Pershing Square Investor Presentation Deck

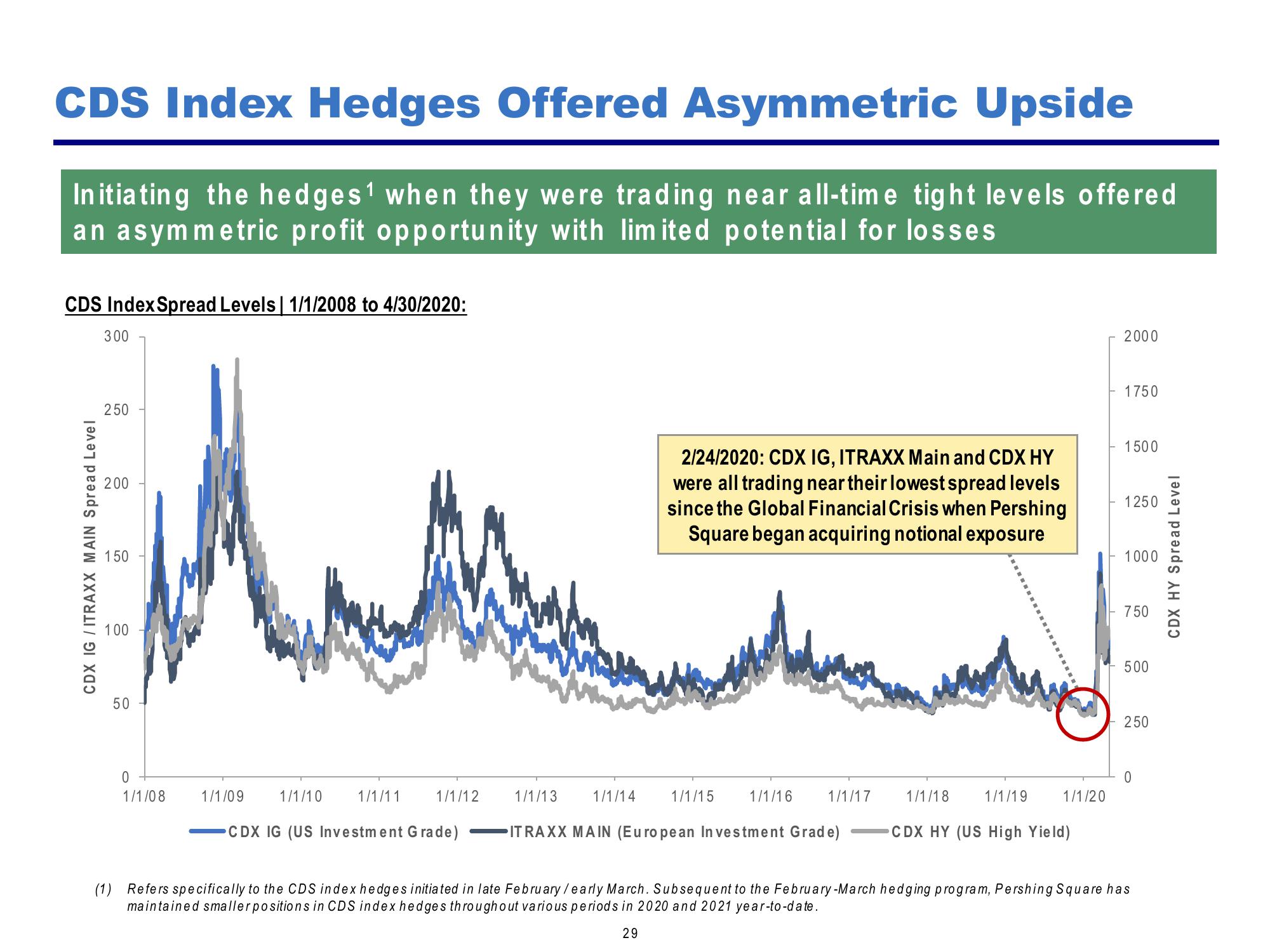

CDS Index Hedges Offered Asymmetric Upside

Initiating the hedges¹ when they were trading near all-time tight levels offered

an asymmetric profit opportunity with limited potential for losses

CDS Index Spread Levels | 1/1/2008 to 4/30/2020:

300

CDX IG /ITRAXX MAIN Spread Level

250

200

150

100

50

0

1/1/08

1/1/09

1/1/10

1/1/11

1/1/12

CDX IG (US Investment Grade)

1/1/13

1/1/14

2/24/2020: CDX IG, ITRAXX Main and CDX HY

were all trading near their lowest spread levels

since the Global Financial Crisis when Pershing

Square began acquiring notional exposure

1/1/15

1/1/16

1/1/17

ITRAXX MAIN (European Investment Grade)

1/1/18

CDX HY (US High Yield)

1/1/19

1/1/20

2000

1750

1500

1250

1000

750

500

250

0

(1) Refers specifically to the CDS index hedges initiated in late February / early March. Subsequent to the February-March hedging program, Pershing Square has

maintained smaller positions in CDS index hedges throughout various periods in 2020 and 2021 year-to-date.

29

CDX HY Spread LevelView entire presentation