Silicon Valley Bank Results Presentation Deck

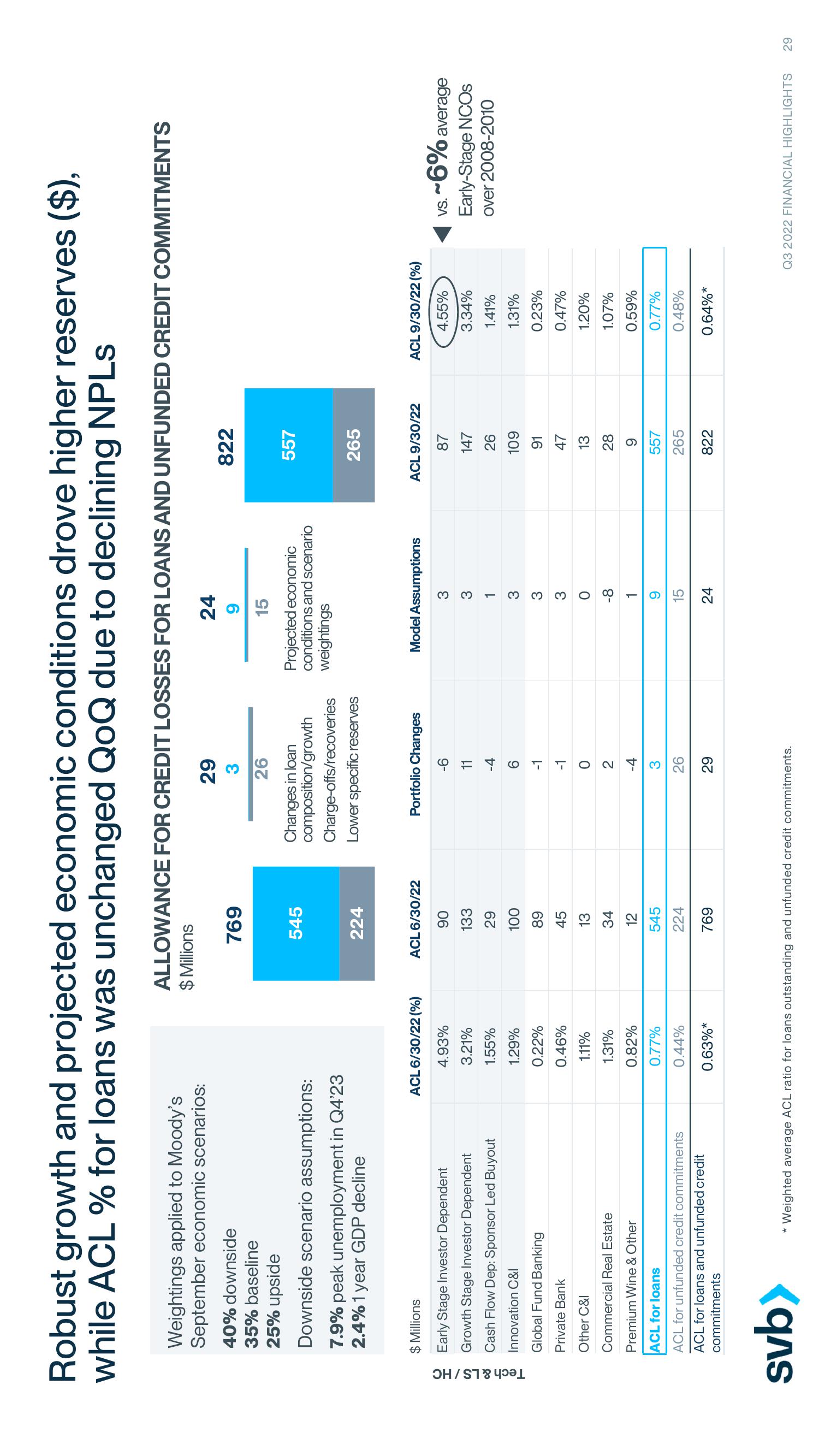

Robust growth and projected economic conditions drove higher reserves ($),

while ACL % for loans was unchanged QoQ due to declining NPLs

Tech & LS / HC

Weightings applied to Moody's

September economic scenarios:

40% downside

35% baseline

25% upside

Downside scenario assumptions:

7.9% peak unemployment in Q4'23

2.4% 1 year GDP decline

$ Millions

Early Stage Investor Dependent

Growth Stage Investor Dependent

Cash Flow Dep: Sponsor Led Buyout

Innovation C&I

Global Fund Banking

Private Bank

Other C&I

Commercial Real Estate

Premium Wine & Other

ACL for loans

ACL for unfunded credit commitments

ACL for loans and unfunded credit

commitments

svb>

ACL 6/30/22 (%)

4.93%

3.21%

1.55%

1.29%

0.22%

0.46%

1.11%

1.31%

0.82%

0.77%

0.44%

0.63%*

ALLOWANCE FOR CREDIT LOSSES FOR LOANS AND UNFUNDED CREDIT COMMITMENTS

$ Millions

769

545

224

ACL 6/30/22

90

133

29

100

89

45

13

34

12

545

224

769

29

3

26

Changes in loan

composition/growth

Charge-offs/recoveries

Lower specific reserves

Portfolio Changes

-6

11

-4

6

-1

WANOL

26

29

* Weighted average ACL ratio for loans outstanding and unfunded credit commitments.

24

9

15

Projected economic

conditions and scenario

weightings

Model Assumptions

♡ ♡ ♡ ♡ ♡ O SEN

3

3

1

3

3

3

-8

1

9

15

24

822

557

265

ACL 9/30/22

87

147

26

109

91

47

13

28

9

557

265

822

ACL 9/30/22 (%)

4.55%

3.34%

1.41%

1.31%

0.23%

0.47%

1.20%

1.07%

0.59%

0.77%

0.48%

0.64%*

vs. ~6% average

Early-Stage NCOS

over 2008-2010

Q3 2022 FINANCIAL HIGHLIGHTS 29View entire presentation