KKR Real Estate Finance Trust Results Presentation Deck

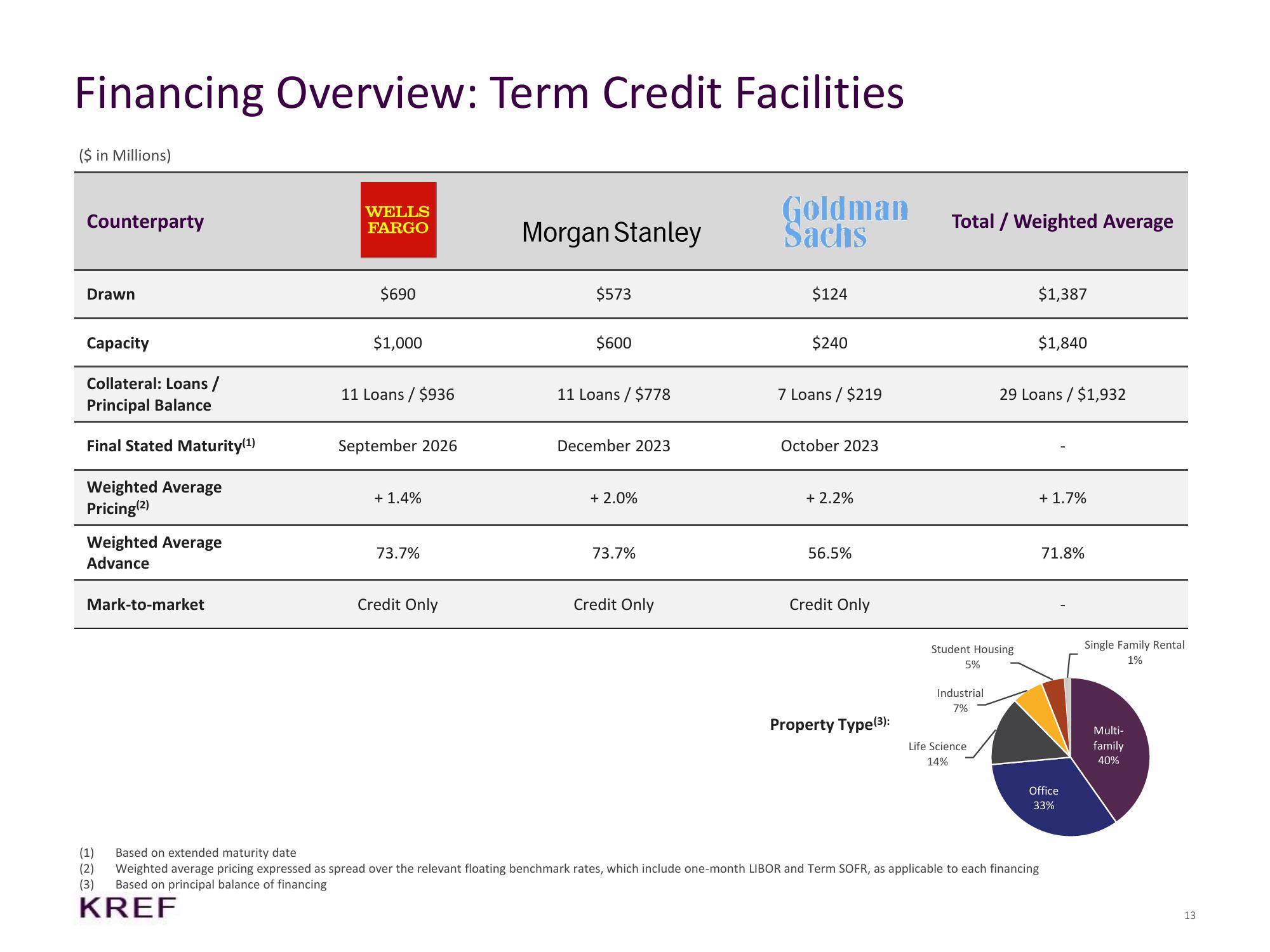

Financing Overview: Term Credit Facilities

($ in Millions)

Counterparty

Drawn

Capacity

Collateral: Loans /

Principal Balance

Final Stated Maturity (¹)

Weighted Average

Pricing (2)

Weighted Average

Advance

Mark-to-market

WELLS

FARGO

$690

$1,000

11 Loans / $936

September 2026

+ 1.4%

73.7%

Credit Only

Morgan Stanley

$573

$600

11 Loans / $778

December 2023

+ 2.0%

73.7%

Credit Only

Goldman

$124

$240

7 Loans / $219

October 2023

+ 2.2%

56.5%

Credit Only

Property Type(³):

Total / Weighted Average

Student Housing

5%

Industrial

7%

Life Science

14%

$1,387

$1,840

29 Loans / $1,932

+ 1.7%

71.8%

Office

33%

(1)

Based on extended maturity date

(2) Weighted average pricing expressed as spread over the relevant floating benchmark rates, which include one-month LIBOR and Term SOFR, as applicable to each financing

(3) Based on principal balance of financing

KREF

Single Family Rental

1%

Multi-

family

40%

13View entire presentation