Bank of America Investment Banking Pitch Book

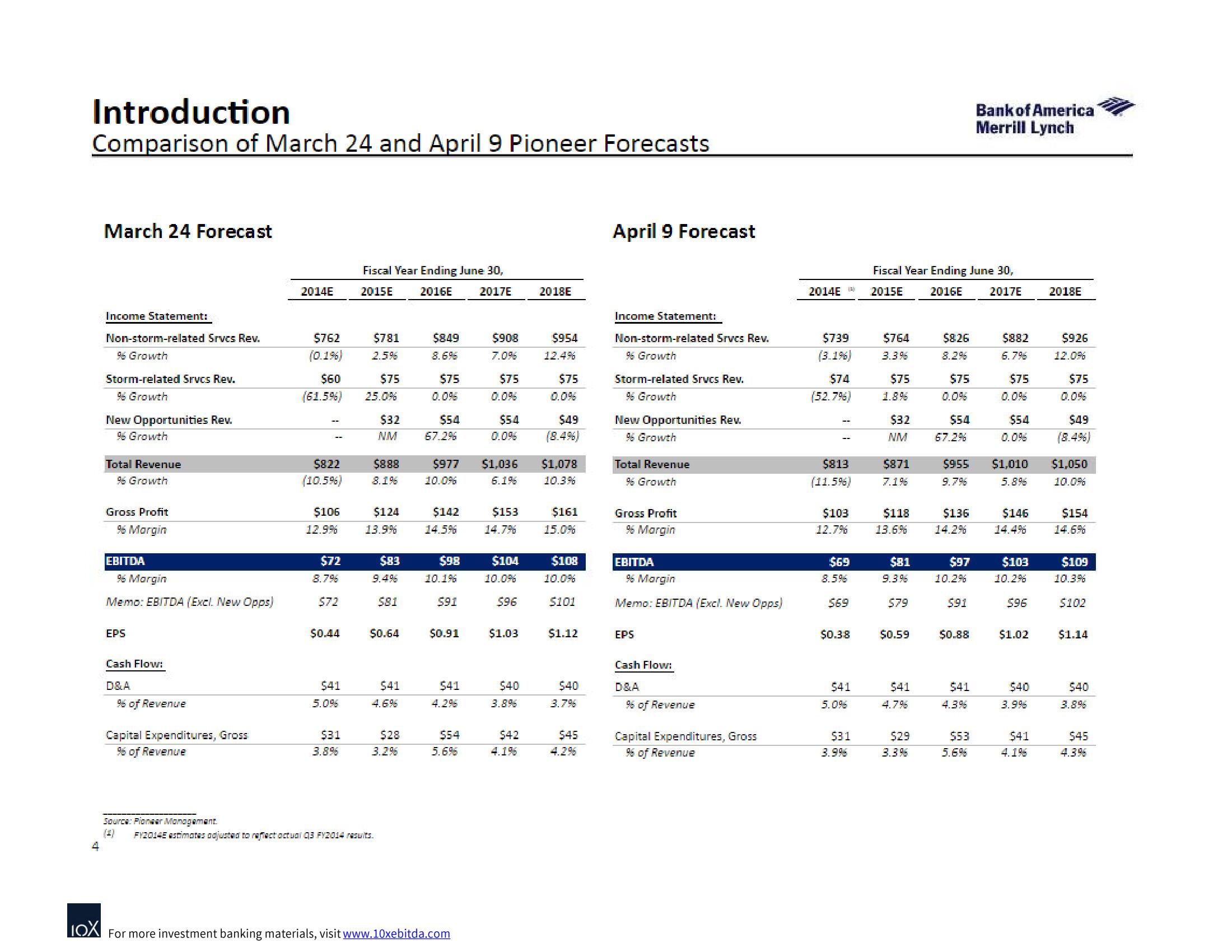

Introduction

Comparison of March 24 and April 9 Pioneer Forecasts

4

March 24 Forecast

Income Statement:

Non-storm-related Srvcs Rev.

96 Growth

Storm-related Srvcs Rev.

% Growth

New Opportunities Rev.

96 Growth

Total Revenue

96 Growth

Gross Profit

96 Margin

EBITDA

96 Margin

Memo: EBITDA (Excl. New Opps)

EPS

Cash Flow:

D&A

96 of Revenue

Capital Expenditures, Gross

96 of Revenue

Source: Pioneer Management.

2014E

$762

(0.1%)

$60

(61.5%)

$822

(10.5%)

$106

12.9%

$72

8.796

$72

$0.44

$41

5.0%

$31

3.8%

Fiscal Year Ending June 30,

2015E

2016E

2017E

$781

2.5%

$75

25.0%

$32

NM

$888

8.1%

$124

13.9%

$83

$81

$0.64

F12014E estimates adjusted to reflect actual q3 FY2014 results.

$41

4.696

$28

3.2%

$849

8.696

$75

$54

67.2%

$142

14.5%

$98

10.1%

$91

$0.91

$41

4.296

$54

5.696

$908

LOX For more investment banking materials, visit www.10xebitda.com

$75

$977 $1,036 $1,078

10.0%

6.196

10.3%

$5.4

0.096

$153

14.7%

$104

10.0%

596

$1.03

$40

3.8%

$42

2018E

4.1%

$954

12.4%

$75

0.0%

$49

(8.4%)

$161

15.0%

$108

10.0%

$101

$1.12

$40

3.7%

$45

April 9 Forecast

Income Statement:

Non-storm-related Srvcs Rev.

96 Growth

Storm-related Srvcs Rev.

%6 Growth

New Opportunities Rev.

% Growth

Total Revenue

% Growth

Gross Profit

96 Margin

EBITDA

96 Margin

Memo: EBITDA (Excl. New Opps)

EPS

Cash Flow:

D&A

96 of Revenue

Capital Expenditures, Gross

96 of Revenue

2014E

$739

(3.196)

$74

(52.79%)

--

$813

(11.5%)

$103

12.7%

$69

8.596

$69

$0.38

$41

5.0%

$31

3.995

Fiscal Year Ending June 30,

2015E

2016E

2017E

$764

3.3%

$75

$32

NM

$871

7.1%

$118

13.6%

$81

9.3.96

5.79

$0.59

$41

4.796

$29

3.3%

$826

8.2%

$75

0.0%

$54

67.2%

$955

9.7%

$136

14.2%

$97

10.2%

$91

$0.88

$41

4.3%

$53

Bank of America

Merrill Lynch

5.6%

$882

6.796

$75

0.096

$54

0.0%

$1,010

5.896

$146

14.4%

$103

10.2%

$96

$1.02

$40

3.996

$41

4.196

2018E

$926

12.0%

$75

0.096

$49

$1,050

10.0%

$154

14.6%

$109

10.3%

$102

$1.14

$40

3.896

$45View entire presentation