J.P.Morgan Mergers and Acquisitions Presentation Deck

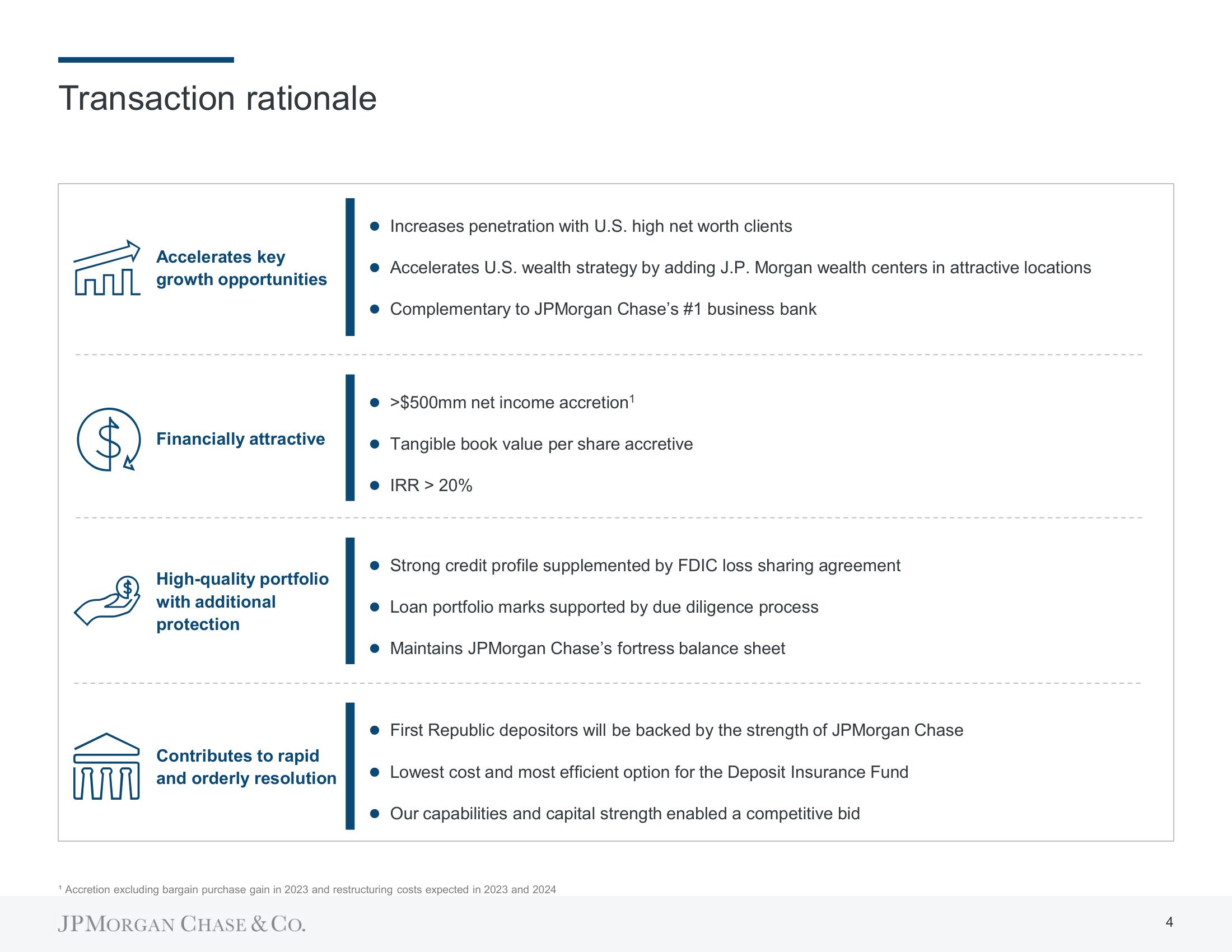

Transaction rationale

$₂

Accelerates key

growth opportunities

Financially attractive

High-quality portfolio

with additional

protection

Contributes to rapid

and orderly resolution

• Increases penetration with U.S. high net worth clients

● Accelerates U.S. wealth strategy by adding J.P. Morgan wealth centers in attractive locations

• Complementary to JPMorgan Chase's #1 business bank

>$500mm net income accretion¹

Tangible book value per share accretive

IRR > 20%

• Strong credit profile supplemented by FDIC loss sharing agreement

• Loan portfolio marks supported by due diligence process

• Maintains JPMorgan Chase's fortress balance sheet

• First Republic depositors will be backed by the strength of JPMorgan Chase

● Lowest cost and most efficient option for the Deposit Insurance Fund

Our capabilities and capital strength enabled a competitive bid

¹ Accretion excluding bargain purchase gain in 2023 and restructuring costs expected in 2023 and 2024

JPMORGAN CHASE & Co.

4View entire presentation