverage

covenant

Nine month results 31 January 2021

Facility

$4.6bn first lien revolver*

$600m senior notes

$600m senior notes

$600m senior notes

$600m senior notes

$600m senior notes

Corporate family

Second lien

■

H

Interest rate

LIBOR + 125-175 bps

■

4.125%

Greater than 1.0x at January 2021

* Pro-rata draws under incremental $500m at LIBOR +225bps

5.250%

4.375%

4.000%

4.250%

S&P

BBB-

BBB-

Covenants are not measured if availability is greater than $460 million

December 2023

August 2025

August 2026

August 2027

May 2028

November 2029

Moody's

Baa3

Maturity

Baa3

Ashtead

group

Fitch

BBB-

BBB-

EBITDA less net cash capex to interest paid, tax paid, dividends paid and debt amortisation must equal or

exceed 1.0xView entire presentation