Pershing Square Investor Presentation Deck

Hilton Worldwide ("HLT")

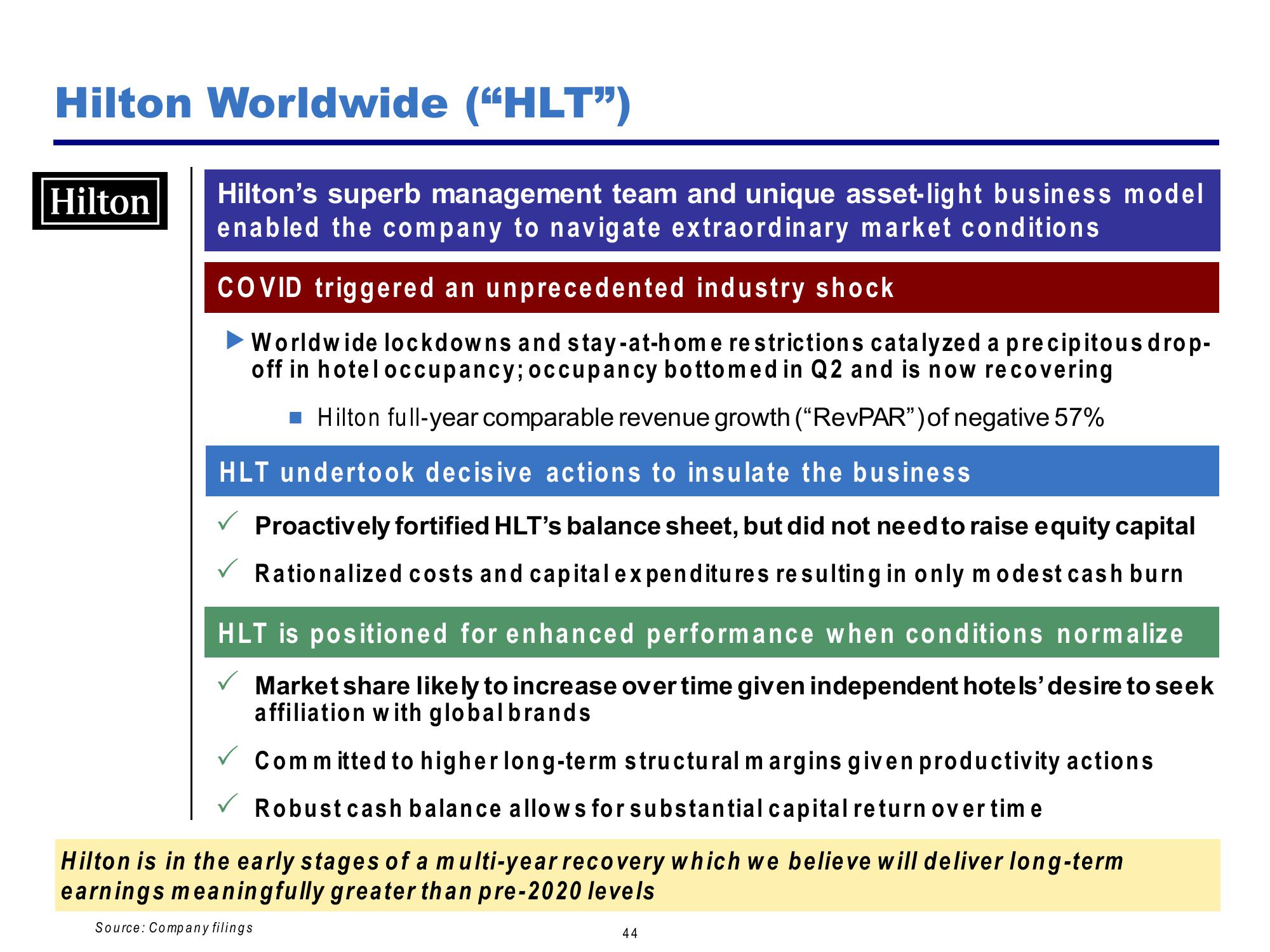

Hilton Hilton's superb management team and unique asset-light business model

enabled the company to navigate extraordinary market conditions

COVID triggered an unprecedented industry shock

► Worldwide lockdowns and stay-at-home restrictions catalyzed a precipitous drop-

off in hotel occupancy; occupancy bottomed in Q2 and is now recovering

■ Hilton full-year comparable revenue growth ("RevPAR") of negative 57%

HLT undertook decisive actions to insulate the business

Proactively fortified HLT's balance sheet, but did not need to raise equity capital

Rationalized costs and capital expenditures resulting in only modest cash burn

HLT is positioned for enhanced performance when conditions normalize

Market share likely to increase over time given independent hotels' desire to seek

affiliation with global brands

Committed to higher long-term structural margins given productivity actions

Robust cash balance allows for substantial capital return over time

Hilton is in the early stages of a multi-year recovery which we believe will deliver long-term

earnings meaningfully greater than pre-2020 levels

Source: Company filings

44View entire presentation