Evercore Investment Banking Pitch Book

Financial Analysis

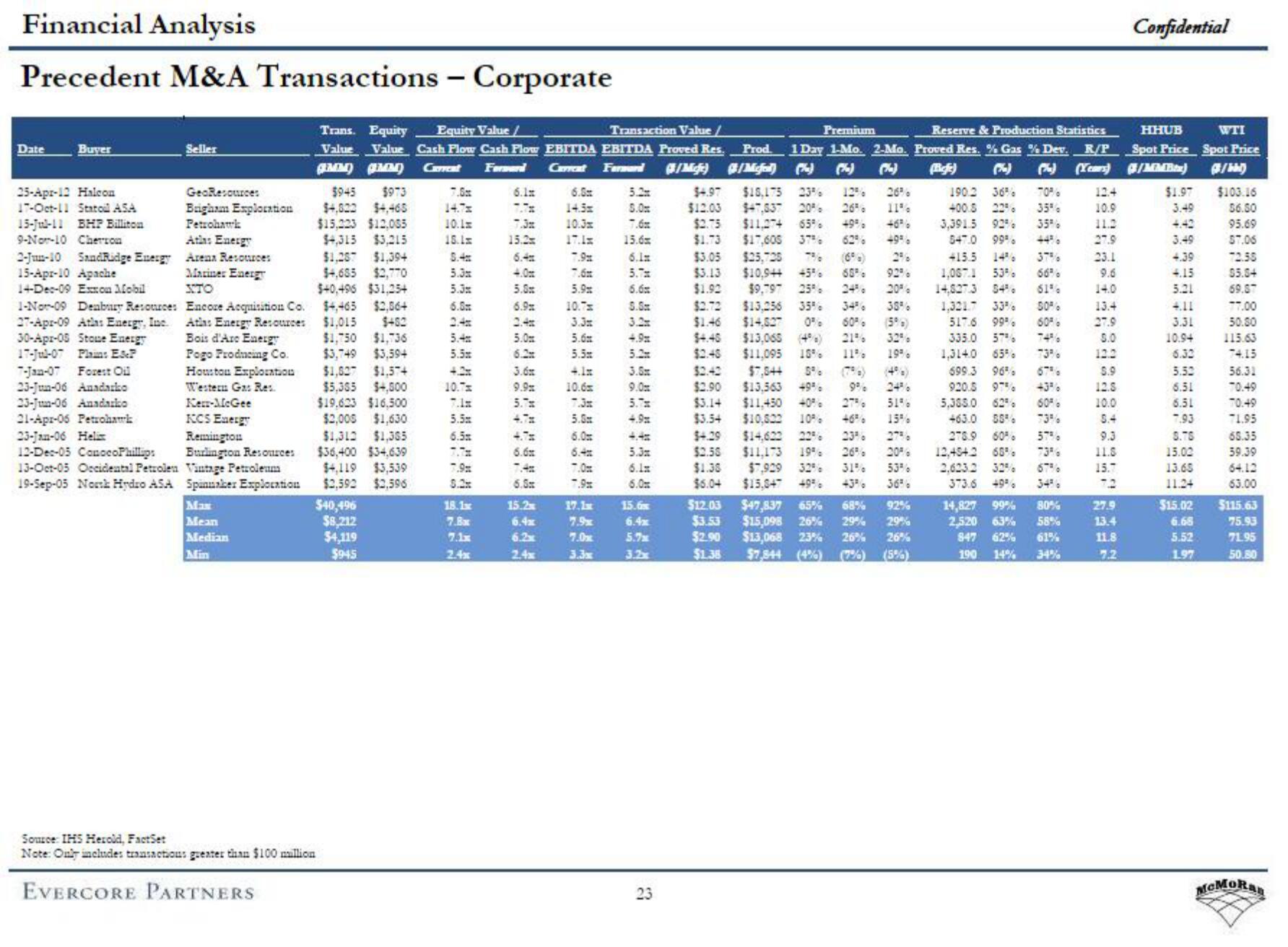

Precedent M&A Transactions - Corporate

Date

Buyer

25-Apr-12 Halcon

17-Oct-11 Statoil ASA

15-Jul-11 BHP Billiton

9-Nor-10 Cherron

Seller

GeoResources

Brigham Exploration

Petrohauk

Atlas Energy

2-Jun-10 SandRidge Energy Arenn Resources

15-Apr-10 Apache

Mariner Energy

STO

14-Dec-09 Exxon Mobil

1-Nor-09 Deabury Resources

27-Apr-09 Atlas Energy, Inc.

30-Apr-08 Stoce Energy

17-Jul-07 Plain: E&P

7-Jan-07 Forest Oil

23-Jun-06 Anadarko

23-Jun-06 Anadarko

21-Apr-05 Petrohawk

23-Jan-06 Heli

12-Dec-05 ConocoPhillips

13-Oct-05 Occidental Petrolen

19-Sep-05 North Hydro ASA

Encore Acquisition Co.

Ath: Energy Resources

Bois d'Arc Energy

Pogo Producing Co.

Houston Exploration

Western Gas Res.

Kerr-McGee

KCS Energy

Remington

Burlington Resources

Vintage Petroleum

Spinuaker Exploration

Max

Mean

Median

Min

Transaction Value/

Premium

Reserve & Production Statistics

Trans. Equity Equity Value /

Value Value Cash Flow Cash Flow EBITDA EBITDA Proved Res. Prod. 1 Day 1-Mo. 2-Mo. Proved Res. % Gas % Dev. R/P

GEMM) (MM) Carreat Fernand

Farmard /Mcft) G/Mcfol

(%)

(Refe)

(Years)

12.4

10.9

11.2

27.9

23.1

(x)

190.2 36% 70%

400.8 22% 35%

3,391.5 92% 35%

547.0 99%

415.5

37%

1,067.1 53% 66%

14,827.3 54% 61%

1,321.7 33% 50%

517.6 99%

335.0 57%

1,3140 65%

9.6

14.0

13.4

27.9

5.0

12.2

60%

74%

73%

5.9

699.3 96% 67%

920.5 97%

12.S

5,388.0 62% 60%

10.0

5.4

463.0 55% 73%

276.9 60% 57%

68% 73%

Source: IHS Herold, FactSet

Note: Only includes transactions greater than $100 million

EVERCORE PARTNERS

$945 $973

$4,822 $4,465

$15,223 $12,065

$4,315 $3,215

$1,287 $1,394

$4,685 $2,770

$+0,495 $31,25+4

$4,465 $2,56+

$1,015 $482

$1,750 $1,736

$3,749 $3,59+

$1,627 $1,574

$5,355 $4,500

$19.623 $16,500

$2,000 $1,630

$1,312 $1,365

$36,400 $34.639

$4,119 $3,539

$2,592 $2,596

$40,496

$8,212

$4,119

$945

7.5x

14.7%

10.1m

15.1m

5.4

5.3x

5.3x

6.8

2.4x

5.4

5.5

10.T=

5.5

6.5x

7.9%

8.2

18.1x

7.8x

7.1x

2.4x

6.1x

15.2

6.4

5.5x

6.9x

5.0

6.2

3.6m

9.9%

5.7x

4.7%

4.7%

6.6x

6.5x

15.2x

6.4x

6.2x

2.4x

6.8

l

10.3x

17.1=

7.9x

5.9x

10.7%

3.3x

5.6

5.5x

4.1=

10.6

5.6

6.0

7.0x

7.9%

17.1x

7.9

7.0x

3.3x

5.2

5.0

7.6x

15.6m

6.1x

5.7x

6.6x

5.S

4.9%

5.2

3.5m

9.0

5.7%

4.9%

5.3x

6.1x

6.0

15.6

6.4x

5.7

3.2x

23

$4.97 $15,175 23%

26%

$12.03 $47,537 20% 26%

11%

$2.75 $11,274 65% 49% 46%

$1.73 $17,605 37% 62% 49%

$3.05 $25,728

(6%) 2%

$3.13 $10,9++ 45% 68% 92%

$1.92 $9,797 25%

20%

$2.72 $13,256 35%

38%

(5%)

32%

$2.45 $11,095 15% 11% 19%

$1.46 $14,827 0% 60%

$4.45 $13,065 (4%) 21%

$2.42 $7,544 5%

$2.90 $13,563 49%

$3.14 $11.450

27%

$3.54 $10,822 10%

46%

$4.29

22% 23%

$2.58 $11,173 19% 26% 20%

$1.38 $7,929 32% 31% 53%

$6.04 $15,847 49%

36%

$12.03 $47,837 65% 68% 92%

$3.53 $15,098 26% 29% 29%

$2.90 $13,068 23% 26% 26%

$1.38 $7,844 (4%)

(7%) (5%)

51%

15%

12,454.2

2,623.2

373.6 49% 34%

14,827 99% 80%

2,520 63% 58%

847 62% 61%

190

14% 34%

9.3

11.8

15.7

7.2

27.9

13.4

11.8

7.2

Confidential

HHUB WTI

Spot Price Spot Price

/MMBix) (/)

$103.16

56.50

95.69

$7.06

$1.97

3.49

4.42

3.49

4.39

4.15

5.21

4.11

3.31

10.94

6.32

5.52

6.51

6.51

7.93

S.TS

15.02

13.65

11.24

$15.02

6.68

5.52

1.97

72.58

$5.54

69.87

77.00

50.80

115.63

74.15

56.31

70.49

70.49

71.95

65.35

59.39

64.12

63.00

$115.63

75.93

71.95

50.80

MCMORanView entire presentation