Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

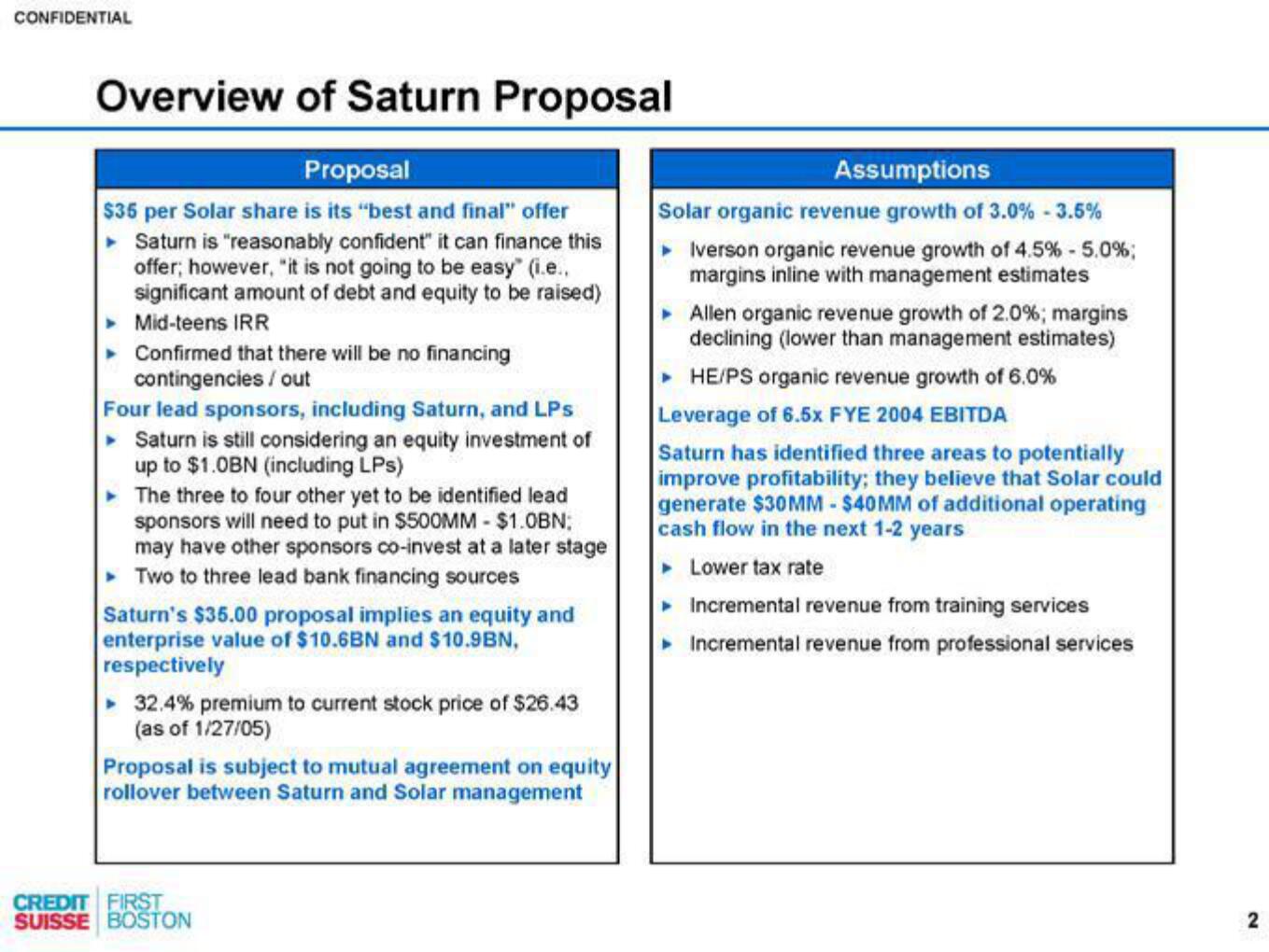

Overview of Saturn Proposal

Proposal

$35 per Solar share is its "best and final" offer

▸ Saturn is "reasonably confident" it can finance this

offer; however, it is not going to be easy" (i.e..

significant amount of debt and equity to be raised)

Mid-teens IRR

▸

▸ Confirmed that there will be no financing

contingencies/out

Four lead sponsors, including Saturn, and LPs

Saturn is still considering an equity investment of

up to $1.0BN (including LPs)

The three to four other yet to be identified lead

sponsors will need to put in $500MM - $1.0BN;

may have other sponsors co-invest at a later stage

Two to three lead bank financing sources

Saturn's $35.00 proposal implies an equity and

enterprise value of $10.6BN and $10.9BN,

respectively

32.4% premium to current stock price of $26.43

(as of 1/27/05)

Proposal is subject to mutual agreement on equity

rollover between Saturn and Solar management

CREDIT FIRST

SUISSE BOSTON

Assumptions

Solar organic revenue growth of 3.0 % - 3.5%

▸ Iverson organic revenue growth of 4.5% - 5.0%;

margins inline with management estimates

▸ Allen organic revenue growth of 2.0%; margins

declining (lower than management estimates)

► HE/PS organic revenue growth of 6.0%

Leverage of 6.5x FYE 2004 EBITDA

Saturn has identified three areas to potentially

improve profitability; they believe that Solar could

generate $30MM - $40MM of additional operating

cash flow in the next 1-2 years

▸ Lower tax rate

▸ Incremental revenue from training services

▸ Incremental revenue from professional services

2View entire presentation