Micro Focus Credit Presentation Deck

3

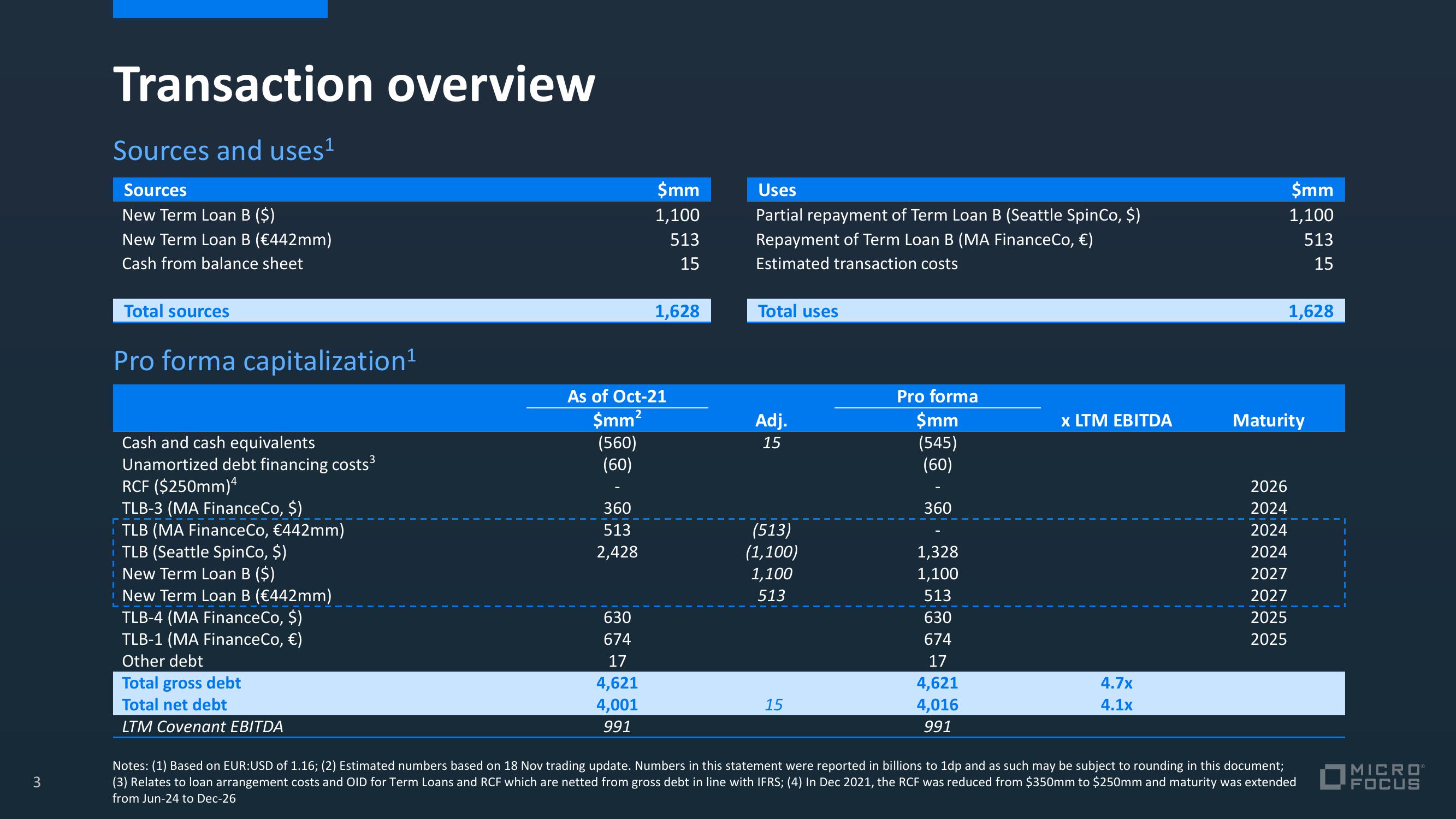

Transaction overview

Sources and uses¹

Sources

New Term Loan B ($)

New Term Loan B (€442mm)

Cash from balance sheet

Total sources

Pro forma capitalization¹

Cash and cash equivalents

Unamortized debt financing costs³

RCF ($250mm)4

TLB-3 (MA Finance Co, $)

TLB (MA FinanceCo, €442mm)

TLB (Seattle SpinCo, $)

New Term Loan B ($)

New Term Loan B (€442mm)

TLB-4 (MA Finance Co, $)

TLB-1 (MA FinanceCo, €)

Other debt

Total gross debt

Total net debt

LTM Covenant EBITDA

360

513

2,428

$mm

1,100

513

15

As of Oct-21

$mm²

(560)

(60)

630

674

17

4,621

4,001

991

1,628

Uses

Partial repayment of Term Loan B (Seattle SpinCo, $)

Repayment of Term Loan B (MA FinanceCo, €)

Estimated transaction costs

Total uses

Adj.

15

(513)

(1,100)

1,100

513

15

Pro forma

$mm

(545)

(60)

360

1,328

1,100

513

630

674

17

4,621

4,016

991

x LTM EBITDA

4.7x

4.1x

$mm

1,100

513

15

2026

2024

2024

2024

2027

2027

2025

2025

1,628

Maturity

Notes: (1) Based on EUR:USD of 1.16; (2) Estimated numbers based on 18 Nov trading update. Numbers in this statement were reported in billions to 1dp and as such may be subject to rounding in this document;

(3) Relates to loan arrangement costs and OID for Term Loans and RCF which are netted from gross debt in line with IFRS; (4) In Dec 2021, the RCF was reduced from $350mm to $250mm and maturity was extended

from Jun-24 to Dec-26

J

I

I

MICROⓇ

FOCUSView entire presentation