Evercore Investment Banking Pitch Book

Discussion Materials

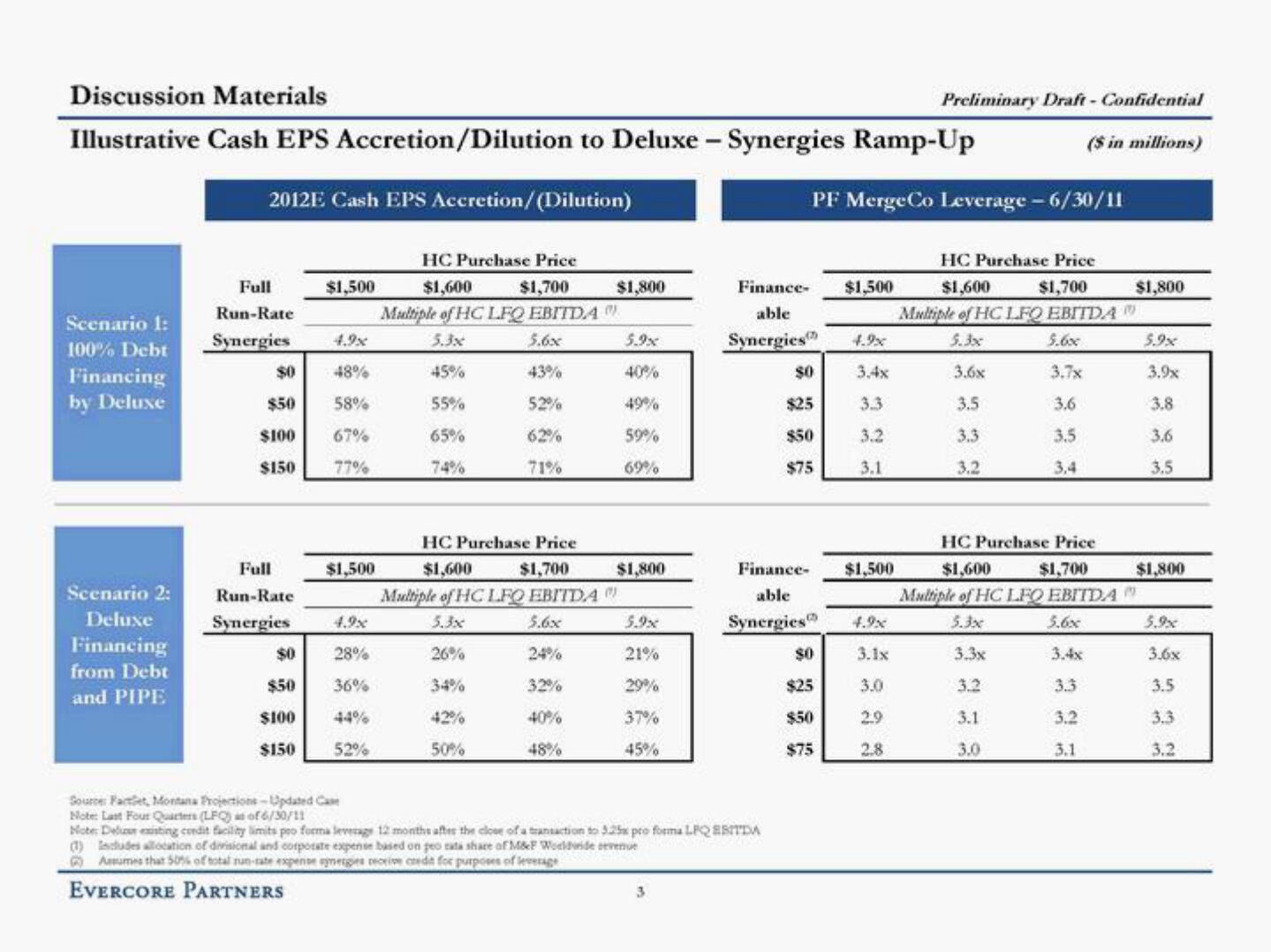

Illustrative Cash EPS Accretion/Dilution to Deluxe - Synergies Ramp-Up

2012E Cash EPS Accretion/(Dilution)

Scenario 1:

100% Debt

Financing

by Deluxe

Scenario 2:

Deluxe

Financing

from Debt

and PIPE

Full

Run-Rate

Synergies

4.9x

$0

48%

$50

58%

$100 67%

$150

77%

Full

Run-Rate

Synergies

$1,500

$0

$50

$100

$150

$1,500

4.9x

28%

36%

52%

HC Purchase Price

$1,600

$1,700

Multiple of HC LFQ EBITDA)

5.3x

45%

55%

65%

74%

5.6x

43%

52%

62%

71%

50%

HC Purchase Price

$1,600 $1,700

Multiple of HC LFQ EBITDA)

5.3x

26%

$1,800

5.6x

24%

32%

40%

48%

5.9%

40%

49%

59%

69%

$1,800

5.9x

21%

29%

37%

45%

(1) Includes allocation of divisional and corporate expense based on peo tata share of M&F Worldwide revenue

Assumes that 50% of total run-rate expense synergies receive credit for purposes of leverage

EVERCORE PARTNERS

Finance-

able

Synergies

Source Faret, Montana Projections-Updated Case

Note: Last Four Quarters (LFQ) as of 6/30/11

Note: Delur existing condit facility limits peo forma leverage 12 months after the close of a transaction to 3.25x pro forma LPQ EBITDA

3

Finance-

able

Synergies

$0

$25

$50

$75

PF Merge Co Leverage - 6/30/11

$0

$25

$50

$75

$1,500

4.9%

3.4x

3.3

3.2

3.1

$1,500

Preliminary Draft - Confidential

($ in millions)

4.9x

3.1x

3.0

2.9

2.8

HC Purchase Price

$1,600 $1,700

Multiple of HC LFQ EBITDA

5.6x

3.7x

3.6

3.5

3.4

3.6x

3.5

3.3

3.2

HC Purchase Price

$1,600 $1,700

Multiple of HC LFQ EBITDA

5.3x

5.6xx

3.3x

3.4x

3.2

3.3

3.1

3.2

3.0

3.1

$1,800

5.9x

3.9x

3.8

3.6

3.5

$1,800

5.9%

3.6x

3.5

3.3

3.2View entire presentation