J.P.Morgan 4Q23 Earnings Results

JPMORGAN CHASE & CO.

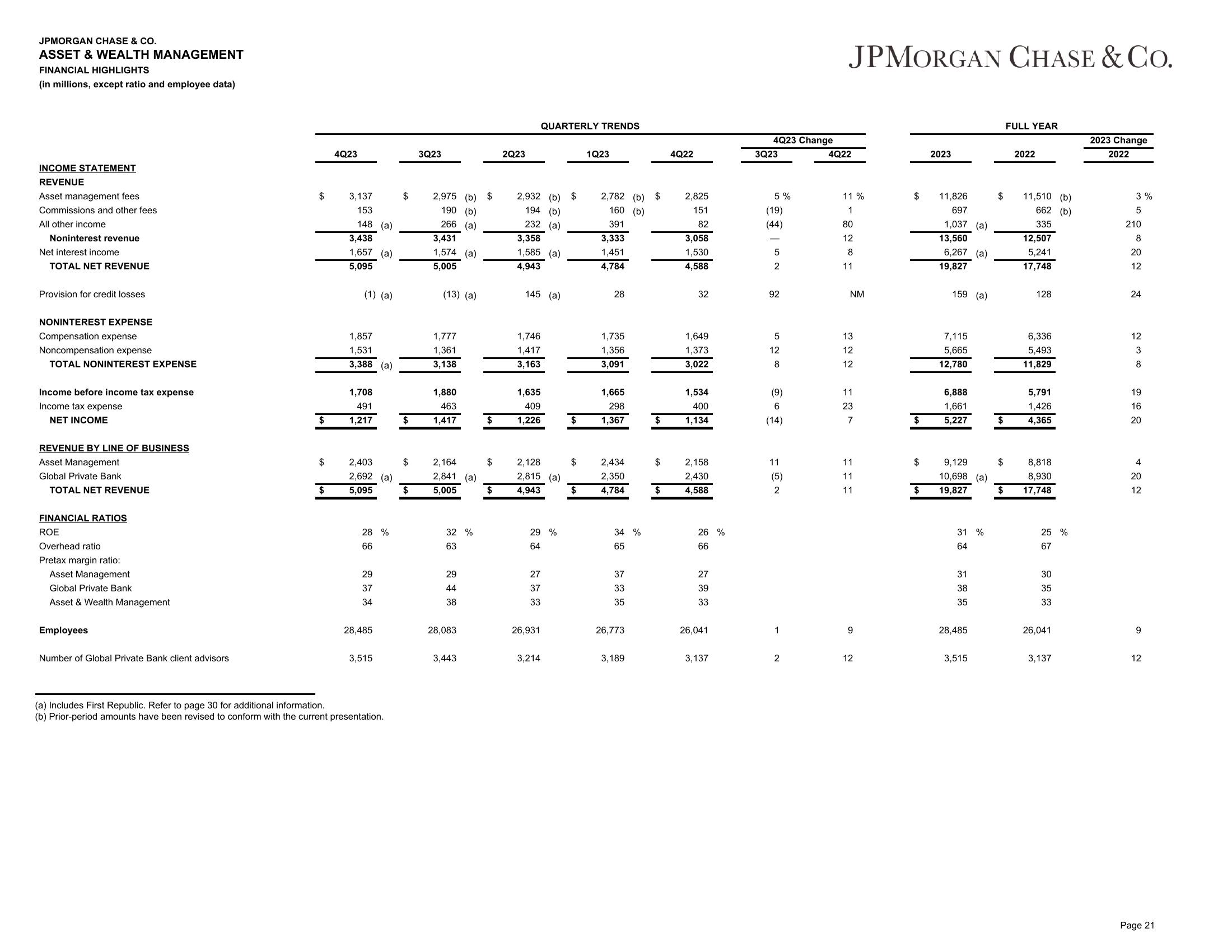

ASSET & WEALTH MANAGEMENT

FINANCIAL HIGHLIGHTS

(in millions, except ratio and employee data)

INCOME STATEMENT

REVENUE

Asset management fees

Commissions and other fees

All other income

Noninterest revenue

Net interest income

TOTAL NET REVENUE

Provision for credit losses

NONINTEREST EXPENSE

Compensation expense

Noncompensation expense

TOTAL NONINTEREST EXPENSE

Income before income tax expense

Income tax expense

NET INCOME

REVENUE BY LINE OF BUSINESS

Asset Management

Global Private Bank

TOTAL NET REVENUE

FINANCIAL RATIOS

ROE

Overhead ratio

Pretax margin ratio:

Asset Management

Global Private Bank

Asset & Wealth Management

Employees

Number of Global Private Bank client advisors

$

$

$

$

4Q23

3,137

153

148 (a)

3,438

1,657 (a)

5,095

(1) (a)

1,857

1,531

3,388 (a)

1,708

491

1,217

2,403

2,692 (a)

5,095

28 %

66

29

37

34

28,485

3,515

(a) Includes First Republic. Refer to page 30 for additional information.

(b) Prior-period amounts have been revised to conform with the current presentation.

$

$

$

FA

$

3Q23

2,975 (b) $

190 (b)

266 (a)

3,431

1,574

5,005

(13) (a)

1,777

1,361

3,138

1,880

463

1,417

2,164

2,841 (a)

5,005

32 %

63

29

44

38

28,083

3,443

$

$

2Q23

2,932 (b)

$

194 (b)

232 (a)

3,358

1,585 (a)

4,943

QUARTERLY TRENDS

145 (a)

1,746

1,417

3,163

1,635

409

1,226

2,128

2,815 (a)

4,943

29 %

64

27

37

33

26,931

3,214

$

$

$

1Q23

2,782 (b) $

160 (b)

391

3,333

1,451

4,784

28

1,735

1,356

3,091

1,665

298

1,367

2,434

2,350

4,784

34 %

65

37

33

35

26,773

3,189

$

$

4Q22

2,825

151

82

3,058

1,530

4,588

32

1,649

1,373

3,022

1,534

400

1,134

2,158

2,430

4,588

26 %

66

27

39

33

26,041

3,137

4Q23 Change

3Q23

5%

(19)

(44)

5

2

92

CÔNG

(14)

11

(5)

2

1

2

JPMORGAN CHASE & Co.

4Q22

11%

1

80

12

8

11

NM

13

12

12

11

23

7

11

11

11

9

12

$

$

$

$

2023

11,826

697

1,037 (a)

13,560

6,267 (a)

19,827

159 (a)

7,115

5,665

12,780

6,888

1,661

5,227

9,129

10,698 (a)

19,827

31 %

64

31

38

35

28,485

3,515

$

$ 11,510 (b)

662 (b)

335

$

FULL YEAR

$

2022

12,507

5,241

17,748

128

6,336

5,493

11,829

5,791

1,426

4,365

8,818

8,930

17,748

25 %

67

30

35

33

26,041

3,137

2023 Change

2022

3%

5

210

8

20

12

24

12

3

8

19

16

20

4

20

12

9

12

Page 21View entire presentation