Goldman Sachs Investment Banking Pitch Book

Goldman

Sachs

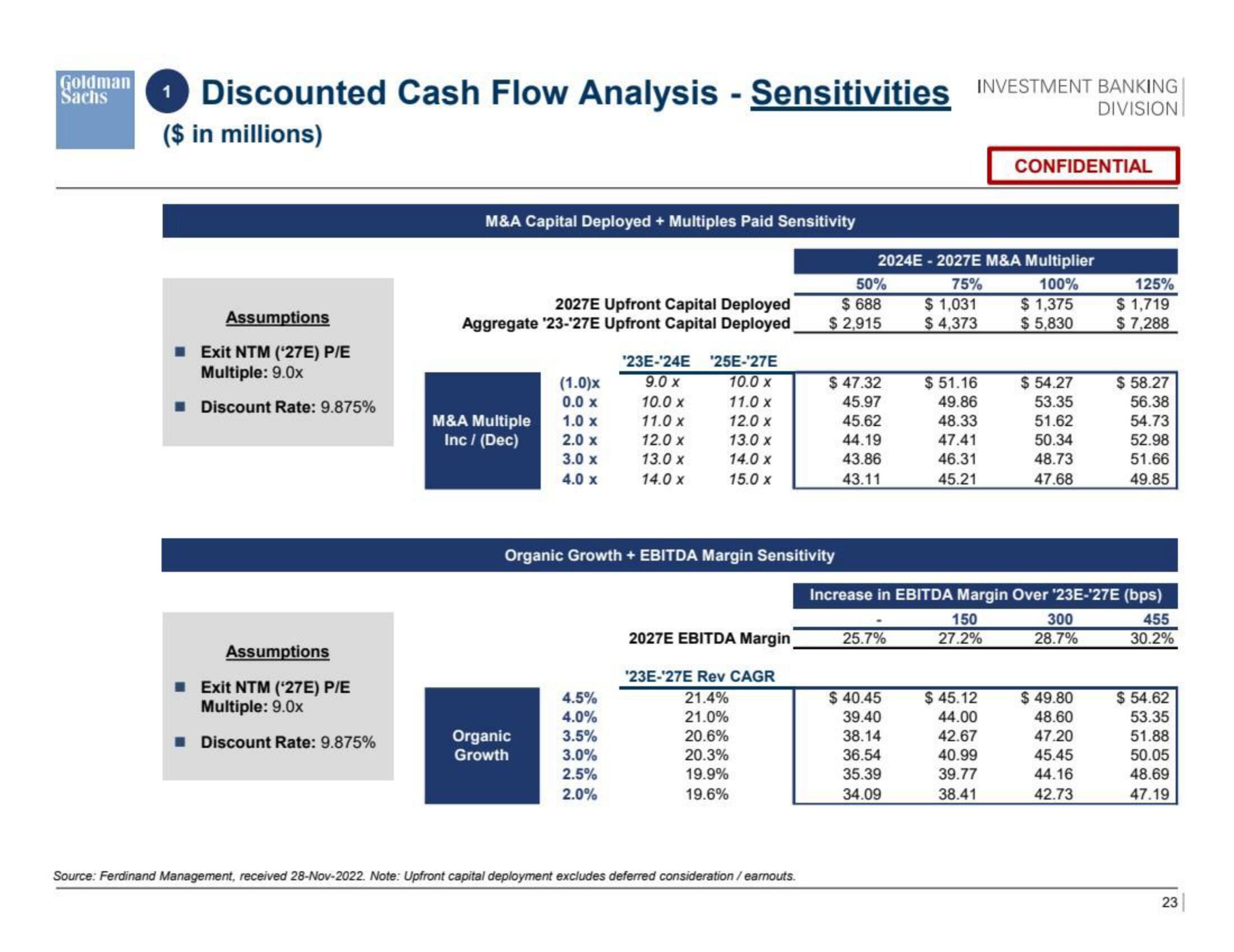

Discounted Cash Flow Analysis - Sensitivities INVESTMENT BANKING

DIVISION

($ in millions)

Assumptions

Exit NTM (¹27E) P/E

Multiple: 9.0x

Discount Rate: 9.875%

Assumptions

Exit NTM (27E) P/E

Multiple: 9.0x

Discount Rate: 9.875%

M&A Capital Deployed + Multiples Paid Sensitivity

2027E Upfront Capital Deployed

Aggregate '23-¹27E Upfront Capital Deployed

M&A Multiple

Inc / (Dec)

(1.0)x

0.0 x

1.0 x

2.0 x

3.0 x

4.0 x

Organic

Growth

'23E-¹24E '25E-'27E

9.0 x

10.0 X

10.0 X

11.0 x

11.0 x

12.0 X

13.0 x

14.0 X

15.0 x

4.5%

4.0%

3.5%

3.0%

2.5%

2.0%

12.0 x

13.0 x

14.0 X

Organic Growth + EBITDA Margin Sensitivity

2027E EBITDA Margin

'23E-¹27E Rev CAGR

21.4%

21.0%

20.6%

20.3%

19.9%

19.6%

Source: Ferdinand Management, received 28-Nov-2022. Note: Upfront capital deployment excludes deferred consideration / earnouts.

2024E-2027E M&A Multiplier

100%

$ 1,375

$5,830

50%

$ 688

$ 2,915

$ 47.32

45.97

45.62

44.19

43.86

43.11

25.7%

75%

$ 1,031

$4,373

$40.45

39.40

38.14

36.54

35.39

34.09

$51.16

49.86

48.33

47.41

46.31

45.21

CONFIDENTIAL

150

27.2%

$ 45.12

44.00

42.67

40.99

39.77

38.41

$ 54.27

53.35

51.62

50.34

48.73

47.68

Increase in EBITDA Margin Over ¹23E-¹27E (bps)

455

30.2%

300

28.7%

125%

$ 1,719

$7,288

$ 49.80

48.60

47.20

45.45

44.16

42.73

$ 58.27

56.38

54.73

52.98

51.66

49.85

$ 54.62

53.35

51.88

50.05

48.69

47.19

23View entire presentation