Spirit Mergers and Acquisitions Presentation Deck

> 》》》

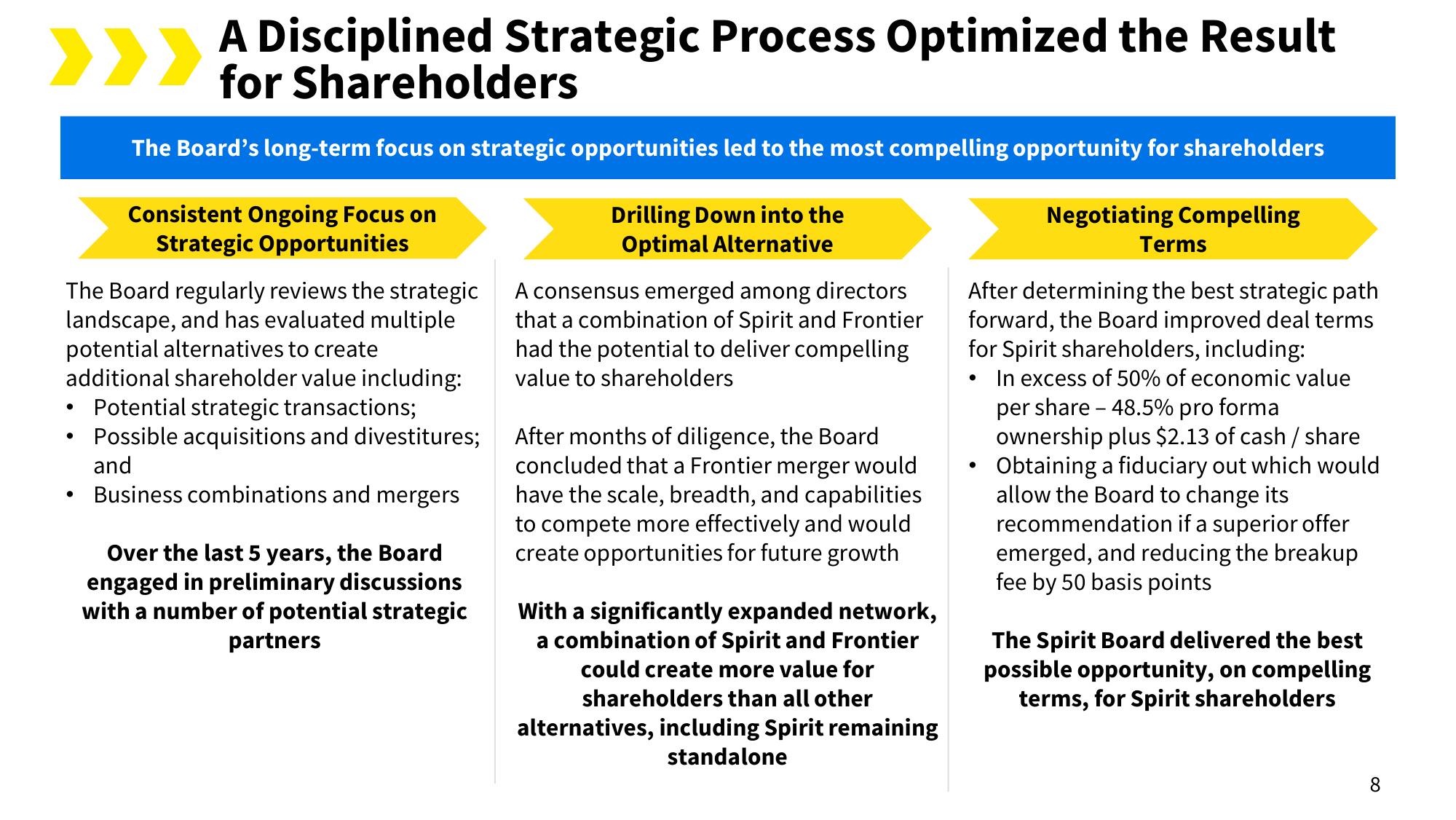

A Disciplined Strategic Process Optimized the Result

for Shareholders

The Board's long-term focus on strategic opportunities led to the most compelling opportunity for shareholders

●

The Board regularly reviews the strategic

landscape, and has evaluated multiple

potential alternatives to create

additional shareholder value including:

Potential strategic transactions;

Possible acquisitions and divestitures;

and

Business combinations and mergers

●

Consistent Ongoing Focus on

Strategic Opportunities

Over the last 5 years, the Board

engaged in preliminary discussions

with a number of potential strategic

partners

Drilling Down into the

Optimal Alternative

A consensus emerged among directors

that a combination of Spirit and Frontier

had the potential to deliver compelling

value to shareholders

After months of diligence, the Board

concluded that a Frontier merger would

have the scale, breadth, and capabilities

to compete more effectively and would

create opportunities for future growth

With a significantly expanded network,

a combination of Spirit and Frontier

could create more value for

shareholders than all other

alternatives, including Spirit remaining

standalone

Terms

After determining the best strategic path

forward, the Board improved deal terms

for Spirit shareholders, including:

In excess of 50% of economic value

per share - 48.5% pro forma

ownership plus $2.13 of cash/share

Obtaining a fiduciary out which would

allow the Board to change its

recommendation if a superior offer

emerged, and reducing the breakup

fee by 50 basis points

●

Negotiating Compelling

●

The Spirit Board delivered the best

possible opportunity, on compelling

terms, for Spirit shareholders

8View entire presentation