Bank of America Results Presentation Deck

Asset Quality - Consumer and Commercial Portfolios

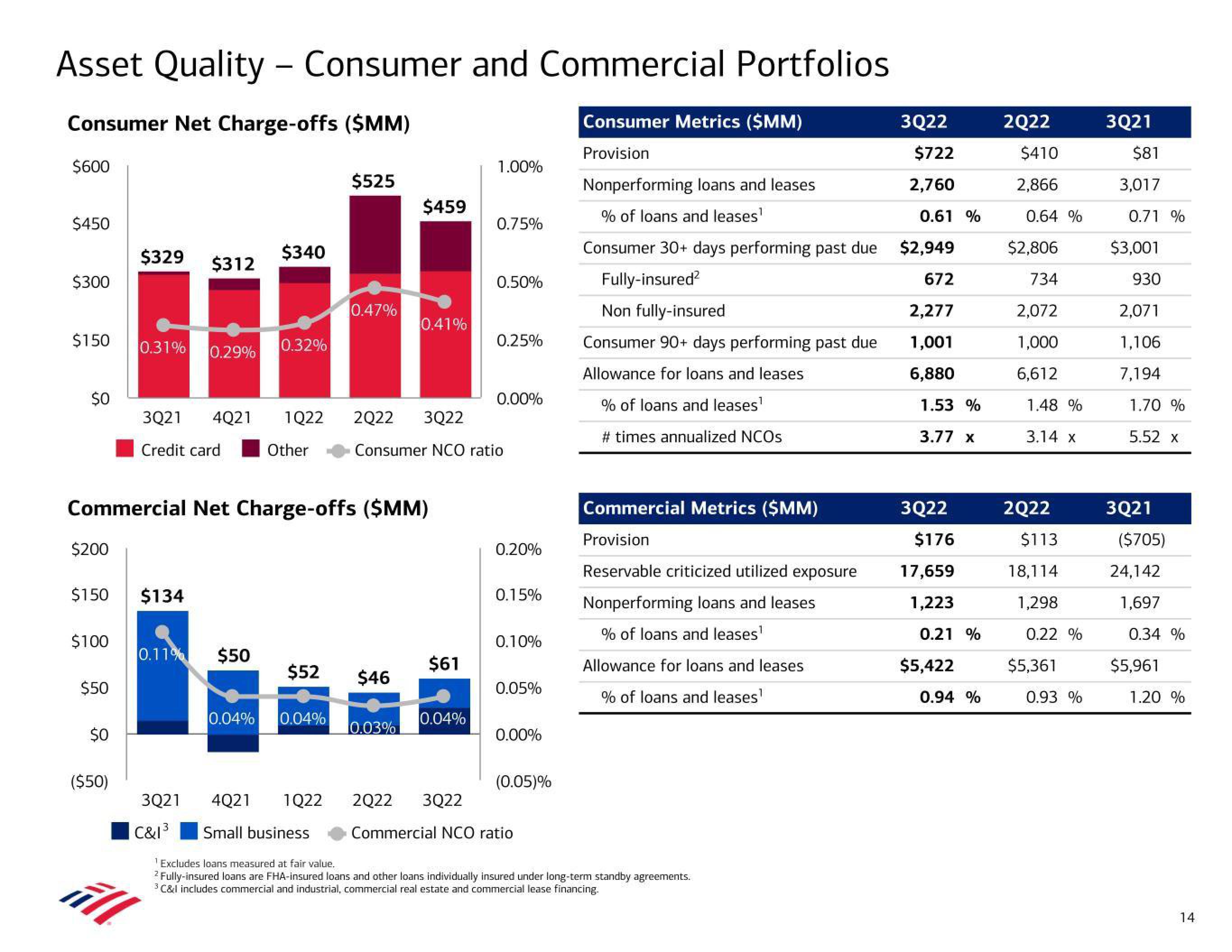

Consumer Net Charge-offs ($MM)

Consumer Metrics ($MM)

Provision

$600

$450

$300

$150

$0

$200

$150

$100

$50

$0

($50)

$329

0.31%

ill

$312

0.29%

$134

Commercial Net Charge-offs ($MM)

$340

0.11% $50

0.32%

3Q21 4Q21 1Q22 2Q22 3Q22

Credit card

Other

$52

$525

0.04% 0.04%

4Q21 1Q22

3Q21

C&1³ Small business

0.47%

$459

0.41%

$46

10.03%

$61

1.00%

Consumer NCO ratio

0.04%

0.75%

0.50%

0.25%

0.00%

0.20%

0.15%

0.10%

0.05%

0.00%

(0.05)%

2Q22 3Q22

Commercial NCO ratio

Nonperforming loans and leases

% of loans and leases¹

Consumer 30+ days performing past due

Fully-insured²

Non fully-insured

Consumer 90+ days performing past due

Allowance for loans and leases

% of loans and leases¹

# times annualized NCOs

Commercial Metrics ($MM)

Provision

Reservable criticized utilized exposure

Nonperforming loans and leases

% of loans and leases¹

Allowance for loans and leases

% of loans and leases¹

¹Excludes loans measured at fair value.

2 Fully-insured loans are FHA-insured loans and other loans individually insured under long-term standby agreements.

³ C&I includes commercial and industrial, commercial real estate and commercial lease financing.

3Q22

$722

2,760

0.61 %

$2,949

672

2,277

1,001

6,880

1.53 %

3.77 x

3Q22

$176

17,659

1,223

0.21 %

$5,422

0.94 %

2Q22

$410

2,866

0.64 %

$2,806

734

2,072

1,000

6,612

1.48 %

3.14 Xx

2Q22

$113

18,114

1,298

0.22 %

$5,361

0.93 %

3Q21

$81

3,017

0.71 %

$3,001

930

2,071

1,106

7,194

1.70 %

5.52 x

3Q21

($705)

24,142

1,697

0.34 %

$5,961

1.20 %

14View entire presentation