Ginkgo Results Presentation Deck

Significant incremental upside opportunities in Zymergen transaction that

could improve financial case

1 Product Portfolio

• Zymergen exploring strategic alternatives for its Advanced Materials and Drug

Discovery businesses

2

o Sale(s) could create additional cash proceeds and reduce operating expenses

o Spin-out could reduce costs, create a new customer for Ginkgo, and provide an

opportunity for additional upside through equity appreciation

• Not contemplated in base case runway and revenue forecasts, but believe

product portfolio is strong, and Zymergen has already received serious inbound

interest in the portfolio since announcement

Real Estate Rationalization

• Ginkgo assuming a present value of ~$186 million in total future lease liabilities(1)

(including ~$30 million in 2023) in connection with Zymergen's real estate

portfolio, largely due to their new HQ in Emeryville, CA

o Note: the merger agreement provides protections related to cost overruns so

minimal uncertainty re: build-out costs

• We will actively evaluate real estate portfolio rationalization, and any successful

effort to mitigate the lease liability could represent meaningful upside to the base

case and further reduce incremental cash burn from the Zymergen transaction

(1) Represents the lump sum present value across Zymergen's leases

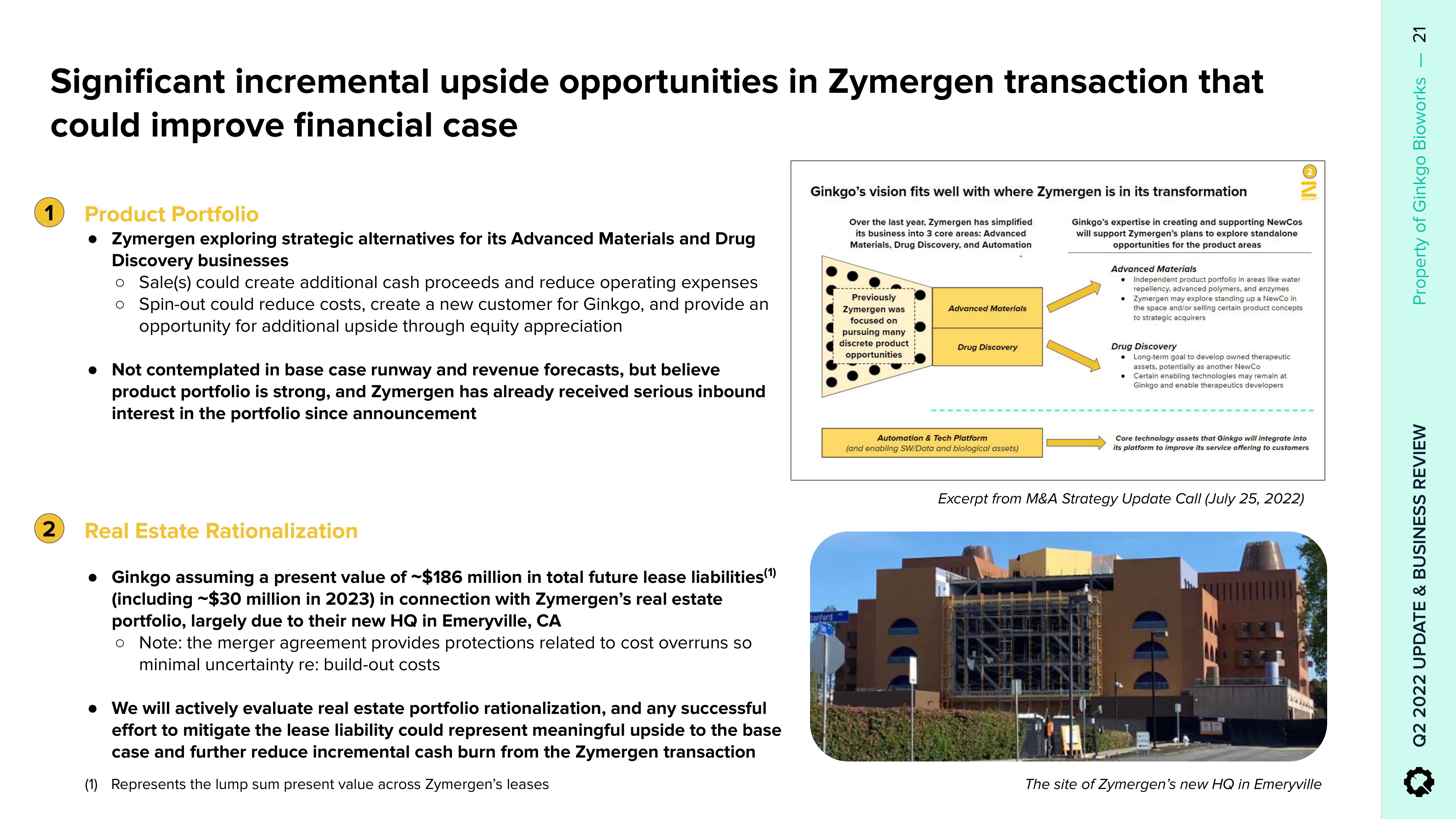

Ginkgo's vision fits well with where Zymergen is in its transformation

Over the last year, Zymergen has simplified

its business into 3 core areas: Advanced

Materials, Drug Discovery, and Automation

Previously

Zymergen was

focused on

pursuing many

discrete product

opportunities

Advanced Materials

Drug Discovery

Automation & Tech Platform

(and enabling SW/Data and biological assets)

Ginkgo's expertise in creating and supporting NewCos

will support Zymergen's plans to explore standalone

opportunities for the product areas

ON

Advanced Materials

• Independent product portfolio in areas like water

repellency, advanced polymers, and enzymes

• Zymergen may explore standing up a NewCo in

the space and/or selling certain product concepts

to strategic acquirers

Drug Discovery

Long-term goal to develop owned therapeutic

assets, potentially as another NewCo

• Certain enabling technologies may remain at

Ginkgo and enable therapeutics developers

Core technology assets that Ginkgo will integrate into

its platform to improve its service offering to customers

Excerpt from M&A Strategy Update Call (July 25, 2022)

The site of Zymergen's new HQ in Emeryville

21

Property of Ginkgo Bioworks

Q2 2022 UPDATE & BUSINESS REVIEWView entire presentation