Massachusetts Water Resources Authority (“MWRA”) Employees’ Retirement System

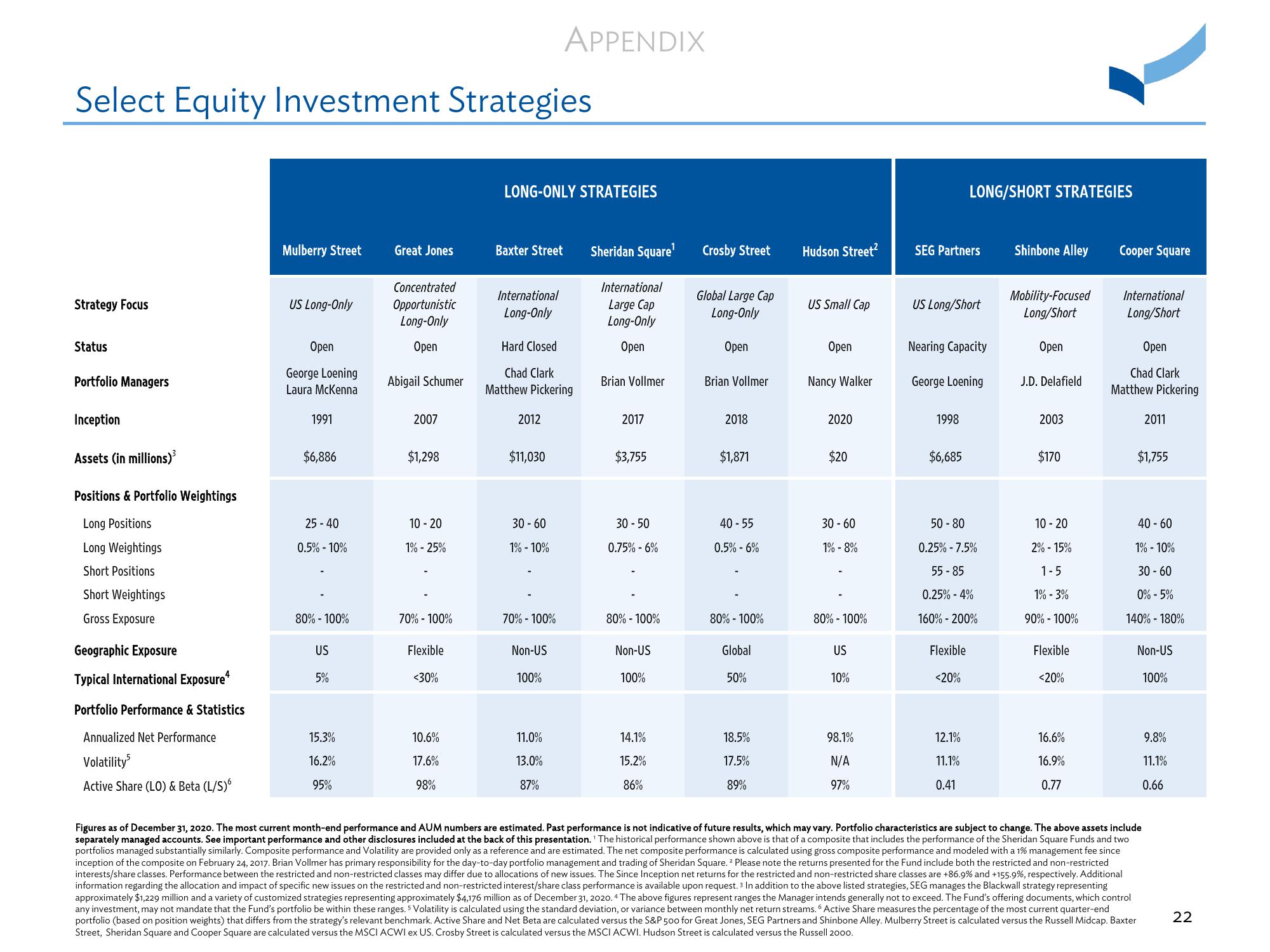

Select Equity Investment Strategies

Strategy Focus

Status

Portfolio Managers

Inception

Assets (in millions)³

Positions & Portfolio Weightings

Long Positions

Long Weightings

Short Positions

Short Weightings

Gross Exposure

Geographic Exposure

Typical International Exposure+

Portfolio Performance & Statistics

Annualized Net Performance

Volatility5

Active Share (LO) & Beta (L/S)6

Mulberry Street

US Long-Only

Open

George Loening

Laura McKenna

1991

$6,886

25-40

0.5% -10%

80%-100%

US

5%

15.3%

16.2%

95%

Great Jones

Concentrated

Opportunistic

Long-Only

Open

Abigail Schumer

2007

$1,298

10-20

1% - 25%

70% - 100%

Flexible

<30%

10.6%

17.6%

98%

LONG-ONLY STRATEGIES

Baxter Street

International

Long-Only

Hard Closed

Chad Clark

Matthew Pickering

2012

$11,030

30-60

1% - 10%

APPENDIX

70% - 100%

Non-US

100%

11.0%

13.0%

87%

Sheridan Square'

International

Large Cap

Long-Only

Open

Brian Vollmer

2017

$3,755

30-50

0.75% -6%

80% - 100%

Non-US

100%

14.1%

15.2%

86%

Crosby Street

Global Large Cap

Long-Only

Open

Brian Vollmer

2018

$1,871

40-55

0.5% -6%

80% - 100%

Global

50%

18.5%

17.5%

89%

Hudson Street²

US Small Cap

Open

Nancy Walker

2020

$20

30-60

1% -8%

80% - 100%

US

10%

98.1%

N/A

97%

SEG Partners

US Long/Short

Nearing Capacity

George Loening

1998

LONG/SHORT STRATEGIES

$6,685

50-80

0.25% -7.5%

55-85

0.25% -4%

160% - 200%

Flexible

<20%

12.1%

11.1%

0.41

Shinbone Alley

Mobility-Focused

Long/Short

Open

J.D. Delafield

2003

$170

10 - 20

2% -15%

1-5

1% -3%

90%-100%

Flexible

<20%

16.6%

16.9%

0.77

Cooper Square

International

Long/Short

Open

Chad Clark

Matthew Pickering

2011

$1,755

40-60

1% - 10%

30-60

0% - 5%

140% - 180%

Non-US

Figures as of December 31, 2020. The most current month-end performance and AUM numbers are estimated. Past performance is not indicative of future results, which may vary. Portfolio characteristics are subject to change. The above assets include

separately managed accounts. See important performance and other disclosures included at the back of this presentation. The historical performance shown above is that of a composite that includes the performance of the Sheridan Square Funds and two

portfolios managed substantially similarly. Composite performance and Volatility are provided only as a reference and are estimated. The net composite performance is calculated using gross composite performance and modeled with a 1% management fee since

inception of the composite on February 24, 2017. Brian Vollmer has primary responsibility for the day-to-day portfolio management and trading of Sheridan Square. ² Please note the returns presented for the Fund include both the restricted and non-restricted

interests/share classes. Performance between the restricted and non-restricted classes may differ due to allocations of new issues. The Since Inception net returns for the restricted and non-restricted share classes are +86.9% and +155.9%, respectively. Additional

information regarding the allocation and impact of specific new issues on the restricted and non-restricted interest/share class performance is available upon request. 3 In addition to the above listed strategies, SEG manages the Blackwall strategy representing

approximately $1,229 million and a variety of customized strategies representing approximately $4,176 million as of December 31, 2020.4 The above figures represent ranges the Manager intends generally not to exceed. The Fund's offering documents, which control

any investment, may not mandate that the Fund's portfolio be within these ranges. 5 Volatility is calculated using the standard deviation, or variance between monthly net return streams. Active Share measures the percentage of the most current quarter-end

portfolio (based on position weights) that differs from the strategy's relevant benchmark. Active Share and Net Beta are calculated versus the S&P 500 for Great Jones, SEG Partners and Shinbone Alley. Mulberry Street is calculated versus the Russell Midcap. Baxter

Street, Sheridan Square and Cooper Square are calculated versus the MSCI ACWI ex US. Crosby Street is calculated versus the MSCI ACWI. Hudson Street is calculated versus the Russell 2000.

100%

9.8%

11.1%

0.66

22View entire presentation