TPG Results Presentation Deck

Pro Forma GAAP Statements of Operations

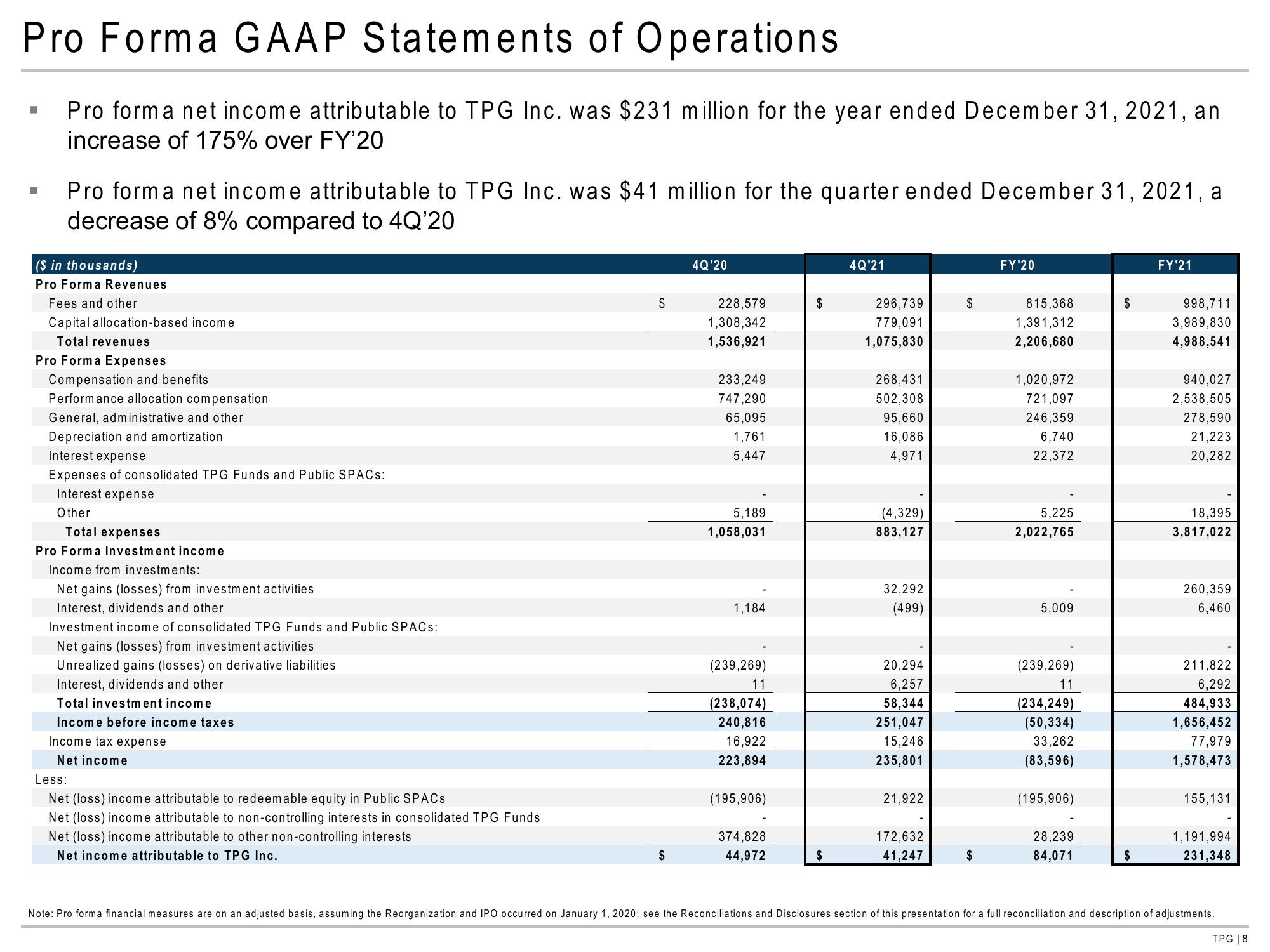

Pro form a net income attributable to TPG Inc. was $231 million for the year ended December 31, 2021, an

increase of 175% over FY'20

■

■

Pro forma net income attributable to TPG Inc. was $41 million for the quarter ended December 31, 2021, a

decrease of 8% compared to 4Q'20

($ in thousands)

Pro Forma Revenues

Fees and other

Capital allocation-based income

Total revenues

Pro Forma Expenses

Compensation and benefits

Performance allocation compensation

General, administrative and other

Depreciation and amortization

Interest expense

Expenses of consolidated TPG Funds and Public SPACs:

Interest expense

Other

Total expenses

Pro Forma Investment income

Income from investments:

Net gains (losses) from investment activities

Interest, dividends and other

Investment income of consolidated TPG Funds and Public SPACs:

Net gains (losses) from investment activities

Unrealized gains (losses) on derivative liabilities

Interest, dividends and other

Total investment income

Income before income taxes

Income tax expense

Net income

Less:

Net (loss) income attributable to redeemable equity in Public SPACs

Net (loss) income attributable to non-controlling interests in consolidated TPG Funds

Net (loss) income attributable to other non-controlling interests

Net income attributable to TPG Inc.

$

$

4Q'20

228,579

1,308,342

1,536,921

233,249

747,290

65,095

1,761

5,447

5,189

1,058,031

1,184

(239,269)

11

(238,074)

240,816

16,922

223,894

(195,906)

374,828

44,972

$

$

4Q'21

296,739

779,091

1,075,830

268,431

502,308

95,660

16,086

4,971

(4,329)

883,127

32,292

(499)

20,294

6,257

58,344

251,047

15,246

235,801

21,922

172,632

41,247

$

$

FY'20

815,368

1,391,312

2,206,680

1,020,972

721,097

246,359

6,740

22,372

5,225

2,022,765

5,009

(239,269)

11

(234,249)

(50,334)

33,262

(83,596)

(195,906)

28,239

84,071

$

$

FY'21

998,711

3,989,830

4,988,541

940,027

2,538,505

278,590

21,223

20,282

18,395

3,817,022

260,359

6,460

211,822

6,292

484,933

1,656,452

77,979

1,578,473

155,131

1,191,994

231,348

Note: Pro forma financial measures are on an adjusted basis, assuming the Reorganization and IPO occurred on January 1, 2020; see the Reconciliations and Disclosures section of this presentation for a full reconciliation and description of adjustments.

TPG 8View entire presentation