Tudor, Pickering, Holt & Co Investment Banking

AMGP Status Quo

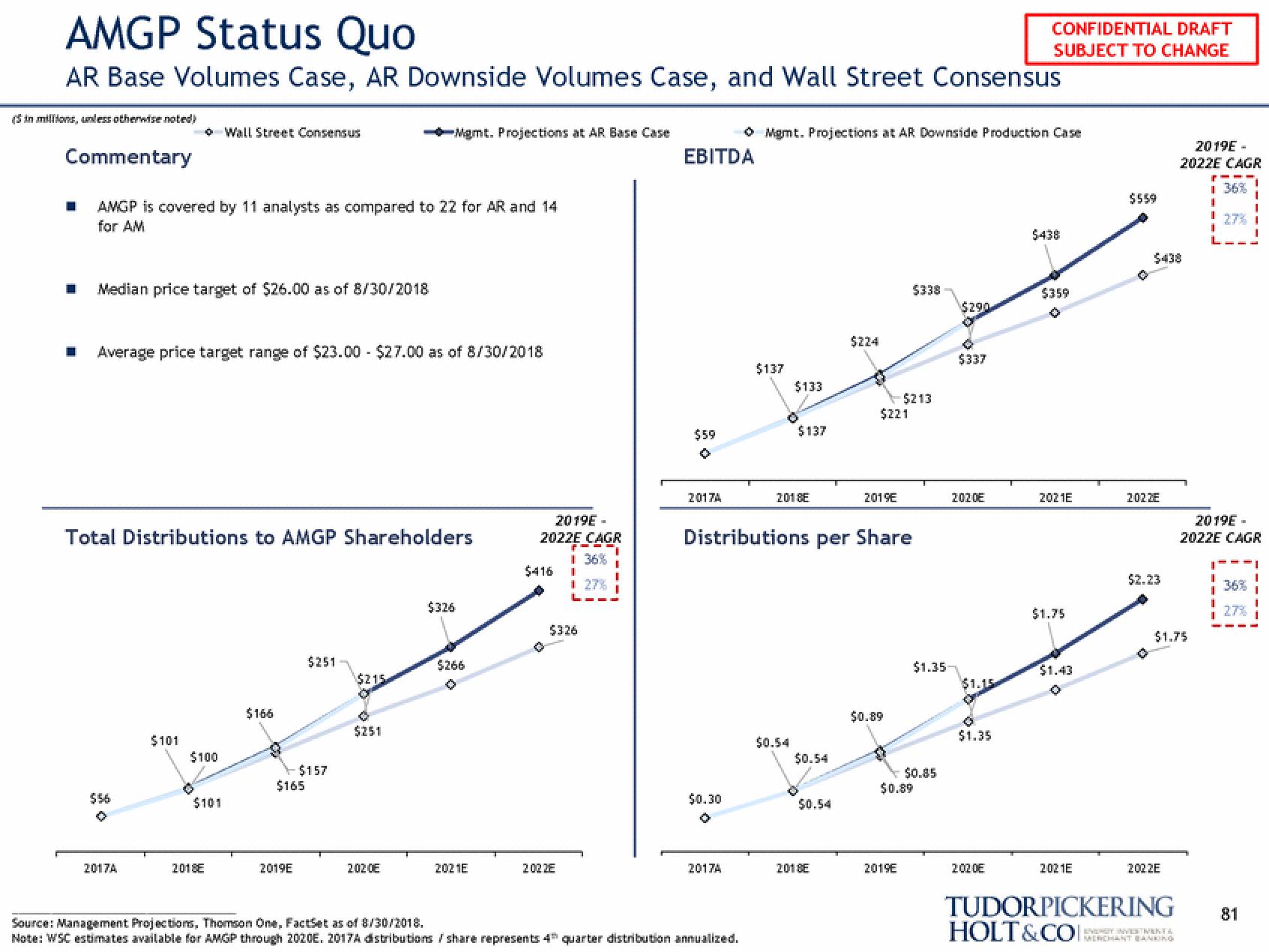

AR Base Volumes Case, AR Downside Volumes Case, and Wall Street Consensus

(in millions, unless otherwise noted)

Commentary

☐

AMGP is covered by 11 analysts as compared to 22 for AR and 14

for AM

Median price target of $26.00 as of 8/30/2018

Average price target range of $23.00 $27.00 as of 8/30/2018

$56

Total Distributions to AMGP Shareholders

2017A

Wall Street Consensus

$101

$100

$101

2018E

$166

$165

2019E

$251

$157

Mgmt. Projections at AR Base Case

$215

$251

202 CE

$326

$266

2021E

2019E-

2022E CAGR

-

1 36%

$416 I

$326

2022E

EBITDA

$59

2017A

$0.30

O

2017A

ⒸMgmt. Projections at AR Downside Production Case

Source: Management Projections, Thomson One, FactSet as of 8/30/2018.

Note: WSC estimates available for AMGP through 2020E. 2017A distributions / share represents 4 quarter distribution annualized.

$137

$133

$137

2018E

$0.54

Distributions per Share

$0.54

$0.54

$224

2018E

$221

2019E

$0.89

$338

$213

2019E

$0.89

$1.35

$0.85

$290

$337

2020E

$1.15

$1.35

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

2:02.0E

$438

$359

2021E

$1.75

$1.43

2021E

$559

202 ZE

$438

$2.23

0

2019E-

2022E CAGR

1 36%

1 27% 1

202.2E

$1.75

TUDORPICKERING

HOLT&COCHANT BANKING

2019E-

2022E CAGR

I

27%

81View entire presentation