First Busey Results Presentation Deck

2Q23 Earnings Investor Presentation

Wealth Management

1

■

■

■

■

■

■

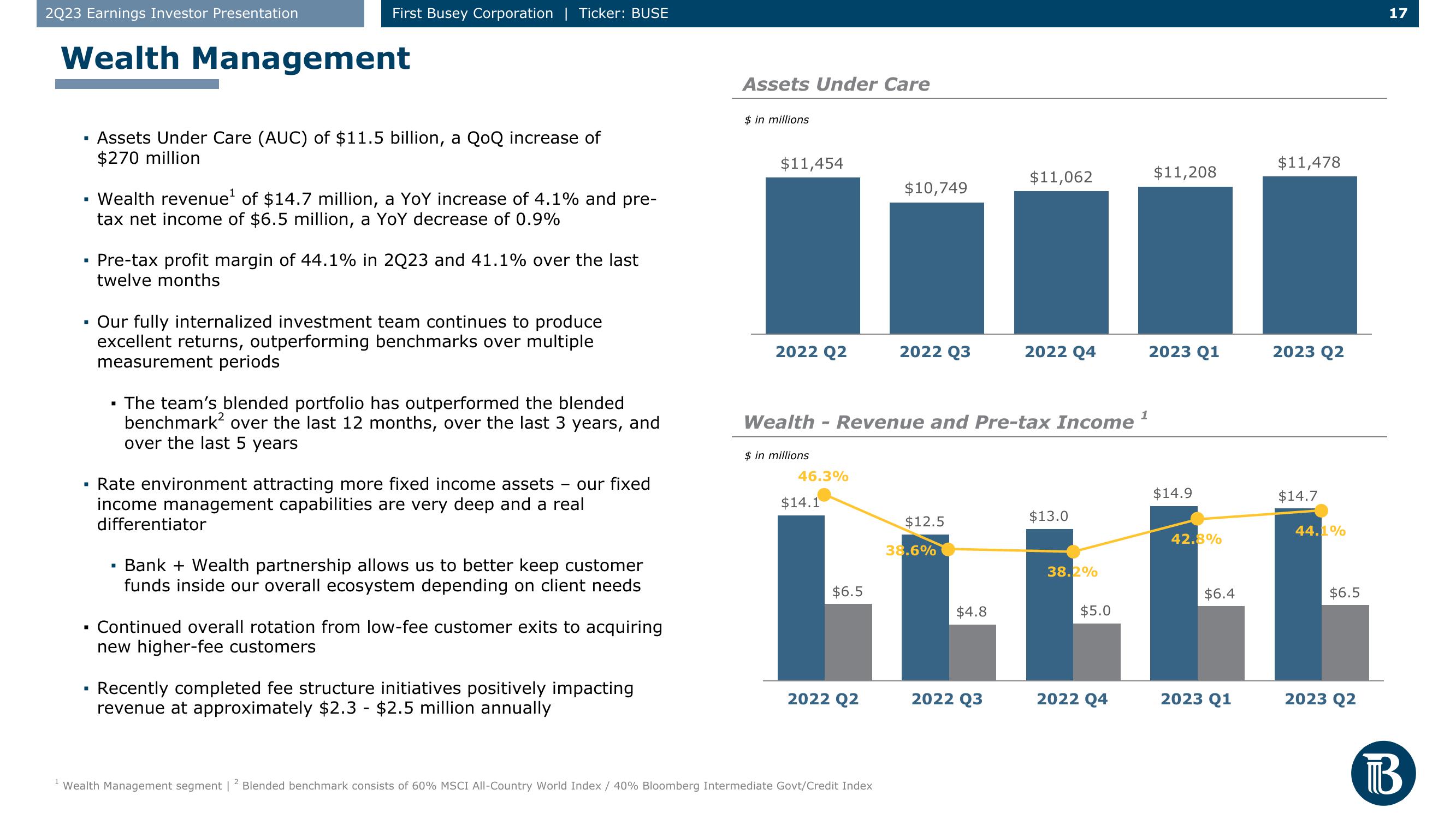

Assets Under Care (AUC) of $11.5 billion, a QoQ increase of

$270 million

First Busey Corporation | Ticker: BUSE

Wealth revenue¹ of $14.7 million, a YoY increase of 4.1% and pre-

tax net income of $6.5 million, a YoY decrease of 0.9%

Pre-tax profit margin of 44.1% in 2Q23 and 41.1% over the last

twelve months

Our fully internalized investment team continues to produce

excellent returns, outperforming benchmarks over multiple

measurement periods

■

■

The team's blended portfolio has outperformed the blended

benchmark² over the last 12 months, over the last 3 years, and

over the last 5 years

Rate environment attracting more fixed income assets - our fixed

income management capabilities are very deep and a real

differentiator

Bank + Wealth partnership allows us to better keep customer

funds inside our overall ecosystem depending on client needs

Continued overall rotation from low-fee customer exits to acquiring

new higher-fee customers

Recently completed fee structure initiatives positively impacting

revenue at approximately $2.3 - $2.5 million annually

Assets Under Care

$ in millions

$11,454

2022 Q2

$ in millions

46.3%

$14.1

Wealth Revenue and Pre-tax Income

$6.5

2022 Q2

$10,749

Wealth Management segment | Blended benchmark consists of 60% MSCI All-Country World Index / 40% Bloomberg Intermediate Govt/Credit Index

2022 Q3

$12.5

38.6%

$4.8

$11,062

2022 Q3

2022 Q4

$13.0

38.2%

$5.0

2022 Q4

1

$11,208

2023 Q1

$14.9

42.8%

$6.4

2023 Q1

$11,478

2023 Q2

$14.7

44.1%

$6.5

2023 Q2

17

ТВView entire presentation