Freyr SPAC Presentation Deck

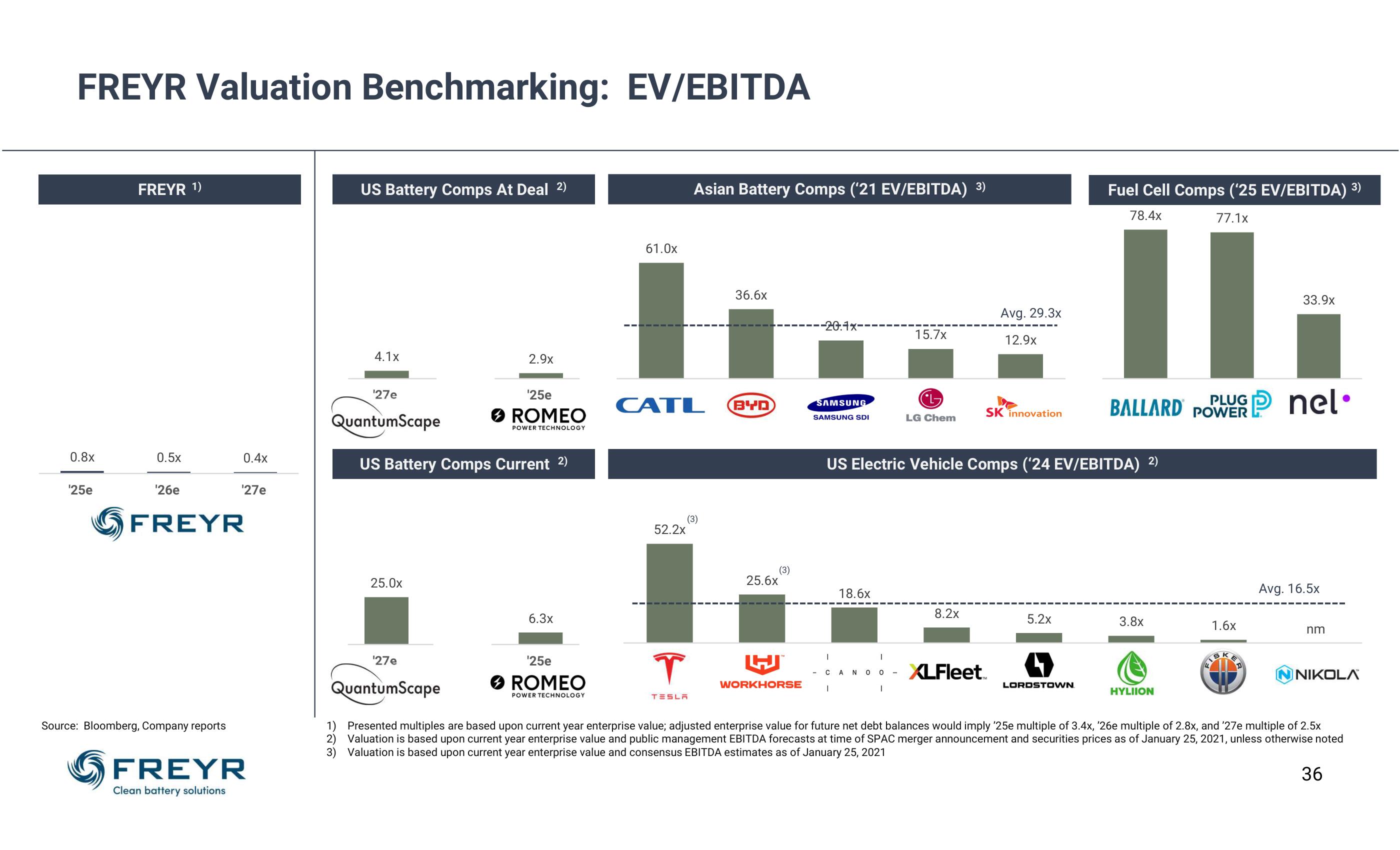

FREYR Valuation Benchmarking: EV/EBITDA

0.8x

'25e

FREYR ¹)

0.5x

'26e

FREYR

Source: Bloomberg, Company reports

0.4x

¹27e

FREYR

Clean battery solutions

US Battery Comps At Deal 2)

4.1x

¹27e

QuantumScape

25.0x

2.9x

US Battery Comps Current 2)

¹27e

QuantumScape

¹25e

ROMEO

POWER TECHNOLOGY

6.3x

¹25e

ROMEO

POWER TECHNOLOGY

61.0x

CATL

52.2x

T

Asian Battery Comps ('21 EV/EBITDA) 3)

(3)

TESLA

36.6x

BYD

(3)

25.6x

WORKHORSE

-20.1x-

SAMSUNG

SAMSUNG SDI

18.6x

-CANOO

1

15.7x

I

L

LG Chem

US Electric Vehicle Comps ('24 EV/EBITDA) 2)

8.2x

Avg. 29.3x

12.9x

XLFleet

SK innovation

5.2x

Fuel Cell Comps ('25 EV/EBITDA) 3)

78.4x

77.1x

LORDSTOWN

PLUG

BALLARD POWER

3.8x

HYLIION

1.6x

FIBRER

33.9x

nel.

Avg. 16.5x

nm

NIKOLA

1) Presented multiples are based upon current year enterprise value; adjusted enterprise value for future net debt balances would imply '25e multiple of 3.4x, '26e multiple of 2.8x, and '27e multiple of 2.5x

2) Valuation is based upon current year enterprise value and public management EBITDA forecasts at time of SPAC merger announcement and securities prices as of January 25, 2021, unless otherwise noted

Valuation is based upon current year enterprise value and consensus EBITDA estimates as of January 25, 2021

3)

36View entire presentation