Alternus Energy SPAC Presentation Deck

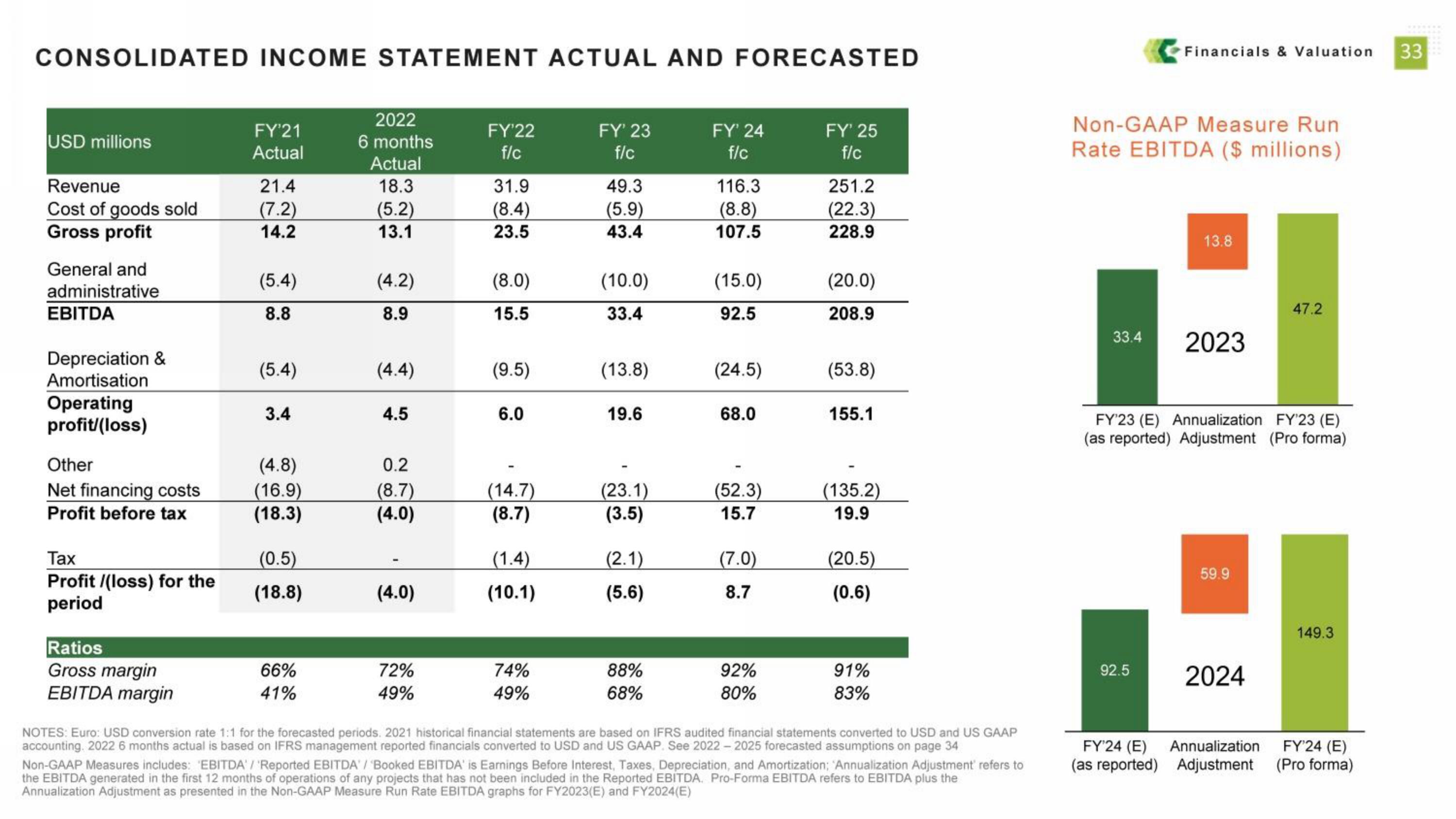

CONSOLIDATED INCOME STATEMENT ACTUAL AND FORECASTED

USD millions

Revenue

Cost of goods sold

Gross profit

General and

administrative

EBITDA

Depreciation &

Amortisation

Operating

profit/(loss)

Other

Net financing costs

Profit before tax

Tax

Profit /(loss) for the

period

Ratios

Gross margin

EBITDA margin

FY'21

Actual

21.4

(7.2)

14.2

(5.4)

8.8

(5.4)

3.4

(4.8)

(16.9)

(18.3)

(0.5)

(18.8)

66%

41%

2022

6 months

Actual

18.3

(5.2)

13.1

(4.2)

8.9

(4.4)

4.5

0.2

(8.7)

(4.0)

(4.0)

72%

49%

FY'22

f/c

31.9

(8.4)

23.5

(8.0)

15.5

(9.5)

6.0

(14.7)

(8.7)

(1.4)

(10.1)

74%

49%

FY' 23

f/c

49.3

(5.9)

43.4

(10.0)

33.4

(13.8)

19.6

(23.1)

(3.5)

(2.1)

(5.6)

88%

68%

FY' 24

f/c

116.3

(8.8)

107.5

(15.0)

92.5

(24.5)

68.0

(52.3)

15.7

(7.0)

8.7

92%

80%

FY' 25

f/c

251.2

(22.3)

228.9

(20.0)

208.9

(53.8)

155.1

(135.2)

19.9

(20.5)

(0.6)

91%

83%

NOTES: Euro: USD conversion rate 1:1 for the forecasted periods. 2021 historical financial statements are based on IFRS audited financial statements converted to USD and US GAAP

accounting, 2022 6 months actual is based on IFRS management reported financials converted to USD and US GAAP. See 2022- 2025 forecasted assumptions on page 34

Non-GAAP Measures includes: 'EBITDA' / 'Reported EBITDA/ Booked EBITDA' is Earnings Before Interest, Taxes, Depreciation, and Amortization; Annualization Adjustment' refers to

the EBITDA generated in the first 12 months of operations of any projects that has not been included in the Reported EBITDA. Pro-Forma EBITDA refers to EBITDA plus the

Annualization Adjustment as presented in the Non-GAAP Measure Run Rate EBITDA graphs for FY2023(E) and FY2024(E)

Financials & Valuation

Non-GAAP Measure Run

Rate EBITDA ($ millions)

13.8

33.4 2023

92.5

FY'23 (E) Annualization FY'23 (E)

(as reported) Adjustment (Pro forma)

59.9

2024

47.2

FY'24 (E) Annualization

(as reported) Adjustment

149.3

FY'24 (E)

(Pro forma)

33View entire presentation