Shoals Results Presentation Deck

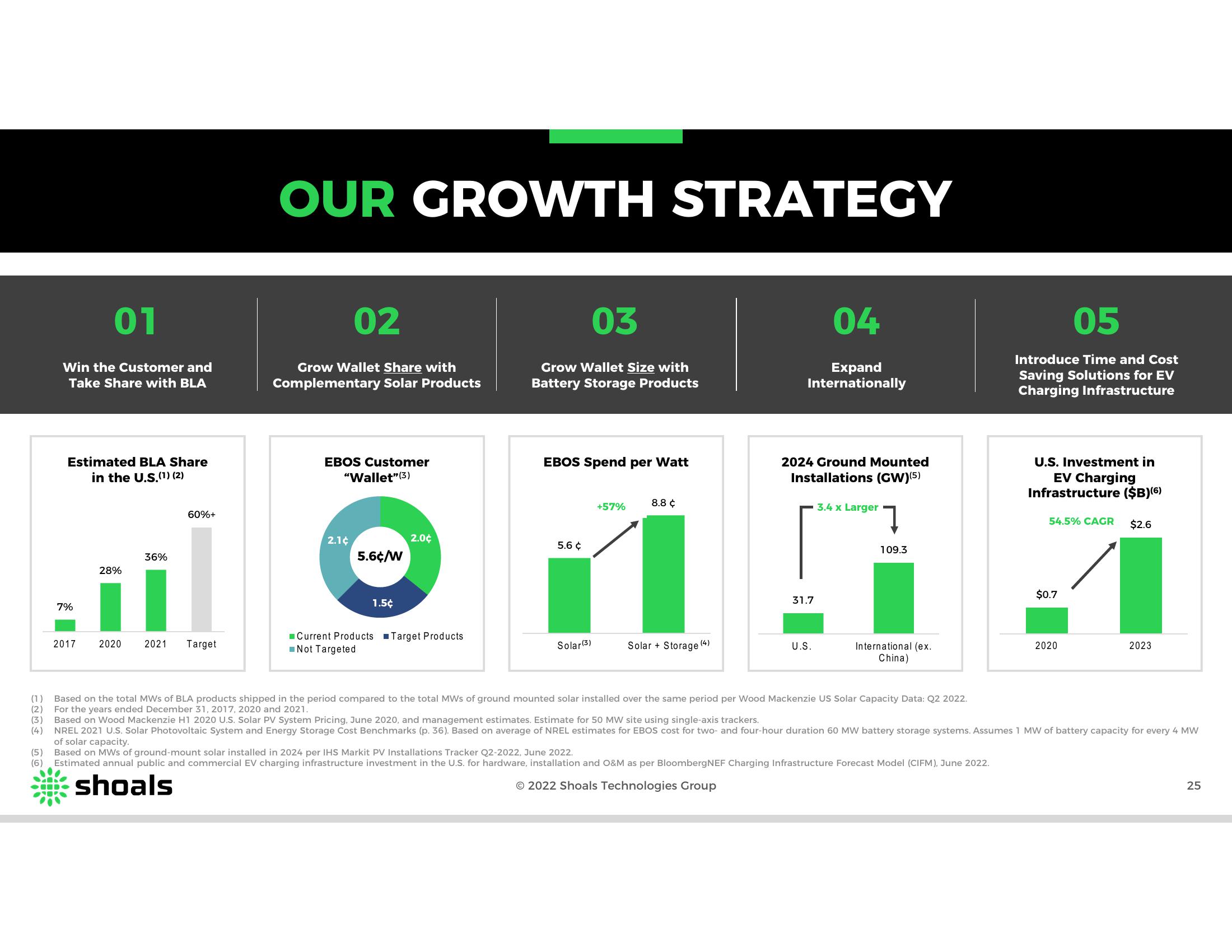

01

Win the Customer and

Take Share with BLA

Estimated BLA Share

in the U.S. (1) (2)

7%

2017

28%

2020

36%

60%+

2021 Target

OUR GROWTH STRATEGY

02

Grow Wallet Share with

Complementary Solar Products

EBOS Customer

"Wallet" (3)

2.1¢

5.6¢/W

1.5¢

2.0¢

Current Products Target Products

Not Targeted

03

Grow Wallet Size with

Battery Storage Products

EBOS Spend per Watt

8.8 ¢

+57%

5.6 ¢

11

Solar (3)

Solar + Storage (4)

04

Expand

Internationally

2024 Ground Mounted

Installations (GW)(5)

31.7

U.S.

3.4 x Larger

109.3

International (ex.

China)

05

Introduce Time and Cost

Saving Solutions for EV

Charging Infrastructure

U.S. Investment in

EV Charging

Infrastructure ($B)(6)

54.5% CAGR

$0.7

2020

$2.6

2023

(1) Based on the total MWs of BLA products shipped in the period compared to the total MWs of ground mounted solar installed over the same period per Wood Mackenzie US Solar Capacity Data: Q2 2022.

(2) For the years ended December 31, 2017, 2020 and 2021.

June 2020, and mana emer estimates. Estimate for 50 MW site sing gle-axis trackers.

(3)

Based on Wood Mackenzie H1 2020 U.S. Solar PV System

(4) NREL 2021 U.S. Solar Photovoltaic System and Energy Storage Cost Benchmarks (p. 36). Based on average of NREL estimates for EBOS cost for two- and four-hour duration 60 MW battery storage systems. Assumes 1 MW of battery capacity for every 4 MW

of solar capacity.

Based on MWs of ground-mount solar installed in 2024 per IHS Markit PV Installations Tracker Q2-2022, June 2022.

(5)

(6) Estimated annual public and commercial EV charging infrastructure investment in the U.S. for hardware, installation and O&M as per BloombergNEF Charging Infrastructure Forecast Model (CIFM), June 2022.

shoals

© 2022 Shoals Technologies Group

25View entire presentation