Brivo SPAC Presentation Deck

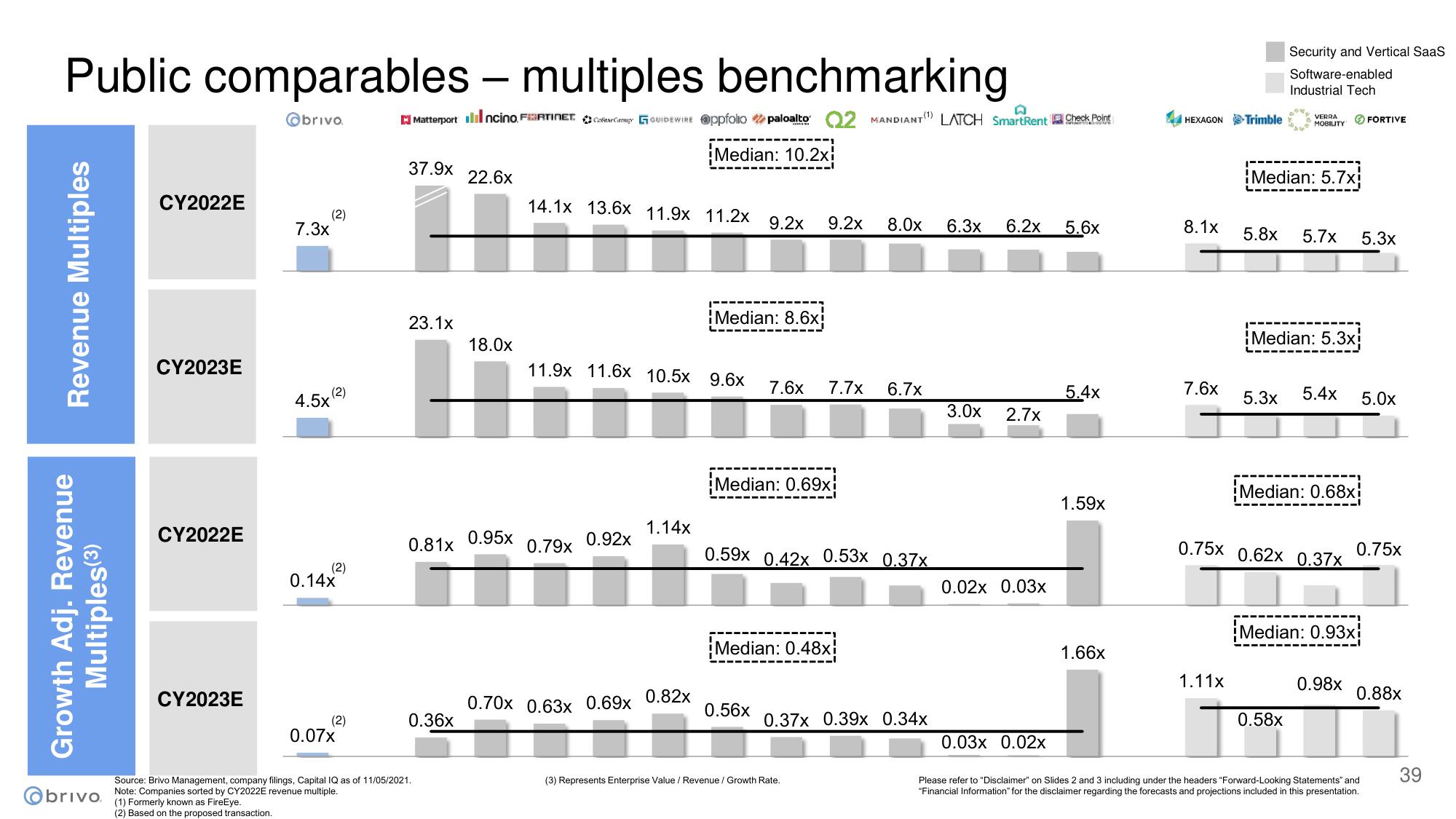

Public comparables - multiples benchmarking

Obrivo

Revenue Multiples

Growth Adj. Revenue

Multiples (3)

CY2022E

CY2023E

CY2022E

CY2023E

7.3x

(2)

(2)

4.5x

(2)

0.14x

(2)

0.07x

D

Matterport Ilincino FERTINETG GUIDEWIRE @ppfolio paloalto 2 MANDIANT (¹) LATCH SmartRent Check Point

Median: 10.2x

Obrivo. Note: Companies sorted by CY2022E revenue multiple.

(1) Formerly known as FireEye.

(2) Based on the proposed transaction.

37.9x

23.1x

0.81x

0.36x

Source: Brivo Management, company filings, Capital IQ as of 11/05/2021.

22.6x

18.0x

0.95x

14.1x 13.6x 11.9x 11.2x

0.79x

11.9x 11.6x 10.5x 9.6x 7.6x

0.92x

0.70x 0.63x 0.69x

1.14x

0.82x

9.2x 9.2x 8.0x 6.3x 6.2x

Median: 8.6x

Median: 0.69x!

7.7x 6.7x

0.59x 0.42x 0.53x 0.37x

0.56x

Median: 0.48x!

0.37x 0.39x 0.34x

(3) Represents Enterprise Value / Revenue / Growth Rate.

3.0x

2.7x

0.02x 0.03x

0.03x 0.02x

5.6x

5.4x

1.59x

1.66x

HEXAGON Trimble

8.1x

7.6x

1.11x

Security and Vertical SaaS

Software-enabled

Industrial Tech

VERRA

MOBILITY

Median: 5.7x

5.8x 5.7x 5.3x

¡Median: 5.3x

5.3x 5.4x 5.0x

Median: 0.68x

0.75x 0.62x 0.37x

0.58x

Median: 0.93x

FORTIVE

0.98x

0.75x

0.88x

Please refer to "Disclaimer" on Slides 2 and 3 including under the headers "Forward-Looking Statements" and

"Financial Information for the disclaimer regarding the forecasts and projections included in this presentation.

39View entire presentation