One Medical Investor Conference Presentation Deck

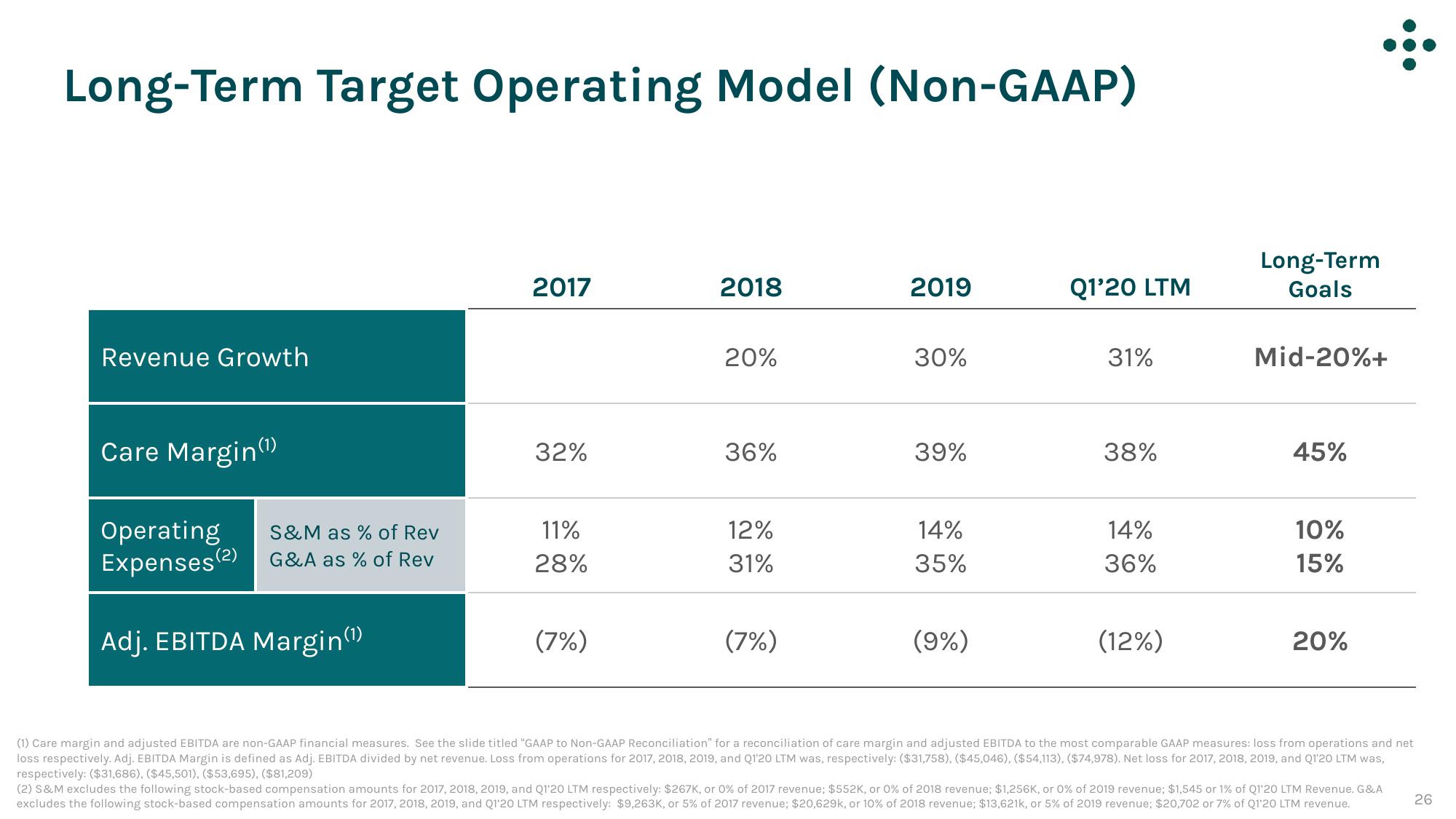

Long-Term Target Operating Model (Non-GAAP)

Revenue Growth

Care Margin(¹)

Operating

Expenses (2)

S&M as % of Rev

G&A as % of Rev

Adj. EBITDA Margin(¹)

2017

32%

11%

28%

(7%)

2018

20%

36%

12%

31%

(7%)

2019

30%

39%

14%

35%

(9%)

Q1'20 LTM

31%

38%

14%

36%

(12%)

Long-Term

Goals

Mid-20%+

45%

10%

15%

20%

(1) Care margin and adjusted EBITDA are non-GAAP financial measures. See the slide titled "GAAP to Non-GAAP Reconciliation" for a reconciliation of care margin and adjusted EBITDA to the most comparable GAAP measures: loss from operations and net

loss respectively. Adj. EBITDA Margin is defined as Adj. EBITDA divided by net revenue. Loss from operations for 2017, 2018, 2019, and Q1'20 LTM was, respectively: ($31,758), ($45,046), ($54,113), ($74,978). Net loss for 2017, 2018, 2019, and Q1'20 LTM was,

respectively: ($31,686), ($45,501), ($53,695), ($81,209)

(2) S&M excludes the following stock-based compensation amounts for 2017, 2018, 2019, and Q1'20 LTM respectively: $267K, or 0% of 2017 revenue; $552K, or 0% of 2018 revenue; $1,256K, or 0% of 2019 revenue; $1,545 or 1% of Q1'20 LTM Revenue. G&A

excludes the following stock-based compensation amounts for 2017, 2018, 2019, and Q1'20 LTM respectively: $9,263K, or 5% of 2017 revenue; $20,629k, or 10% of 2018 revenue: $13,621k, or 5% of 2019 revenue; $20,702 or 7% of Q1'20 LTM revenue.

26View entire presentation